Time Warner Cable 2006 Annual Report Download - page 9

Download and view the complete annual report

Please find page 9 of the 2006 Time Warner Cable annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

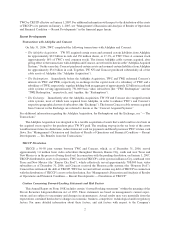

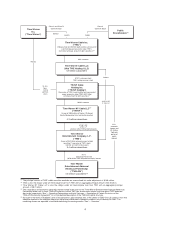

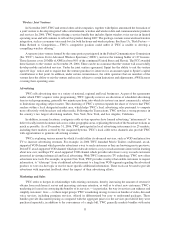

Class A and Class B

Common Stock

Class A

Common Stock

Indirect

Indirect

12.43%

Non-

voting

common

stock

15.96%84.04%

100% common

87.57% common stock

100% voting common stock

100.0% common

and $2.4 billion TWE preferred equity

51.55% GP

3.75% LP

97.1%

economic interest and

$378 million TWE-A/N preferred equity interest

Indirect

42.51% GP

2.19% LP

2.9%

economic

interest and

$1.2 billion

TWE-A/N

preferred

equity

interest

(1)(2)

Time Warner NY Cable LLC(3)

(“TW NY”)

(Issuer of $300 million of Series A Preferred

Equity Membership Units held by third parties)

4.3 million subscribers

Time Warner

Entertainment Company, L.P.

(“TWE”)

(Issuer of $3.2 billion principal amount of debt

securities;(1) guarantor of TWC’s bank

facilities and commercial paper)

3.4 million subscribers

Time Warner

Entertainment-Advance/

Newhouse Partnership

(“TWE-A/N”)

4.8 million subscribers(4)

Public

Stockholders(5)

Time Warner

Inc.

(“Time Warner”)

Time Warner Cable Inc.

(“TWC”)

(Obligor under $14.0 billion bank facilities and issuer of

commercial paper; guarantor under TWE’s

$3.2 billion principal amount of debt securities)(1)(2)

Time Warner Cable LLC

(f/k/a TWE Holding I LLC)

0.9 million subscribers

TW NY Cable

Holding Inc.

(“TW NY Holding”)

(Guarantor of TWC’s bank facilities and commercial

paper; guarantor under TWE’s $3.2 billion

principal amount of debt securities)(1)

(1)

(2) TWC is also the obligor under an intercompany loan from TWE with an aggregate principal amount of $2.3 billion.

(3) Time Warner NY Cable LLC is also the obligor under an intercompany loan from TWC with an aggregate principal

amount of $8.7 billion.

(4) The subscribers and economic ownership interests listed in the chart for the Time Warner Entertainment-Advance/Newhouse

Partnership relate only to those TWE-A/N systems in which TWC has an economic interest and over which TWC exercises

day-to-day supervision. See “— Operating Partnerships and Joint Ventures — Description of Certain Provisions of the

TWE-A/N Partnership Agreement” for a more detailed description of the TWE-A/N capital structure.

(5) Pursuant to the terms of Adelphia’s plan of reorganization, approximately 75% of the shares of TWC Class A common stock that

Adelphia received in the Adelphia Acquisition have been distributed to Adelphia’s creditors as of February 20, 2007. The

remaining shares are expected to be distributed during the coming months. See “— Overview.”

The principal amount of TWE’s debt securities excludes an unamortized fair value adjustment of $140 million.

4