Time Warner Cable 2006 Annual Report Download - page 126

Download and view the complete annual report

Please find page 126 of the 2006 Time Warner Cable annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

material changes to the allocation reflected above. The discounted cash flow approach was based upon

management’s estimated future cash flows from the acquired assets and liabilities and utilized a discount rate

consistent with the inherent risk of each of the acquired assets and liabilities.

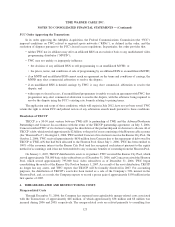

In connection with the closing of the Adelphia Acquisition, the $8.9 billion cash payment was funded by

borrowings under the Company’s $6.0 billion senior unsecured five-year revolving credit facility with a maturity

date of February 15, 2011 (the “Cable Revolving Facility”), the Company’s two $4.0 billion term loan facilities (the

“Cable Term Facilities” and together with the Cable Revolving Facility, the “Cable Facilities”) with maturity dates

of February 24, 2009 and February 21, 2011, respectively, the issuance of TWC commercial paper and the proceeds

of the private placement issuance by TW NY of $300 million of non-voting Series A Preferred Equity Membership

Units with a mandatory redemption date of August 1, 2013 and a cash dividend rate of 8.21% per annum (the “TW

NY Series A Preferred Membership Units”). In connection with the TWC Redemption, the $1.857 billion in cash

was funded through the issuance of TWC commercial paper and borrowings under the Cable Revolving Facility. In

addition, in connection with the TWE Redemption, the $147 million in cash was funded by the repayment of a pre-

existing loan TWE had made to TWC (which repayment TWC funded through the issuance of commercial paper

and borrowings under the Cable Revolving Facility).

The results of the systems acquired in connection with the Transactions have been included in the consolidated

statement of operations since the closing of the Transactions on July 31, 2006. The systems transferred to Comcast

in connection with the Redemptions and the Exchange (the “Transferred Systems”), including the gains discussed

above, have been reflected as discontinued operations in the consolidated statement of operations for all periods

presented.

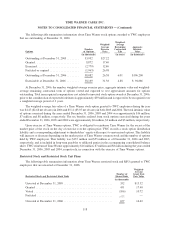

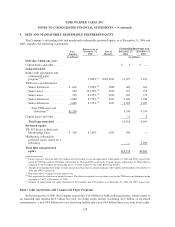

Financial data for the Transferred Systems included in discontinued operations for the years ended Decem-

ber 31, 2006, 2005 and 2004 is as follows (in millions):

2006 2005 2004

Year Ended December 31,

Total revenues ............................................. $ 457 $686 $623

Pretax income ............................................. 285 163 158

Income tax benefit (provision) ................................. 753 (59) (63)

Net income ............................................... 1,038 104 95

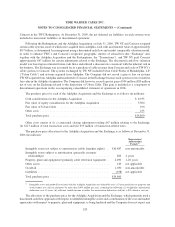

The tax benefit resulted primarily from the reversal of historical deferred tax liabilities (included in noncurrent

liabilities of discontinued operations) that had been established on systems transferred to Comcast in the TWC

Redemption. The TWC Redemption was designed to qualify as a tax-free split-off under section 355 of the Tax

Code, and as a result, such liabilities were no longer required. However, if the IRS were successful in challenging

the tax-free characterization of the TWC Redemption, an additional cash liability on account of taxes of up to an

estimated $900 million could become payable by the Company.

121

TIME WARNER CABLE INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)