Time Warner Cable 2006 Annual Report Download - page 102

Download and view the complete annual report

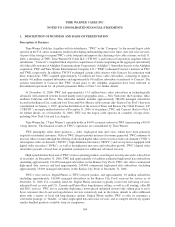

Please find page 102 of the 2006 Time Warner Cable annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.or services, the Company evaluates whether it has fair value evidence for each product or service being purchased. If

the Company has fair value evidence for each product or service being purchased, it accounts for each separately,

based on the relevant cost recognition accounting policies. However, if the Company is unable to determine fair

value for one or more of the purchased elements, the Company would recognize the cost of the transaction on a

straight-line basis over the term of the agreement.

This policy also would apply in instances where the Company settles a dispute at the same time the Company

purchases a product or service from that same counterparty. For example, the Company may settle a dispute on an

existing programming contract with a programming vendor at the same time that it is renegotiating a new

programming contract with the same programming vendor. Because the Company is negotiating both the settlement

of the dispute and a new programming contract, each of the elements should be accounted for at fair value. The

amount allocated to the settlement of the dispute would be recognized immediately, whereas the amount allocated

to the new programming contract would be accounted for prospectively, consistent with the accounting for other

similar programming agreements.

Property, Plant and Equipment

TWC incurs expenditures associated with the construction of its cable systems. Costs associated with the

construction of the cable transmission and distribution facilities and new cable service installations are capitalized.

With respect to certain customer premise equipment, which includes converters and cable modems, TWC

capitalizes installation charges only upon the initial deployment of these assets. All costs incurred in subsequent

disconnects and reconnects are expensed as incurred. Depreciation on these assets is provided, generally using the

straight-line method, over their estimated useful lives.

TWC uses product-specific and, in the case of customers who have multiple products installed at once, bundle-

specific standard costing models to capitalize installation activities. Significant judgment is involved in the

development of these costing models, including the average time required to perform an installation and the

determination of the nature and amount of indirect costs to be capitalized. Additionally, the development of

standard costing models for new products such as Digital Phone involve more estimates than the standard costing

models for established products because the Company has less historical data related to the installation of new

products. The standard costing models are reviewed annually and adjusted prospectively, if necessary, based on

comparisons to actual costs incurred.

TWC generally capitalizes expenditures for tangible fixed assets having a useful life of greater than one year.

Types of capitalized expenditures include: customer premise equipment, scalable infrastructure, line extensions,

plant upgrades and rebuilds and support capital. For converters and modems, useful life is generally 3 to 4 years and

for plant upgrades, useful life is up to 16 years. In connection with the Transactions, TW NY acquired significant

amounts of property, plant and equipment, which were recorded at their estimated fair values. The remaining useful

lives assigned to such assets were generally shorter than the useful lives assigned to comparable new assets to reflect

the age, condition and intended use of the acquired property, plant and equipment.

Programming Agreements

The Company exercises significant judgment in estimating programming expense associated with certain

video programming contracts. The Company’s policy is to record video programming costs based on TWC’s

contractual agreements with programming vendors, which are generally multi-year agreements that provide for

TWC to make payments to the programming vendors at agreed upon rates, which represent fair market value, based

on the number of subscribers to which TWC provides the service. If a programming contract expires prior to

entering into a new agreement, the Company is required to estimate the programming costs during the period there

is no contract in place. The Company considers the previous contractual rates, inflation and the status of the

negotiations in determining its estimates. When the programming contract terms are finalized, an adjustment to

97

TIME WARNER CABLE INC.

MANAGEMENT’S DISCUSSION AND ANALYSIS OF RESULTS

OF OPERATIONS AND FINANCIAL CONDITION — (Continued)