Time Warner Cable 2006 Annual Report Download - page 127

Download and view the complete annual report

Please find page 127 of the 2006 Time Warner Cable annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

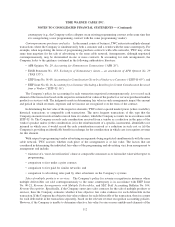

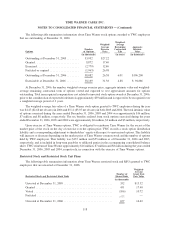

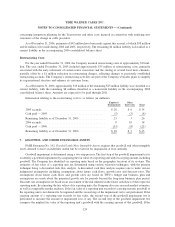

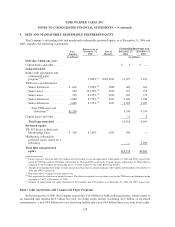

The following schedule presents 2006 and 2005 supplemental unaudited pro forma information as if the

Transactions had occurred on January 1, 2005. The unaudited pro forma information is presented based on

information available, is intended for informational purposes only and is not necessarily indicative of and does not

purport to represent what the Company’s future financial condition or operating results will be after giving effect to

the Transactions and does not reflect actions that may be undertaken by management in integrating these businesses

(e.g., the cost of incremental capital expenditures). In addition, this information does not reflect financial and

operating benefits the Company expects to realize as a result of the Transactions (in millions, except per share data).

2006 2005

Year Ended December 31,

Subscription revenues ............................................. $13,241 $11,720

Advertising revenues ............................................. 808 741

Total revenues .................................................. 14,049 12,461

Costs of revenues

(a)

.............................................. (6,626) (5,972)

Selling, general and administrative expenses

(a)

........................... (2,433) (2,050)

Depreciation .................................................... (2,223) (2,125)

Amortization ................................................... (296) (291)

Other, net

(b)

.................................................... (65) (46)

Operating Income ................................................ 2,406 1,977

Interest expense, net .............................................. (909) (917)

Other expense, net ............................................... (2) (40)

Income before income taxes, discontinued operations and cumulative effect of

accounting change ............................................. 1,495 1,020

Income tax provision ............................................. (601) (50)

Income before discontinued operations and cumulative effect of accounting

change ...................................................... $ 894 $ 970

Income per common share before discontinued operations and cumulative effect

of accounting change ........................................... $ 0.92 $ 0.99

(a)

Costs of revenues and selling, general and administrative expenses exclude depreciation.

(b)

Other, net includes asset impairments recorded at the Acquired Systems of $9 million and $4 million for the years ended December 31,

2006 and 2005, respectively.

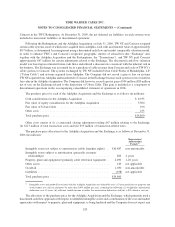

On February 13, 2007, Adelphia’s plan of reorganization under Chapter 11 of title 11 of the United States Code

became effective and, under applicable securities law regulations and provisions of the U.S. bankruptcy code, TWC

became a public company subject to the requirements of the Securities Exchange Act of 1934 on the same day.

Under the terms of the plan, as of February 20, 2007, approximately 75% of the shares of TWC Class A common

stock that Adelphia received as part of the payment for its assets in July 2006 have been distributed to Adelphia’s

creditors. The remaining shares are expected to be distributed during the coming months as remaining disputes are

resolved by the bankruptcy court, including 4% of such shares that are being held in escrow in connection with the

Adelphia Acquisition. It is expected that the TWC Class A common stock will begin to trade on the New York Stock

Exchange on or about March 1, 2007.

At the closing of the Adelphia Acquisition, TWC and Adelphia entered into a registration rights and sale

agreement (the “Adelphia Registration Rights and Sale Agreement”), which governed the disposition of the shares

of TWC’s Class A common stock received by Adelphia in the Adelphia Acquisition. Upon the effectiveness of

Adelphia’s plan of reorganization, the parties’ obligations under the Adelphia Registration Rights and Sale

Agreement terminated.

122

TIME WARNER CABLE INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)