Time Warner Cable 2006 Annual Report Download - page 110

Download and view the complete annual report

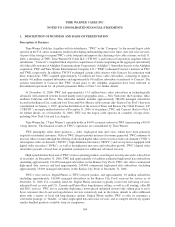

Please find page 110 of the 2006 Time Warner Cable annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.In November 2005, TWC and several other cable companies, together with Sprint Nextel Corporation

(“Sprint”), announced the formation of a joint venture to develop integrated video entertainment, wireline and

wireless data and communications products and services. In 2006, TWC began offering a bundle that includes

Sprint wireless voice service in limited operating areas and will continue to roll out this product during 2007.

Some of TWC’s principal competitors, in particular, direct broadcast satellite operators and incumbent local

telephone companies, either offer or are making significant capital investments that will allow them to offer services

that provide features and functions comparable to the video, data and/or voice services that TWC offers and they are

aggressively seeking to offer them in bundles similar to TWC’s.

In addition to the subscription services described above, TWC also earns revenues by selling advertising time

to national, regional and local businesses.

As of July 31, 2006, the date the transactions with Adelphia and Comcast closed, the penetration rates for basic

video, digital video and high-speed data services were generally lower in the systems acquired from Adelphia and

Comcast (the “Acquired Systems”) than in TWC’s legacy systems. Furthermore, certain advanced services were not

available in some of the Acquired Systems, and IP-based telephony service was not available in any of the Acquired

Systems. To increase the penetration of these services in the Acquired Systems, TWC is in the midst of a significant

integration effort that includes upgrading the capacity and technical performance of these systems to levels that will

allow the delivery of these advanced services and features. As of December 31, 2006, Digital Phone was available in

some of the Acquired Systems on a limited basis.

Basis of Presentation

Changes in Basis of Presentation

On February 13, 2007, the Company filed with the Securities and Exchange Commission (“SEC”) a Current

Report on Form 8-K that contained recast consolidated financial information as of December 31, 2005 and 2004 and

for each year in the three-year period ended December 31, 2005. The financial information was recast so that the

basis of presentation would be consistent with that of 2006. Specifically, the financial information was recast to

reflect (i) the retrospective application of Financial Accounting Standards Board (“FASB”) Statement No. 123

(revised 2004), Share-Based Payment (“FAS 123R”), which was adopted by the Company in 2006, (ii) the

retrospective presentation of certain cable systems transferred in 2006 as discontinued operations and (iii) the effect

of a stock dividend that occurred immediately prior to the consummation of the acquisition of assets of Adelphia.

The financial information presented herein reflects the impact of that recast as well as the restatement discussed

below under the heading “Restatement of Prior Financial Information.”

Stock-based compensation. Historically, TWC employees have participated in various Time Warner equity

plans. TWC has established the Time Warner Cable Inc. 2006 Stock Incentive Plan (the “2006 Plan”). The

Company expects that its employees will participate in the 2006 Plan starting in 2007 and thereafter will not

continue to participate in Time Warner’s equity plan. TWC employees who have outstanding equity awards under

the Time Warner equity plans will retain any rights under those Time Warner equity awards pursuant to their terms

regardless of their participation in the 2006 Plan. The Company has adopted the provisions of FAS 123R as of

January 1, 2006. The provisions of FAS 123R require a company to measure the cost of employee services received

in exchange for an award of equity instruments based on the grant-date fair value of the award. That cost is

recognized in the statement of operations over the period during which an employee is required to provide service in

exchange for the award. FAS 123R also amends FASB Statement No. 95, Statement of Cash Flows, to require that

excess tax benefits, as defined, realized from the exercise of stock options be reported as a financing cash inflow

rather than as a reduction of taxes paid in cash flow from operations.

Prior to the adoption of FAS 123R, the Company had followed the provisions of FASB Statement No. 123,

Accounting for Stock-Based Compensation (“FAS 123”), which allowed the Company to follow the intrinsic value

method set forth in Accounting Principles Board (“APB”) Opinion No. 25, Accounting for Stock Issued to

105

TIME WARNER CABLE INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)