Time Warner Cable 2006 Annual Report Download - page 154

Download and view the complete annual report

Please find page 154 of the 2006 Time Warner Cable annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

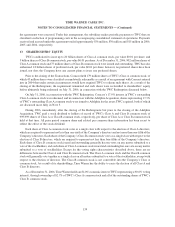

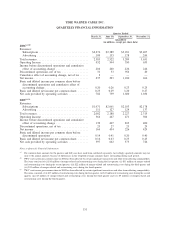

TIME WARNER CABLE INC.

SELECTED FINANCIAL INFORMATION

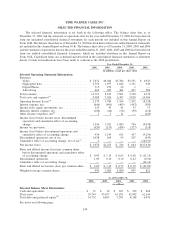

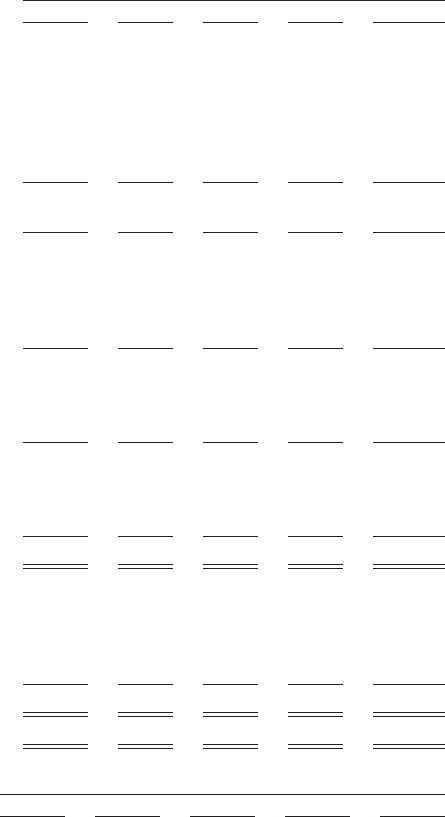

The selected financial information is set forth in the following tables. The balance sheet data as of

December 31, 2002 and the statement of operations data for the year ended December 31, 2002 has been derived

from our unaudited consolidated financial statements for such periods not included in this Annual Report on

Form 10-K. The balance sheet data as of December 31, 2003 has been derived from our audited financial statements

not included in this Annual Report on Form 10-K. The balance sheet data as of December 31, 2004, 2005 and 2006

and the statement of operations data for the years ended December 31, 2003, 2004, 2005 and 2006 has been derived

from our audited consolidated financial statements, which are included elsewhere in this Annual Report on

Form 10-K. Capitalized terms are as defined and described in the consolidated financial statements or elsewhere

herein. Certain reclassifications have been made to conform to the 2006 presentation.

2006 2005 2004 2003 2002

Year Ended December 31,

(in millions, except per share data)

Selected Operating Statement Information:

Revenues:

Video..................................... $ 7,632 $6,044 $5,706 $5,351 $ 4,923

High-speed data . ............................ 2,756 1,997 1,642 1,331 949

Digital Phone . . . ............................ 715 272 29 1 —

Advertising ................................ 664 499 484 437 504

Total revenues ................................ 11,767 8,812 7,861 7,120 6,376

Total costs and expenses

(a)

....................... 9,588 7,026 6,307 5,818 14,504

Operating Income (Loss)

(a)

....................... 2,179 1,786 1,554 1,302 (8,128)

Interest expense, net............................ (646) (464) (465) (492) (385)

Income from equity investments, net ............... 129 43 41 33 13

Minority interest expense, net..................... (108) (64) (56) (59) (118)

Other income (expense), net

(b)

.................... 2 1 11 — (420)

Income (loss) before income taxes, discontinued

operations and cumulative effect of accounting

change .................................... 1,556 1,302 1,085 784 (9,038)

Income tax provision ........................... (620) (153) (454) (327) (118)

Income (loss) before discontinued operations and

cumulative effect of accounting change ............ 936 1,149 631 457 (9,156)

Discontinued operations, net of tax ................. 1,038 104 95 207 (443)

Cumulative effect of accounting change, net of tax

(c)

. . . 2 — — — (28,031)

Net income (loss) . ............................ $ 1,976 $1,253 $ 726 $ 664 $(37,630)

Basic and diluted income (loss) per common share

before discontinued operations and cumulative effect

of accounting change ......................... $ 0.95 $ 1.15 $ 0.63 $ 0.48 $ (11.15)

Discontinued operations ......................... 1.05 0.10 0.10 0.22 (0.54)

Cumulative effect of accounting change ............. ————(34.14)

Basic and diluted net income (loss) per common share . . $ 2.00 $ 1.25 $ 0.73 $ 0.70 $ (45.83)

Weighted-average common shares ................. 990 1,000 1,000 955 821

2006 2005 2004 2003 2002

As of December 31,

(in millions)

Selected Balance Sheet Information:

Cash and equivalents ......................... $ 51 $ 12 $ 102 $ 329 $ 868

Total assets ................................ 55,743 43,677 43,138 42,902 62,146

Total debt and preferred equity

(d)

................ 14,732 6,863 7,299 8,368 6,976

See notes on following page.

149