Time Warner Cable 2006 Annual Report Download - page 71

Download and view the complete annual report

Please find page 71 of the 2006 Time Warner Cable annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.discontinued operations. In addition to reversing the recognition of revenue, based on the independent examiner’s

conclusions, the Company has recorded corresponding reductions in the cable programming costs over the life of

the related cable programming affiliation agreements (which range from 10 to 12 years) that were acquired

contemporaneously with the execution of the advertising agreements. This has the effect of increasing earnings

beginning in 2003 and continuing through future periods.

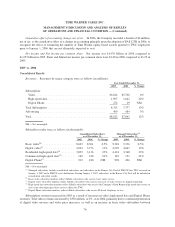

The net effect of restating these transactions is that TWC’s net income was reduced by approximately

$60 million in 2001 and $61 million in 2002 and was increased by approximately $12 million in each of 2003, 2004

and 2005, and by approximately $6 million for the first six months of 2006 (the impact for the year ended

December 31, 2006 was an increase to the Company’s net income of approximately $12 million). While the

restatement resulted in changes in the classification of cash flows within cash provided by operating activities, it has

not impacted total cash flows during the periods.

FINANCIAL STATEMENT PRESENTATION

Revenues

The Company’s revenues consist of Subscription and Advertising revenues. Subscription revenues consist of

revenues from video, high-speed data and Digital Phone services.

Video revenues include monthly fees for basic, standard and digital services, together with related equipment

rental charges, charges for set-top boxes and charges for premium channels and SVOD services. Video revenues

also include installation, Pay-Per-View and VOD charges and franchise fees relating to video charges collected on

behalf of local franchising authorities. Several ancillary items are also included within video revenues, such as

commissions related to the sale of merchandise by home shopping services and rental income earned on the leasing

of antenna attachments on the Company’s transmission towers. In each period presented, these ancillary items

constitute less than 2% of video revenues.

High-speed data revenues include monthly subscriber fees from both residential and commercial subscribers,

along with related equipment rental charges, home networking fees and installation charges. High-speed data

revenues also include fees received from TKCCP (an unconsolidated joint venture at December 31, 2006, which is

in the process of being dissolved), third parties and certain cable systems owned by a subsidiary of TWE-A/N and

managed by the Advance/Newhouse Partnership (“A/N”).

Digital Phone revenues include monthly subscriber fees from voice subscribers, including Digital Phone

subscribers and circuit-switched subscribers acquired from Comcast in the Exchange, along with related instal-

lation charges. TWC continues to provide traditional, circuit-switched services to those subscribers and will

continue to do so for some period of time, while simultaneously marketing Digital Phone to those customers. After

some period of time, TWC intends to discontinue the circuit-switched offering in accordance with regulatory

requirements, at which time the only voice services provided by TWC in those systems will be Digital Phone

service.

Advertising revenues include the fees charged to local, regional and national advertising customers for

advertising placed on the Company’s video and high-speed data services. Nearly all Advertising revenues are

attributable to the Company’s video service.

Costs and Expenses

Costs of revenues include: video programming costs (including fees paid to the programming vendors net of

certain amounts received from the vendors); high-speed data connectivity costs; Digital Phone network costs; other

service-related expenses, including non-administrative labor costs directly associated with the delivery of products

and services to subscribers; maintenance of the Company’s delivery systems; franchise fees; and other related

66

TIME WARNER CABLE INC.

MANAGEMENT’S DISCUSSION AND ANALYSIS OF RESULTS

OF OPERATIONS AND FINANCIAL CONDITION — (Continued)