Time Warner Cable 2006 Annual Report Download - page 95

Download and view the complete annual report

Please find page 95 of the 2006 Time Warner Cable annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

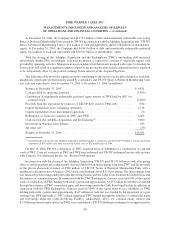

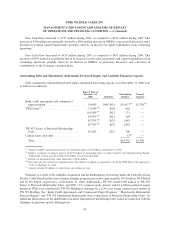

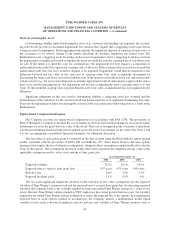

2007

2008-

2009

2010-

2011

2012 and

Thereafter Total

(in millions)

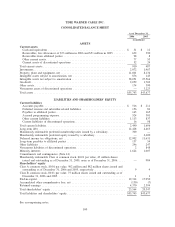

Programming purchases

(a)

.............. $2,867 $ 4,203 $ 2,846 $1,843 $11,759

Outstanding debt obligations and

mandatorily redeemable preferred

membership units

(b)

................. 4 4,600 7,094 2,911 14,609

Interest and dividends

(c)

................ 922 1,594 957 2,816 6,289

Facility leases

(d)

..................... 73 140 128 461 802

Data processing services . . ............. 40 79 79 36 234

High-speed data connectivity ............ 19 3 1 — 23

Digital Phone connectivity

(e)

............ 193 401 196 — 790

Converter and modem purchases ......... 399 3 — — 402

Other ............................. 20 17 2 7 46

Total .............................. $4,537 $11,040 $11,303 $8,074 $34,954

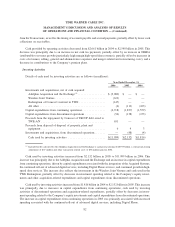

(a)

The Company has purchase commitments with various programming vendors to provide video services to subscribers. Programming

fees represent a significant portion of its costs of revenues. Future fees under such contracts are based on numerous variables, including

number and type of customers. The amounts of the commitments reflected above are based on the number of subscribers at

December 31, 2006 applied to the per subscriber contractual rates contained in the contracts that were in effect as of December 31, 2006.

(b)

Outstanding debt obligations and mandatorily redeemable preferred membership units represent the principal amounts due on

outstanding debt obligations and mandatorily redeemable preferred membership units as of December 31, 2006. Amounts do not

include any fair value adjustments, bond premiums, discounts, interest payments or dividends.

(c)

With the exception of commercial paper issued under the Company’s commercial paper program, amounts are based on the outstanding

debt or mandatorily redeemable preferred membership units balances, respective interest or dividend rates (interest rates on variable-

rate debt were held constant through maturity at the December 31, 2006 rates) and maturity schedule of the respective instruments as of

December 31, 2006. With regard to commercial paper issued under the commercial paper program, amounts assume the outstanding

commercial paper and interest rates at December 31, 2006 will remain outstanding through the maturity of the underlying credit facility.

Interest ultimately paid on these obligations may differ based on changes in interest rates for variable-rate debt, as well as any potential

future refinancings entered into by the Company. See Note 9 to the accompanying consolidated financial statements for further details.

(d)

The Company has facility lease commitments under various operating leases including minimum lease obligations for real estate and

operating equipment.

(e)

Digital Phone connectivity commitments are based on the number of Digital Phone subscribers at December 31, 2006 and the per

subscriber contractual rates contained in the contracts that were in effect as of December 31, 2006.

The Company’s total rent expense, which primarily includes facility rental expense and pole attachment rental

fees, amounted to $149 million, $98 million and $101 million for the years ended December 31, 2006, 2005 and

2004, respectively.

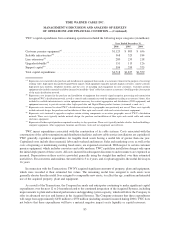

Contingent Commitments

Prior to the TWE Restructuring, TWE had various contingent commitments, including guarantees, related to

TWE’s non-cable businesses, including Warner Bros., Home Box Office, and TWE’s interests in The WB

Television Network (which has subsequently ceased operations), Comedy Central (which was subsequently sold)

and the Courtroom Television Network (collectively, the “Non-cable Businesses”). In connection with the

restructuring of TWE, some of these commitments were not transferred with their applicable Non-cable Business

and they remain contingent commitments of TWE. Specifically, in connection with the Non-cable Businesses’

former investment in the Six Flags theme parks located in Georgia and Texas (“Six Flags Georgia” and “Six Flags

Texas,” respectively, and, collectively, the “Parks”), in 1997, Time Warner and TWE each agreed to guarantee (the

“Six Flags Guarantee”), for the benefit of the limited partners, certain obligations of the partnerships that hold the

Parks (the “Partnerships”), including the following (the “Guaranteed Obligations”): (a) the obligation to make a

minimum amount of annual distributions to the limited partners of the Partnerships; (b) the obligation to make a

minimum amount of capital expenditures each year; (c) the requirement that an annual offer to purchase be made in

90

TIME WARNER CABLE INC.

MANAGEMENT’S DISCUSSION AND ANALYSIS OF RESULTS

OF OPERATIONS AND FINANCIAL CONDITION — (Continued)