Time Warner Cable 2006 Annual Report Download - page 120

Download and view the complete annual report

Please find page 120 of the 2006 Time Warner Cable annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.3. RECENT ACCOUNTING STANDARDS

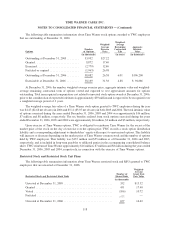

Employers’ Accounting for Defined Benefit Pension and Other Postretirement Plans

On December 31, 2006, the Company adopted the provisions of FASB Statement No. 158, Employers’

Accounting for Defined Benefit Pension and Other Postretirement Benefits (“FAS 158”). FAS 158 addresses the

accounting for defined benefit pension plans and other postretirement benefit plans (“plans”). Specifically, FAS 158

requires companies to recognize an asset for a plan’s overfunded status or a liability for a plan’s underfunded status

as of the end of the company’s fiscal year, the offset of which is recorded, net of tax, as a component of accumulated

other comprehensive income (loss) in shareholders’ equity. As a result of adopting FAS 158, on December 31, 2006,

the Company reflected the funded status of its plans by reducing its net pension asset by approximately $208 million

to reflect actuarial and investment losses that had been deferred pursuant to prior pension accounting rules and

recording a corresponding deferred tax asset of approximately $84 million and a net after-tax charge of approx-

imately $124 million in accumulated other comprehensive loss, net, in shareholders’ equity.

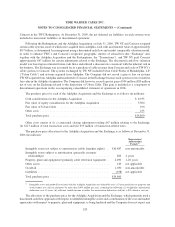

Accounting for Sabbatical Leave and Other Similar Benefits

In June 2006, the Emerging Issues Task Force (“EITF”) reached a consensus on EITF Issue No. 06-02,

Accounting for Sabbatical Leave and Other Similar Benefits (“EITF 06-02”). EITF 06-02 provides that an

employee’s right to a compensated absence under a sabbatical leave or similar benefit arrangement in which the

employee is not required to perform any duties during the absence is an accumulating benefit. Therefore, such

arrangements should be accounted for as a liability with the cost recognized over the service period during which

the employee earns the benefit. The provisions of EITF 06-02 became effective for TWC as of January 1, 2007 with

respect to certain employment arrangements that are similar to a sabbatical leave and are expected to result in a

reduction to retained earnings of approximately $62 million ($37 million, net of tax).

Income Statement Classification of Taxes Collected from Customers

In June 2006, the EITF reached a consensus on EITF Issue No. 06-03, How Taxes Collected from Customers

and Remitted to Governmental Authorities Should Be Presented in the Income Statement (That Is, Gross versus Net

Presentation) (“EITF 06-03”). EITF 06-03 provides that the presentation of taxes assessed by a governmental

authority that is directly imposed on a revenue-producing transaction between a seller and a customer on either a

gross basis (included in revenues and costs) or on a net basis (excluded from revenues) is an accounting policy

decision that should be disclosed. The provisions of EITF 06-03 became effective for TWC as of January 1, 2007.

EITF 06-03 is not expected to have a material impact on the Company’s consolidated financial statements.

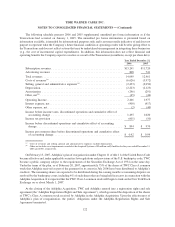

Accounting for Uncertainty in Income Taxes

In June 2006, the FASB issued FASB Interpretation No. 48, Accounting for Uncertainty in Income Taxes — an

interpretation of FASB Statement No. 109 (“FIN 48”), which clarifies the accounting for uncertainty in income tax

positions. This Interpretation requires that the Company recognize in the consolidated financial statements the tax

benefits related to tax positions that are more likely than not to be sustained upon examination based on the

technical merits of the position. The provisions of FIN 48 became effective for TWC as of the beginning of the

Company’s 2007 fiscal year. The cumulative impact of this guidance is not expected to have a material impact on

the Company’s consolidated financial statements.

Consideration Given by a Service Provider to Manufacturers or Resellers of Equipment

In September 2006, the EITF reached a consensus on EITF Issue No. 06-01, Accounting for Consideration

Given by a Service Provider to Manufacturers or Resellers of Equipment Necessary for an End-Customer to

Receive Service from the Service Provider (“EITF 06-01”). EITF 06-01 provides that consideration provided to the

manufacturers or resellers of specialized equipment should be accounted for as a reduction of revenue if the

consideration provided is in the form of cash and the service provider directs that such cash be provided directly to

the customer. Otherwise, the consideration should be recorded as an expense. EITF 06-01 will be effective for TWC

115

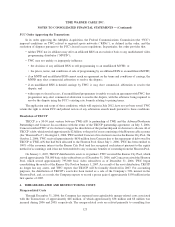

TIME WARNER CABLE INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)