Time Warner Cable 2006 Annual Report Download - page 69

Download and view the complete annual report

Please find page 69 of the 2006 Time Warner Cable annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

The application and scope of these conditions, which will expire in July 2012, have not yet been tested. TWC

retains the right to obtain FCC and judicial review of any arbitration awards made pursuant to these conditions.

Dissolution of TKCCP

TKCCP is a 50-50 joint venture between Time Warner Entertainment-Advance/Newhouse Partnership

(“TWE-A/N”) (a partnership of TWE and the Advance/Newhouse Partnership) and Comcast. In accordance with

the terms of the TKCCP partnership agreement, on July 3, 2006, Comcast notified TWC of its election to trigger the

dissolution of the partnership and its decision to allocate all of TKCCP’s debt, which totaled approximately

$2 billion, to the pool of assets consisting of the Houston cable systems (the “Houston Pool”). On August 1, 2006,

TWC notified Comcast of its election to receive the Kansas City Pool. On October 2, 2006, TWC received

approximately $630 million from Comcast due to the repayment of debt owed by TKCCP to TWE-A/N that had

been allocated to the Houston Pool. Since July 1, 2006, TWC has been entitled to 100% of the economic interest in

the Kansas City Pool (and has recognized such interest pursuant to the equity method of accounting), and it has not

been entitled to any economic benefits of ownership from the Houston Pool.

On January 1, 2007, TKCCP distributed its assets to its partners. TWC received the Kansas City Pool, which

served approximately 788,000 basic video subscribers as of December 31, 2006, and Comcast received the Houston

Pool, which served approximately 795,000 basic video subscribers as of December 31, 2006. TWC began

consolidating the results of the Kansas City Pool on January 1, 2007. As a result of the asset distribution, TKCCP

no longer has any assets, and TWC expects that TKCCP will be formally dissolved in 2007. For accounting

purposes, the distribution of TKCCP’s assets has been treated as a sale of the Company’s 50% interest in the

Houston Pool, and, as a result, the Company expects to record a pretax gain of approximately $150 million in the

first quarter of 2007.

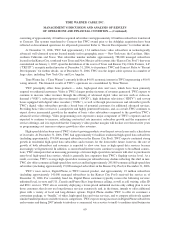

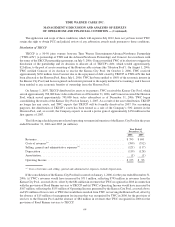

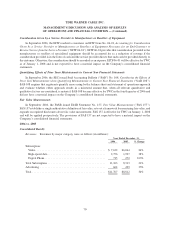

The following schedule presents selected operating statement information of the Kansas City Pool for the years

ended December 31, 2006 and 2005 (in millions):

2006 2005

Year Ended

December 31,

Revenues. ....................................................... $795 $691

Costs of revenues

(a)

................................................ (399) (352)

Selling, general and administrative expenses

(a)

............................ (121) (117)

Depreciation ..................................................... (119) (128)

Amortization ..................................................... (1) (1)

Operating Income ................................................. $155 $ 93

(a)

Costs of revenues and selling, general and administrative expenses exclude depreciation.

If the consolidation of the Kansas City Pool had occurred on January 1, 2006, for the year ended December 31,

2006, (i) TWC’s revenues would have increased by $711 million, reflecting $795 million in revenues from the

Kansas City Pool, as noted above, offset by the $84 million in revenues that TWC recognized in 2006 in connection

with the provision of Road Runner services to TKCCP and (ii) TWC’s Operating Income would have increased by

$107 million, reflecting the $155 million of Operating Income generated by the Kansas City Pool, as noted above,

and $51 million of lower costs at TWC that would have resulted from TWC not serving the Houston Pool, offset by

the absence of $15 million of management fee income that was recognized by TWC in 2006 for the provision of

services to the Houston Pool and the absence of $84 million in revenues that TWC recognized in 2006 for the

provision of Road Runner services to TKCCP.

64

TIME WARNER CABLE INC.

MANAGEMENT’S DISCUSSION AND ANALYSIS OF RESULTS

OF OPERATIONS AND FINANCIAL CONDITION — (Continued)