Time Warner Cable 2006 Annual Report Download - page 140

Download and view the complete annual report

Please find page 140 of the 2006 Time Warner Cable annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

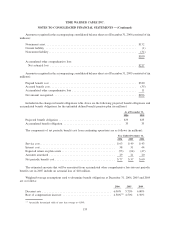

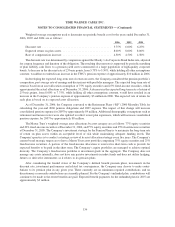

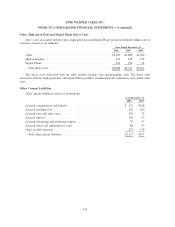

Amounts recognized in the accompanying consolidated balance sheet as of December 31, 2006 consisted of (in

millions):

Noncurrent asset . . ........................................................ $132

Current liability . ......................................................... (1)

Noncurrent liability ........................................................ (31)

$100

Accumulated other comprehensive loss:

Net actuarial loss ....................................................... $217

Amounts recognized in the accompanying consolidated balance sheet as of December 31, 2005 consisted of (in

millions):

Prepaid benefit cost ....................................................... $320

Accrued benefit cost ....................................................... (35)

Accumulated other comprehensive loss ......................................... 11

Net amount recognized ..................................................... $296

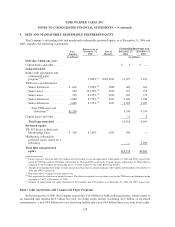

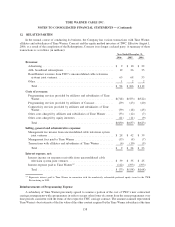

Included in the change in benefit obligations table above are the following projected benefit obligations and

accumulated benefit obligations for the unfunded defined benefit pension plan (in millions):

2006 2005

As of December 31,

Projected benefit obligation ........................................ $33 $35

Accumulated benefit obligation ..................................... 35 35

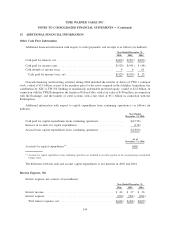

The components of net periodic benefit cost from continuing operations are as follows (in millions):

2006 2005 2004

Year Ended December 31,

Service cost................................................ $63 $49 $43

Interest cost................................................ 58 51 44

Expected return on plan assets .................................. (73) (64) (47)

Amounts amortized .......................................... 29 21 20

Net periodic benefit cost ...................................... $77 $57 $60

The estimated amounts that will be amortized from accumulated other comprehensive loss into net periodic

benefit cost in 2007 include an actuarial loss of $10 million.

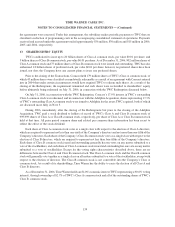

Weighted-average assumptions used to determine benefit obligations at December 31, 2006, 2005 and 2004

are as follows:

2006 2005 2004

Discount rate ............................................ 6.00% 5.75% 6.00%

Rate of compensation increase . .............................. 4.50%

(a)

4.50% 4.50%

(a)

Actuarially determined table of rates that average to 4.50%.

135

TIME WARNER CABLE INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)