Time Warner Cable 2006 Annual Report Download - page 115

Download and view the complete annual report

Please find page 115 of the 2006 Time Warner Cable annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.in its value, the investment is written down to its fair value by a charge to earnings. This evaluation is dependent on

the specific facts and circumstances. For investments accounted for using the cost or equity method of accounting,

TWC evaluates information including budgets, business plans and financial statements in determining whether an

other-than-temporary decline in value exists. Factors indicative of an other-than-temporary decline include

recurring operating losses, credit defaults and subsequent rounds of financings at an amount below the cost basis

of the investment. This list is not all-inclusive and the Company’s management weighs all quantitative and

qualitative factors in determining if an other-than-temporary decline in the value of an investment has occurred.

Long-lived Assets

Long-lived assets, including finite-lived intangible assets, are tested for impairment whenever events or

changes in circumstances indicate that the related carrying amounts may not be recoverable. Determining the extent

of an impairment, if any, typically requires various estimates and assumptions including cash flows directly

attributable to the asset, the useful life of the asset and residual value, if any. When necessary, the Company uses

internal cash flow estimates, quoted market prices and appraisals, as appropriate, to determine fair value.

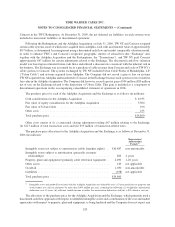

Goodwill and Indefinite-lived Intangible Assets

Goodwill and indefinite-lived intangible assets, primarily certain franchise assets, are tested annually during

the fourth quarter and whenever events or circumstances make it more likely than not that an impairment may have

occurred, such as a significant adverse change in the business climate or a decision to sell or dispose of the unit.

Estimating fair value is performed by utilizing various valuation techniques, with the primary technique being a

discounted cash flow model. The use of a discounted cash flow model often involves the use of significant estimates

and assumptions. Refer to Note 7 for further details.

Computer Software

TWC capitalizes certain costs incurred for the development of internal use software. These costs, which

include the costs associated with coding, software configuration, upgrades and enhancements, are included in

property, plant and equipment in the accompanying consolidated balance sheet. Such costs are depreciated on a

straight-line basis over 3 to 5 years. These costs, net of accumulated depreciation, totaled $371 million and

$280 million as of December 31, 2006 and 2005, respectively. Amortization of capitalized software costs was

$81 million in 2006, $54 million in 2005 and $53 million in 2004.

Accounting for Pension Plans

TWC has defined benefit pension plans covering a majority of its employees. Pension benefits are based on

formulas that reflect the employees’ years of service and compensation during their employment period and

participation in the plans. The pension expense recognized by the Company is determined using certain assump-

tions, including the expected long-term rate of return on plan assets, the discount rate used to determine the present

value of future pension benefits and the rate of compensation increases. The determination of these assumptions is

discussed in more detail in Note 11.

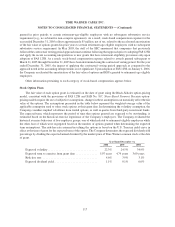

Stock-based Compensation

The Company accounts for stock-based compensation in accordance with FAS 123R, which requires that the

Company measure the cost of employee services received in exchange for an award of equity instruments based on

the grant-date fair value of the award. That cost is recognized in the consolidated statement of operations over the

period during which an employee is required to provide service in exchange for the award. Refer to “Changes in

Basis of Presentation” in Note 1 and Note 4 for further information.

110

TIME WARNER CABLE INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)