Time Warner Cable 2006 Annual Report Download - page 134

Download and view the complete annual report

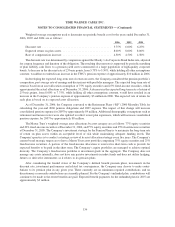

Please find page 134 of the 2006 Time Warner Cable annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Collectively, these facilities refinanced $4.0 billion of previously existing committed bank financing, while the

$2.0 billion increase in the revolving credit facility and the $8.0 billion of new term loan facilities were used to

finance, in part, the cash portions of the Transactions. As discussed below, the increase in the revolving credit

facility and the two term loan facilities became effective concurrent with the closing of the Adelphia Acquisition,

and the term loans were fully utilized at that time.

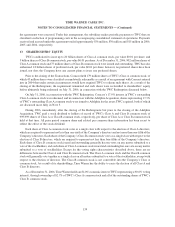

Following the financing transactions described above, TWC has a $6.0 billion senior unsecured five-year

revolving credit facility with a maturity date of February 15, 2011 (the “Cable Revolving Facility”). This represents

a refinancing of TWC’s previous $4.0 billion of revolving bank commitments with a maturity date of November 23,

2009, plus an increase of $2.0 billion effective concurrent with the closing of the Adelphia Acquisition. Also

effective concurrent with the closing of the Adelphia Acquisition are two $4.0 billion term loan facilities (the

“Cable Term Facilities” and, collectively with the Cable Revolving Facility, the “Cable Facilities”), with maturity

dates of February 24, 2009 and February 21, 2011, respectively. TWE is no longer a borrower in respect of any of the

Cable Facilities, although TWE and TW NY Holding guarantee the obligations of TWC under the Cable Facilities.

As of December 31, 2006, there were borrowings of $8.0 billion outstanding under the Cable Term Facilities.

On October 18, 2006, TW NY Holding executed and delivered unconditional guaranties of the obligations of

TWC under the Cable Facilities. In addition, contemporaneously with the completion by TW NY of the TWE GP

Transfer described below, TW NY was released from its guaranties of TWC’s obligations under the Cable Facilities

in accordance with the terms of the Cable Facilities. In addition, following the adoption of the amendments to the

TWE Indenture pursuant to the Eleventh Supplemental Indenture described below, the guaranties previously

provided by ATC and Warner Communications Inc. (“WCI”), subsidiaries of Time Warner, of TWC’s obligations

under the Cable Facilities were automatically terminated in accordance with the terms of the Cable Facilities.

Borrowings under the Cable Revolving Facility bear interest at a rate based on the credit rating of TWC, which

rate was LIBOR plus 0.27% per annum as of December 31, 2006. In addition, TWC is required to pay a facility fee

on the aggregate commitments under the Cable Revolving Facility at a rate determined by the credit rating of TWC,

which rate was 0.08% per annum as of December 31, 2006. TWC may also incur an additional usage fee of

0.10% per annum on the outstanding loans and other extensions of credit under the Cable Revolving Facility if and

when such amounts exceed 50% of the aggregate commitments thereunder. Borrowings under the Cable Term

Facilities bear interest at a rate based on the credit rating of TWC, which rate was LIBOR plus 0.40% per annum as

of December 31, 2006. In addition, TWC paid a facility fee on the aggregate commitments under the Cable Term

Facilities for the period prior to the closing of the Adelphia Acquisition at a rate of 0.08% per annum.

The Cable Revolving Facility provides same-day funding capability and a portion of the commitment, not to

exceed $500 million at any time, may be used for the issuance of letters of credit. The Cable Facilities contain a

maximum leverage ratio covenant of 5.0 times the consolidated EBITDA of TWC. The terms and related financial

metrics associated with the leverage ratio are defined in the Cable Facility agreements. At December 31, 2006,

TWC was in compliance with the leverage covenant, with a leverage ratio, calculated in accordance with the

agreements, of approximately 3.3 times. The Cable Facilities do not contain any credit ratings-based defaults or

covenants or any ongoing covenant or representations specifically relating to a material adverse change in the

financial condition or results of operations of Time Warner or TWC. Borrowings under the Cable Revolving Facility

may be used for general corporate purposes and unused credit is available to support borrowings under TWC’s

commercial paper program. Borrowings under the Cable Facilities were used to finance, in part, the cash portions of

the Transactions. As of December 31, 2006, there were borrowings of $925 million and letters of credit totaling

$159 million outstanding under the Cable Revolving Facility, and approximately $2.152 billion of commercial

paper was supported by the Cable Revolving Facility. TWC’s unused committed capacity as of December 31, 2006

was $2.798 billion, net of $17 million unamortized discount on commercial paper and including $51 million of cash

and equivalents.

On December 4, 2006, TWC entered into a $6.0 billion unsecured commercial paper program (the “New

Program”) that replaced its previous $2.0 billion commercial paper program (the “Prior Program”). TWC’s

129

TIME WARNER CABLE INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)