Time Warner Cable 2006 Annual Report Download - page 128

Download and view the complete annual report

Please find page 128 of the 2006 Time Warner Cable annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.FCC Order Approving the Transactions

In its order approving the Adelphia Acquisition, the Federal Communications Commission (the “FCC”)

imposed conditions on TWC related to regional sports networks (“RSNs”), as defined in the order, and the

resolution of disputes pursuant to the FCC’s leased access regulations. In particular, the order provides that:

• neither TWC nor its affiliates may offer an affiliated RSN on an exclusive basis to any multichannel video

programming distributor (“MVPD”);

• TWC may not unduly or improperly influence:

• the decision of any affiliated RSN to sell programming to an unaffiliated MVPD; or

• the prices, terms, and conditions of sale of programming by an affiliated RSN to an unaffiliated MVPD;

• if an MVPD and an affiliated RSN cannot reach an agreement on the terms and conditions of carriage, the

MVPD may elect commercial arbitration to resolve the dispute;

• if an unaffiliated RSN is denied carriage by TWC, it may elect commercial arbitration to resolve the

dispute; and

• with respect to leased access, if an unaffiliated programmer is unable to reach an agreement with TWC, that

programmer may elect commercial arbitration to resolve the dispute, with the arbitrator being required to

resolve the dispute using the FCC’s existing rate formula relating to pricing terms.

The application and scope of these conditions, which will expire in July 2012, have not yet been tested. TWC

retains the right to obtain FCC and judicial review of any arbitration awards made pursuant to these conditions.

Dissolution of TKCCP

TKCCP is a 50-50 joint venture between TWE-A/N (a partnership of TWE and the Advance/Newhouse

Partnership) and Comcast. In accordance with the terms of the TKCCP partnership agreement, on July 3, 2006,

Comcast notified TWC of its election to trigger the dissolution of the partnership and its decision to allocate all of

TKCCP’s debt, which totaled approximately $2 billion, to the pool of assets consisting of the Houston cable systems

(the “Houston Pool”). On August 1, 2006, TWC notified Comcast of its election to receive the Kansas City Pool. On

October 2, 2006, TWC received approximately $630 million from Comcast due to the repayment of debt owed by

TKCCP to TWE-A/N that had been allocated to the Houston Pool. Since July 1, 2006, TWC has been entitled to

100% of the economic interest in the Kansas City Pool (and has recognized such interest pursuant to the equity

method of accounting), and it has not been entitled to any economic benefits of ownership from the Houston Pool.

On January 1, 2007, TKCCP distributed its assets to its partners. TWC received the Kansas City Pool, which

served approximately 788,000 basic video subscribers as of December 31, 2006, and Comcast received the Houston

Pool, which served approximately 795,000 basic video subscribers as of December 31, 2006. TWC began

consolidating the results of the Kansas City Pool on January 1, 2007. As a result of the asset distribution, TKCCP

no longer has any assets, and TWC expects that TKCCP will be formally dissolved in 2007. For accounting

purposes, the distribution of TKCCP’s assets has been treated as a sale of the Company’s 50% interest in the

Houston Pool, and, as a result, the Company expects to record a pretax gain of approximately $150 million in the

first quarter of 2007.

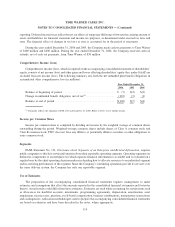

6. MERGER-RELATED AND RESTRUCTURING COSTS

Merger-related Costs

Through December 31, 2006, the Company has expensed non-capitalizable merger-related costs associated

with the Transactions of approximately $46 million, of which approximately $38 million and $8 million was

incurred during 2006 and 2005, respectively. The merger-related costs are related primarily to consulting fees

123

TIME WARNER CABLE INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)