Time Warner Cable 2006 Annual Report Download - page 119

Download and view the complete annual report

Please find page 119 of the 2006 Time Warner Cable annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

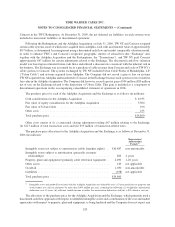

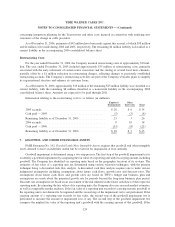

reporting. Deferred income taxes reflect the net tax effects of temporary differences between the carrying amount of

assets and liabilities for financial statement and income tax purposes, as determined under enacted tax laws and

rates. The financial effect of changes in tax laws or rates is accounted for in the period of enactment.

During the years ended December 31, 2006 and 2005, the Company made cash tax payments to Time Warner

of $489 million and $496 million. During the year ended December 31, 2004, the Company received cash tax

refunds, net of cash tax payments, from Time Warner of $58 million.

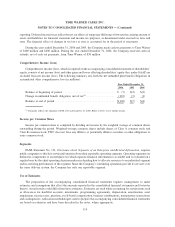

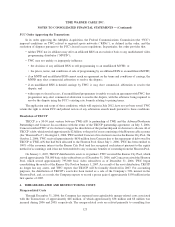

Comprehensive Income (Loss)

Comprehensive income (loss), which is reported on the accompanying consolidated statement of shareholders’

equity, consists of net income (loss) and other gains and losses affecting shareholders’ equity that, under GAAP, are

excluded from net income (loss). The following summary sets forth the net unfunded plan benefit obligations in

accumulated other comprehensive loss (in millions):

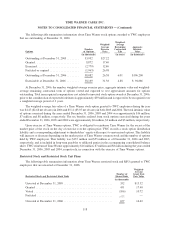

2006 2005 2004

Year Ended December 31,

Balance at beginning of period ................................. $ (7) $(4) $(3)

Change in unfunded benefit obligation, net of tax

(a)

.................. (123) (3) (1)

Balance at end of period ...................................... $(130) $(7) $(4)

(a)

Primarily reflects the adoption of FAS 158 on December 31, 2006. Refer to Note 11 for further details.

Income per Common Share

Income per common share is computed by dividing net income by the weighted average of common shares

outstanding during the period. Weighted-average common shares include shares of Class A common stock and

Class B common stock. TWC does not have any dilutive or potentially dilutive securities or other obligations to

issue common stock.

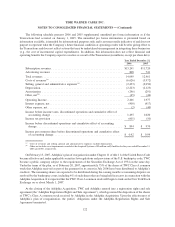

Segments

FASB Statement No. 131, Disclosure about Segments of an Enterprise and Related Information, requires

public companies to disclose certain information about their reportable operating segments. Operating segments are

defined as components of an enterprise for which separate financial information is available and is evaluated on a

regular basis by the chief operating decision makers in deciding how to allocate resources to an individual segment

and in assessing performance of the segment. Since the Company’s continuing operations provide its services over

the same delivery system, the Company has only one reportable segment.

Use of Estimates

The preparation of the accompanying consolidated financial statements requires management to make

estimates and assumptions that affect the amounts reported in the consolidated financial statements and footnotes

thereto. Actual results could differ from those estimates. Estimates are used when accounting for certain items such

as allowances for doubtful accounts, investments, programming agreements, depreciation, amortization, asset

impairment, income taxes, pensions, stock-based compensation, business combinations, nonmonetary transactions

and contingencies. Allocation methodologies used to prepare the accompanying consolidated financial statements

are based on estimates and have been described in the notes, where appropriate.

114

TIME WARNER CABLE INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)