Time Warner Cable 2006 Annual Report Download - page 139

Download and view the complete annual report

Please find page 139 of the 2006 Time Warner Cable annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

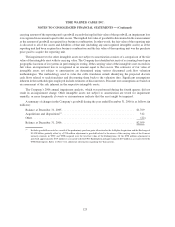

As of July 31, 2006, TWC increased its common equity ownership in TWE from 94.3% to 100%. Net income

for financial reporting purposes of TWE is allocated to the partners in accordance with the partners’ common

ownership interests. Income for tax purposes is allocated in accordance with the partnership agreement and related

tax law. As a result, the allocation of taxable income to the partners differs from the allocation of net income for

financial reporting purposes. In addition, pursuant to the partnership agreement, TWE makes tax distributions based

upon the taxable income of the partnership. The payments are made to each partner in accordance with their

common ownership interest.

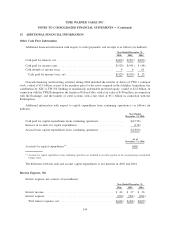

11. EMPLOYEE BENEFIT PLANS

The Company participates in various funded and unfunded non-contributory defined benefit pension plans

administered by Time Warner (the “Pension Plans”) and the TWC Savings Plan (the “401K Plan”), a defined pre-tax

contribution plan.

Benefits under the Pension Plans for all employees are determined based on formulas that reflect employees’

years of service and compensation levels during their employment period and participation in the plans. Former

Adelphia and Comcast employees that became TWC employees in connection with the Transactions will not

receive credit for their years of employment by Adelphia or Comcast and are subject to a one-year waiting period

before becoming eligible to participate in the Pension Plans. The Pension Plans’ assets are held in a master trust with

plan assets of another Time Warner defined benefit pension plan (the “Master Trust”). Time Warner’s common

stock represents approximately 3% of total defined benefit pension plan assets held in the Master Trust at both

December 31, 2006 and 2005. TWC uses a December 31 measurement date for the majority of its plans. A summary

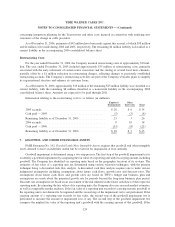

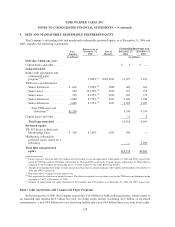

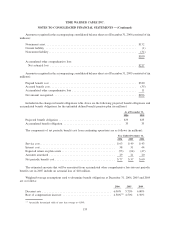

of activity for the Pension Plans is as follows (in millions):

2006 2005

As of December 31,

Change in Benefit Obligations:

Projected benefit obligation, beginning of year ......................... $ 937 $781

Service cost ................................................. 63 49

Interest cost ................................................. 58 51

Actuarial gain (loss) ........................................... (4) 64

Benefits paid ................................................ (16) (12)

Net periodic benefit costs from discontinued operations ................. 4 4

Projected benefit obligation, end of year .............................. $1,042 $937

Accumulated benefit obligation .................................... $ 867 $784

Change in Plan Assets:

Fair value of plan assets, beginning of year............................ $ 927 $802

Actual return on plan assets ..................................... 130 46

Employer contributions ........................................ 101 91

Benefits paid ................................................ (16) (12)

Fair value of plan assets, end of year ................................ $1,142 $927

Funded Status:

Fair value of plan assets, end of year ................................ $1,142 $927

Projected benefit obligation, end of year .............................. 1,042 937

Funded status ................................................. 100 (10)

Unrecognized actuarial loss ....................................... — 306

Net amount recognized .......................................... $ 100 $296

134

TIME WARNER CABLE INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)