Time Warner Cable 2006 Annual Report Download - page 103

Download and view the complete annual report

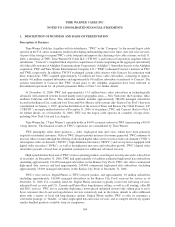

Please find page 103 of the 2006 Time Warner Cable annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.programming expense is recorded, if necessary, to reflect the terms of the new contract. The Company must also

make estimates in the recognition of programming expense related to other items, such as the accounting for free

periods, “most-favored-nation” clauses and service interruptions, as well as the allocation of consideration

exchanged between the parties in multiple-element transactions. Additionally, judgments are also required by

management when the Company purchases multiple services from the same cable programming vendor. In these

scenarios, the total consideration provided to the programming vendor is required to be allocated to the various

services received based upon their respective fair values. Because multiple services from the same programming

vendor are often received over different contractual periods and often have different contractual rates, the allocation

of consideration to the individual services will have an impact on the timing of the Company’s expense recognition.

Income Taxes

From time to time, the Company engages in transactions in which the tax consequences may be subject to

uncertainty. Examples of such transactions include business acquisitions and disposals, issues related to consid-

eration paid or received in connection with acquisitions and disposals, and certain financing transactions.

Significant judgment is required in assessing and estimating the tax consequences of these transactions. For

example, the Adelphia Acquisition was designed as a taxable acquisition. Accordingly, the Company has viewed a

portion of its tax basis in the acquired assets resulting from the Adelphia Acquisition as incremental value above the

amount of basis more generally associated with cable systems. The tax benefit of such incremental step-up would

reduce net cash tax payments by more than $300 million per year, assuming the following: (i) incremental step-up

relating to 85% of the $14.4 billion purchase price (which assumes that 15% of the fair market value of cable

systems represents a typical amount of basis), (ii) straight-line amortization deductions over 15 years, (iii) sufficient

taxable income to utilize the amortization deductions, and (iv) a 40% effective tax rate. The IRS or state and local

taxing authorities might challenge the anticipated tax characterizations or related valuations, and any successful

challenge could significantly increase the Company’s future tax payments and significantly reduce the Company’s

future earnings and cash flow. Additionally, the TWC Redemption was designed to qualify as a tax-free split-off

under section 355 of the Tax Code. If the IRS were successful in challenging the tax-free characterization of the

TWC Redemption, an additional cash liability on account of taxes of up to an estimated $900 million could be

payable by the Company.

The Company prepares and files tax returns based on interpretation of tax laws and regulations. In the normal

course of business, the Company’s tax returns are subject to examination by various taxing authorities. Such

examinations may result in future tax and interest assessments by these taxing authorities. Although the Company

believes it has support for the positions taken on its tax return, the Company has recorded a liability for its best

estimate of the probable loss on certain of these positions. There is considerable judgment involved in determining

whether positions taken on the tax return are probable of being sustained. The Company adjusts its tax reserve

estimates periodically because of ongoing examinations by and settlements with the various taxing authorities, as

well as changes in tax laws, regulations and interpretations. The consolidated tax provision of any given year

includes adjustments to prior year income tax accruals that are considered appropriate.

CAUTION CONCERNING FORWARD-LOOKING STATEMENTS

This document contains “forward-looking statements” within the meaning of the Private Securities Litigation

Reform Act of 1995, particularly statements anticipating future growth in revenues, cash provided by operating

activities and other financial measures. Words such as “anticipates,” “estimates,” “expects,” “projects,” “intends,”

“plans,” “believes” and words and terms of similar substance used in connection with any discussion of future

operating or financial performance identify forward-looking statements. These forward-looking statements are

based on management’s current expectations and beliefs about future events. As with any projection or forecast,

they are inherently susceptible to uncertainty and changes in circumstances, and the Company is under no

98

TIME WARNER CABLE INC.

MANAGEMENT’S DISCUSSION AND ANALYSIS OF RESULTS

OF OPERATIONS AND FINANCIAL CONDITION — (Continued)