Time Warner Cable 2006 Annual Report Download - page 113

Download and view the complete annual report

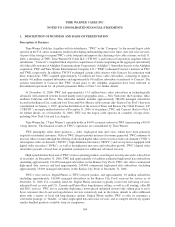

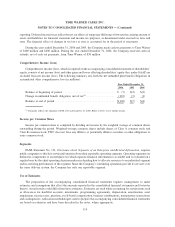

Please find page 113 of the 2006 Time Warner Cable annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.of certain Time Warner corporate costs deemed reasonable by management to present the Company’s consolidated

results of operations, financial position, changes in equity and cash flows on a stand-alone basis. The consolidated

financial statements include the results of Time Warner Entertainment-Advance/Newhouse Partnership

(“TWE-A/N”) only for the systems that are controlled by TWC and for which TWC holds an economic interest.

The Time Warner corporate costs include specified administrative services, including selected tax, human

resources, legal, information technology, treasury, financial, public policy and corporate and investor relations

services, and approximate Time Warner’s estimated overhead cost for services rendered. Intercompany transactions

between the consolidated companies have been eliminated.

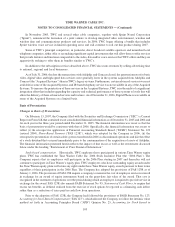

Reclassifications

Certain reclassifications have been made to the prior year financial information to conform to the December 31,

2006 presentation.

2. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

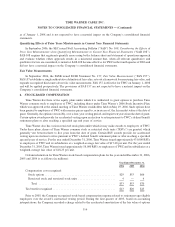

Cash and Equivalents

Cash and equivalents include money market funds, overnight deposits and other investments that are readily

convertible into cash and have original maturities of three months or less. Cash equivalents are carried at cost, which

approximates fair value.

Accounting for Investments

Investments in companies in which TWC has significant influence, but less than a controlling voting interest,

are accounted for using the equity method. Significant influence is generally presumed to exist when TWC owns

between 20% and 50% of the investee. The effect of any changes in TWC ownership interests resulting from the

issuance of capital by consolidated subsidiaries or unconsolidated cable television system joint ventures to

unaffiliated parties is included as an adjustment to shareholders’ equity.

Property, Plant and Equipment

Property, plant and equipment are stated at cost. TWC incurs expenditures associated with the construction of

its cable systems. Costs associated with the construction of the cable transmission and distribution facilities and new

cable service installations are capitalized. With respect to certain customer premise equipment, which includes

converters and cable modems, TWC capitalizes installation charges only upon the initial deployment of these

assets. All costs incurred in subsequent disconnects and reconnects are expensed as incurred. Depreciation on these

assets is provided, generally using the straight-line method, over their estimated useful lives.

TWC uses product-specific and, in the case of customers who have multiple products installed at once, bundle-

specific standard costing models to capitalize installation activities. Significant judgment is involved in the

development of these costing models, including the average time required to perform an installation and the

determination of the nature and amount of indirect costs to be capitalized. Additionally, the development of

standard costing models for new products such as Digital Phone involve more estimates than the standard costing

models for established products because the Company has less historical data related to the installation of new

products. The standard costing models are reviewed annually and adjusted prospectively, if necessary, based on

comparisons to actual costs incurred.

TWC generally capitalizes expenditures for tangible fixed assets having a useful life of greater than one year.

Types of capitalized expenditures include: customer premise equipment, scalable infrastructure, line extensions,

plant upgrades and rebuilds and support capital. In connection with the Transactions, as defined in Note 5 below,

TW NY acquired significant amounts of property, plant and equipment, which were recorded at their estimated fair

108

TIME WARNER CABLE INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)