Time Warner Cable 2006 Annual Report Download - page 101

Download and view the complete annual report

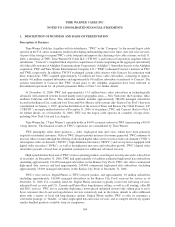

Please find page 101 of the 2006 Time Warner Cable annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.• EITF Issue No. 02-16, Accounting by a Customer (Including a Reseller) for Certain Consideration Received

from a Vendor (“EITF 02-16”).

The Company’s policy for accounting for each transaction negotiated contemporaneously is to record each

element of the transaction based on the respective estimated fair values of the products or services purchased and the

products or services sold. The judgments made in determining fair value in such arrangements impact the amount

and period in which revenues, expenses and net income are recognized over the term of the contract. In determining

the fair value of the respective elements, TWC refers to quoted market prices (where available), historical

transactions or comparable cash transactions. The most frequent transactions of this type that the Company

encounters involve funds received from its vendors, which the Company accounts for in accordance with EITF

02-16. The Company records cash consideration received from a vendor as a reduction in the price of the vendor’s

product unless (i) the consideration is for the reimbursement of a specific, incremental, identifiable cost incurred in

which case it would record the cash consideration received as a reduction in such cost or (ii) the Company is

providing an identifiable benefit in exchange for the consideration in which case it recognizes revenue for this

element.

With respect to programming vendor advertising arrangements being negotiated simultaneously with the same

cable network, TWC assesses whether each piece of the arrangements is at fair value. The factors that are

considered in determining the individual fair values of the programming and advertising vary from arrangement to

arrangement and include:

• existence of a “most-favored-nation” clause or comparable assurances as to fair market value with respect to

programming;

• comparison to fees under a prior contract;

• comparison to fees paid for similar networks; and

• comparison to advertising rates paid by other advertisers on the Company’s systems.

Advertising revenues associated with such arrangements were less than $1 million for each of the years ended

December 31, 2006 and 2005, and were $9 million in 2004.

Sales of Multiple Products or Services

The Company’s policy for revenue recognition in instances where multiple deliverables are sold contempo-

raneously to the same counterparty is in accordance with EITF Issue No. 00-21, Revenue Arrangements with

Multiple Deliverables, and SEC Staff Accounting Bulletin No. 104, Revenue Recognition. Specifically, if the

Company enters into sales contracts for the sale of multiple products or services, then the Company evaluates

whether it has objective fair value evidence for each deliverable in the transaction. If the Company has objective fair

value evidence for each deliverable of the transaction, then it accounts for each deliverable in the transaction

separately, based on the relevant revenue recognition accounting policies. However, if the Company is unable to

determine objective fair value for one or more undelivered elements of the transaction, the Company recognizes

revenue on a straight-line basis over the term of the agreement. For example, the Company sells cable, Digital

Phone and high-speed data services to subscribers in a bundled package at a rate lower than if the subscriber

purchases each product on an individual basis. Subscription revenues received from such subscribers are allocated

to each product in a pro-rata manner based on the fair value of each of the respective services.

Purchases of Multiple Products or Services

The Company’s policy for cost recognition in instances where multiple products or services are purchased

contemporaneously from the same counterparty is consistent with the Company’s policy for the sale of multiple

deliverables to a customer. Specifically, if the Company enters into a contract for the purchase of multiple products

96

TIME WARNER CABLE INC.

MANAGEMENT’S DISCUSSION AND ANALYSIS OF RESULTS

OF OPERATIONS AND FINANCIAL CONDITION — (Continued)