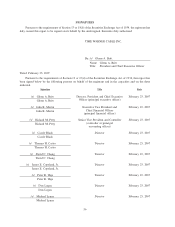

Time Warner Cable 2006 Annual Report Download - page 66

Download and view the complete annual report

Please find page 66 of the 2006 Time Warner Cable annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.in most of the systems TWC owned before and retained after the transactions with Adelphia and Comcast (the

“Legacy Systems”).

In November 2005, TWC and several other cable companies, together with Sprint Nextel Corporation

(“Sprint”), announced the formation of a joint venture to develop integrated video entertainment, wireline and

wireless data and communications products and services. In 2006, TWC began offering a bundle that includes

Sprint wireless voice service in limited operating areas and will continue to roll out this product during 2007.

Some of TWC’s principal competitors, in particular, direct broadcast satellite operators and incumbent local

telephone companies, either offer or are making significant capital investments that will allow them to offer services

that provide features and functions comparable to the video, data and/or voice services that TWC offers and they are

aggressively seeking to offer them in bundles similar to TWC’s. TWC expects that the availability of these service

offerings will intensify competition.

In addition to the subscription services described above, TWC also earns revenues by selling advertising time

to national, regional and local businesses. In 2006, nearly one-half of TWC’s Advertising revenues were derived

from sales to the automotive and media and entertainment industries, with no other individual industry providing a

significant portion of Advertising revenues.

As of July 31, 2006, the date the transactions with Adelphia and Comcast closed, the penetration rates for basic

video, digital video and high-speed data services were generally lower in the systems acquired from Adelphia and

Comcast (the “Acquired Systems”) than in the Legacy Systems. Furthermore, certain advanced services were not

available in some of the Acquired Systems, and IP-based telephony service was not available in any of the Acquired

Systems. To increase the penetration of these services in the Acquired Systems, TWC is in the midst of a significant

integration effort that includes upgrading the capacity and technical performance of these systems to levels that will

allow the delivery of these advanced services and features. Such integration-related efforts are expected to be

largely complete by year-end 2007. As of December 31, 2006, Digital Phone was available in some of the Acquired

Systems on a limited basis. TWC expects to roll out Digital Phone across the Acquired Systems during 2007.

Improvement in the financial and operating performance of the Acquired Systems depends in part on the

completion of these initiatives and the subsequent availability of the Company’s bundled advanced services in the

Acquired Systems. In addition, due to various operational and competitive challenges, the Company expects that the

acquired systems located in the Los Angeles, CA and Dallas, TX areas will likely require more time and resources

than the other acquired systems to stabilize and then meaningfully improve their financial and operating perfor-

mance. As of December 31, 2006, the acquired Los Angeles and Dallas area systems together served approximately

2.0 million subscribers (about 50% of the subscribers served by the Acquired Systems). TWC believes that by

upgrading the plant and integrating the Acquired Systems into its operations, there is a significant opportunity over

time to stem subscriber losses, increase penetration rates of its service offerings, and improve Subscription revenues

and Operating Income before Depreciation and Amortization in the Acquired Systems.

Recent Developments

Adelphia Acquisition

On July 31, 2006, TW NY and Comcast completed their respective acquisitions of assets comprising in the

aggregate substantially all of the cable assets of Adelphia (the “Adelphia Acquisition”). At the closing of the

Adelphia Acquisition, TW NY paid approximately $8.9 billion in cash, after giving effect to certain purchase price

adjustments, and shares representing 17.3% of TWC’s Class A common stock (16% of TWC’s outstanding common

stock) for the portion of the Adelphia assets it acquired. In addition, on July 28, 2006, American Television and

Communications Corporation (“ATC”), a subsidiary of Time Warner, contributed its 1% common equity interest

and $2.4 billion preferred equity interest in TWE to TW NY Cable Holding Inc. (“TW NY Holding”), a newly

created subsidiary of TWC and the parent of TW NY, in exchange for an approximately 12.4% non-voting common

stock interest in TW NY Holding (the “ATC Contribution”).

61

TIME WARNER CABLE INC.

MANAGEMENT’S DISCUSSION AND ANALYSIS OF RESULTS

OF OPERATIONS AND FINANCIAL CONDITION — (Continued)