Time Warner Cable 2006 Annual Report Download - page 124

Download and view the complete annual report

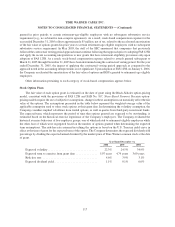

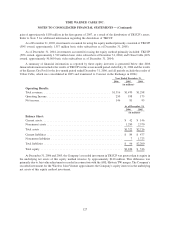

Please find page 124 of the 2006 Time Warner Cable annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.At December 31, 2006, the intrinsic value of Time Warner restricted stock and RSU awards granted to TWC

employees was approximately $11 million. Total unrecognized compensation cost related to unvested Time Warner

restricted stock and RSU awards granted to TWC employees at December 31, 2006 prior to the consideration of

expected forfeitures was approximately $4 million and is expected to be recognized over a weighted-average period

of 2 years. The fair value of Time Warner restricted stock and RSUs granted to TWC employees that vested during

the year ended December 31, 2006 was approximately $1 million.

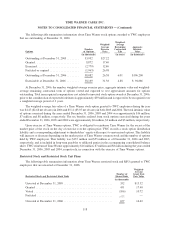

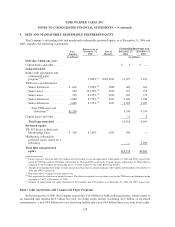

5. TRANSACTIONS WITH ADELPHIA AND COMCAST

Adelphia Acquisition and Related Transactions

On July 31, 2006, TW NY and Comcast completed their respective acquisitions of assets comprising in the

aggregate substantially all of the cable assets of Adelphia (the “Adelphia Acquisition”). At the closing of the

Adelphia Acquisition, TW NY paid approximately $8.9 billion in cash, after giving effect to certain purchase price

adjustments, and shares representing 17.3% of TWC’s Class A common stock (16% of TWC’s outstanding common

stock) valued at approximately $5.5 billion for the portion of the Adelphia assets it acquired. The valuation of

approximately $5.5 billion for the approximately 16% interest in TWC as of July 31, 2006 was determined by

management using a discounted cash flow and market comparable valuation model. The discounted cash flow

valuation model was based upon the Company’s estimated future cash flows derived from its business plan and

utilized a discount rate consistent with the inherent risk in the business. The 16% interest reflects 155,913,430 shares

of Class A common stock issued to Adelphia, which were valued at $35.28 per share for purposes of the Adelphia

Acquisition.

In addition, on July 28, 2006, American Television and Communications Corporation (“ATC”), a subsidiary of

Time Warner, contributed its 1% common equity interest and $2.4 billion preferred equity interest in TWE to

TW NY Cable Holding Inc. (“TW NY Holding”), a newly created subsidiary of TWC and the parent of TW NY, in

exchange for an approximately 12.4% non-voting common stock interest in TW NY Holding having an equivalent

fair value.

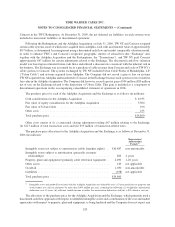

On July 31, 2006, immediately before the closing of the Adelphia Acquisition, Comcast’s interests in TWC

and TWE were redeemed. Specifically, Comcast’s 17.9% interest in TWC was redeemed in exchange for 100% of

the capital stock of a subsidiary of TWC holding both cable systems serving approximately 589,000 subscribers,

with an estimated fair value of approximately $2.470 billion, as determined by management using a discounted cash

flow and market comparable valuation model, and approximately $1.857 billion in cash (the “TWC Redemption”).

In addition, Comcast’s 4.7% interest in TWE was redeemed in exchange for 100% of the equity interests of a

subsidiary of TWE holding both cable systems serving approximately 162,000 subscribers, with an estimated fair

value of approximately $630 million, as determined by management using a discounted cash flow and market

comparable valuation model, and approximately $147 million in cash (the “TWE Redemption” and, together with

the TWC Redemption, the “Redemptions”). The discounted cash flow valuation model was based upon the

Company’s estimated future cash flows derived from its business plan and utilized a discount rate consistent with

the inherent risk in the business. The TWC Redemption was designed to qualify as a tax-free split-off under

section 355 of the Internal Revenue Code of 1986, as amended (the “Tax Code”). For accounting purposes, the

Redemptions were treated as an acquisition of Comcast’s minority interests in TWC and TWE and a disposition of

the cable systems that were transferred to Comcast. The purchase of the minority interests resulted in a reduction of

goodwill of $738 million related to the excess of the carrying value of the Comcast minority interests over the total

fair value of the Redemptions. In addition, the disposition of the cable systems resulted in an after-tax gain of

$945 million, included in discontinued operations, which is comprised of a $131 million pretax gain (calculated as

the difference between the carrying value of the systems acquired by Comcast in the Redemptions totaling

$2.969 billion and the estimated fair value of $3.100 billion) and a net tax benefit of $814 million, including the

reversal of historical deferred tax liabilities of approximately $838 million that had existed on systems transferred to

119

TIME WARNER CABLE INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)