Time Warner Cable 2006 Annual Report Download - page 138

Download and view the complete annual report

Please find page 138 of the 2006 Time Warner Cable annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

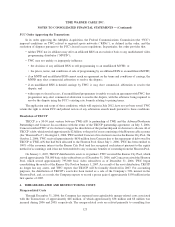

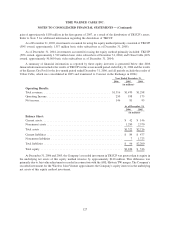

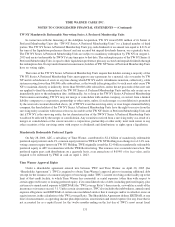

The components of the provision for income taxes are as follows (in millions):

2006 2005 2004

Year Ended December 31,

Federal:

Current ................................................ $(324) $(471) $ 35

Deferred . . . ............................................ (196) (158) (383)

State:

Current ................................................ (56) (77) (45)

Deferred . . . ............................................ (44) 553 (61)

Total income tax provision ................................ $(620) $(153) $(454)

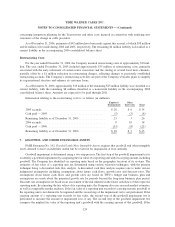

The difference between income taxes expected at the U.S. federal statutory income tax rate of 35% and income

taxes provided is detailed below (in millions):

2006 2005 2004

Year Ended December 31,

Taxes on income at U.S. federal statutory rate ..................... $(545) $(456) $(380)

State and local taxes, net of federal tax benefits .................... (69) (73) (71)

State tax law change, deferred tax impact

(a)

....................... — 205 —

State ownership restructuring and methodology changes, deferred tax

impact

(b)

............................................... — 174 —

Other.................................................... (6) (3) (3)

Reported income tax provision ............................... $(620) $(153) $(454)

(a)

Represents changes to the method of taxation in Ohio. The income tax is being phased out and replaced with a gross receipts tax.

(b)

Represents the restructuring of the Company’s partnership interests in Texas and certain other state methodology changes.

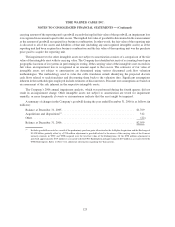

The Company has recorded a tax provision in shareholders’ equity of $1 million in 2006 and a tax benefit in

shareholders’ equity of $3 million and $2 million in 2005 and 2004, respectively, in connection with the exercise of

certain stock options.

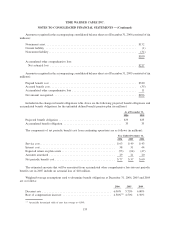

Significant components of TWC’s net deferred tax liabilities are as follows (in millions):

2006 2005

As of December 31,

Cable franchise costs and customer relationships ...................... $(10,806) $(10,037)

Fixed assets ................................................. (1,837) (1,354)

Investments ................................................. (552) (334)

Other ...................................................... (92) (184)

Deferred tax liabilities ....................................... (13,287) (11,909)

Stock-based compensation ...................................... 138 139

Other ...................................................... 247 139

Deferred tax assets .......................................... 385 278

Net deferred tax liabilities ..................................... $(12,902) $(11,631)

133

TIME WARNER CABLE INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)