Time Warner Cable 2006 Annual Report Download - page 125

Download and view the complete annual report

Please find page 125 of the 2006 Time Warner Cable annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Comcast in the TWC Redemption. At December 31, 2005, the net deferred tax liabilities on such systems were

included in noncurrent liabilities of discontinued operations.

Following the Redemptions and the Adelphia Acquisition, on July 31, 2006, TW NY and Comcast swapped

certain cable systems, most of which were acquired from Adelphia, each with an estimated value of approximately

$8.7 billion, as determined by management using a discounted cash flow and market comparable valuation model,

in order to enhance TWC’s and Comcast’s respective geographic clusters of subscribers (the “Exchange” and,

together with the Adelphia Acquisition and the Redemptions, the “Transactions”), and TW NY paid Comcast

approximately $67 million for certain adjustments related to the Exchange. The discounted cash flow valuation

model was based upon estimated future cash flows and utilized a discount rate consistent with the inherent risk in

the business. The Exchange was accounted for as a purchase of cable systems from Comcast and a sale of TW NY’s

cable systems to Comcast. The systems exchanged by TW NY included Urban Cable Works of Philadelphia, L.P.

(“Urban Cable”) and systems acquired from Adelphia. The Company did not record a gain or loss on systems

TW NYacquired from Adelphia and transferred to Comcast in the Exchange because such systems were recorded at

fair value in the Adelphia Acquisition. The Company did, however, record a pretax gain of $34 million ($20 million

net of tax) on the Exchange related to the disposition of Urban Cable. This gain is included as a component of

discontinued operations in the accompanying consolidated statement of operations in 2006.

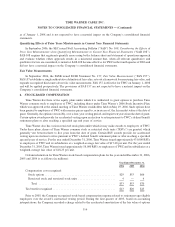

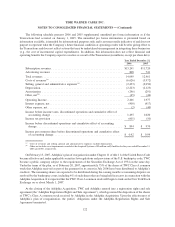

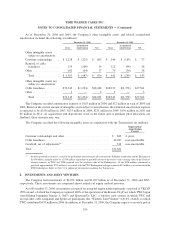

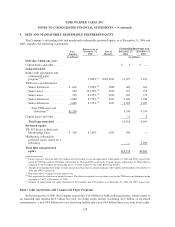

The purchase price for each of the Adelphia Acquisition and the Exchange is as follows (in millions):

Cash consideration for the Adelphia Acquisition . ............................... $ 8,935

Fair value of equity consideration for the Adelphia Acquisition ..................... 5,500

Fair value of Urban Cable ................................................ 190

Other costs ........................................................... 235

Total purchase price ..................................................... $14,860

Other costs consist of (i) a contractual closing adjustment totaling $67 million relating to the Exchange,

(ii) $113 million of total transaction costs and (iii) $55 million of transaction-related taxes.

The purchase price allocation for the Adelphia Acquisition and the Exchange is as follows at December 31,

2006 (in millions):

Depreciation/

Amortization

Periods

(a)

Intangible assets not subject to amortization (cable franchise rights) . . . $10,487 non-amortizable

Intangible assets subject to amortization (primarily customer

relationships) ......................................... 882 4years

Property, plant and equipment (primarily cable television equipment) . . 2,490 1-20 years

Other assets ............................................ 149 notapplicable

Goodwill .............................................. 1,050 non-amortizable

Liabilities .............................................. (198) not applicable

Total purchase price ...................................... $14,860

(a)

Intangible assets and goodwill associated with the Adelphia Acquisition are deductible over a 15-year period for tax purposes and

would reduce net cash tax payments by more than $300 million per year, assuming the following: (i) straight-line amortization

deductions over 15 years, (ii) sufficient taxable income to utilize the amortization deductions and (iii) a 40% effective tax rate.

The allocation of the purchase price for the Adelphia Acquisition and the Exchange, which primarily used a

discounted cash flow approach with respect to identified intangible assets and a combination of the cost and market

approaches with respect to property, plant and equipment, is being finalized and the Company does not expect any

120

TIME WARNER CABLE INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)