Time Warner Cable 2006 Annual Report Download - page 85

Download and view the complete annual report

Please find page 85 of the 2006 Time Warner Cable annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

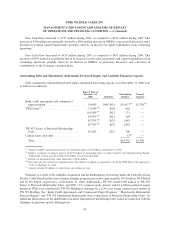

At December 31, 2006, the Company had $14.732 billion of debt and mandatorily redeemable non-voting

Series A Preferred Membership Units issued by TW NY in connection with the Adelphia Acquisition (the “TW NY

Series A Preferred Membership Units”), $51 million of cash and equivalents and $23.564 billion of shareholders’

equity. At December 31, 2005, the Company had $6.863 billion of debt and mandatorily redeemable preferred

equity, $12 million of cash and equivalents and $20.347 billion of shareholders’ equity.

With the closing of the Adelphia Acquisition and the Redemptions, TWC’s outstanding debt increased

substantially during 2006. Accordingly, cash paid for interest is expected to continue to negatively impact cash

provided by operating activities. Management does not believe that the interest incurred with respect to funding the

Transactions will result in a significant negative impact to net income because such incremental interest is expected

to be substantially offset by the positive earnings before interest of the Acquired Systems.

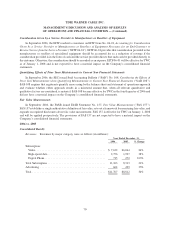

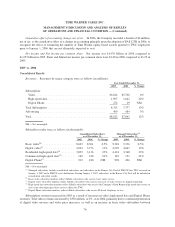

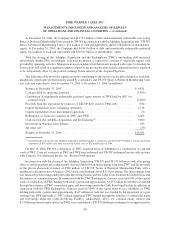

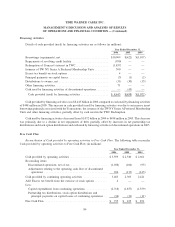

The following table shows the significant items contributing to the increase in net debt (defined as total debt,

mandatorily redeemable preferred equity issued by a subsidiary and TW NY Series A Preferred Membership Units

less cash and equivalents) from December 31, 2005 to December 31, 2006 (in millions):

Balance at December 31, 2005 ............................................. $ 6,851

Cash provided by operating activities ........................................ (3,595)

Contribution of mandatorily redeemable preferred equity interest in TWE held by ATC for

common stock ....................................................... (2,400)

Proceeds from the repayment by Comcast of TKCCP debt owed to TWE-A/N .......... (631)

Capital expenditures from continuing operations . ............................... 2,718

Capital expenditures from discontinued operations .............................. 56

Redemption of Comcast’s interests in TWC and TWE ............................ 2,004

Cash used for the Adelphia Acquisition and the Exchange

(a)

....................... 9,080

Investment in Wireless Joint Venture......................................... 633

All other, net .......................................................... (35)

Balance at December 31, 2006 ............................................. $14,681

(a)

Included in the cash used for the Adelphia Acquisition and the Exchange is cash paid at closing of $8.935 billion, a contractual closing

adjustment of $67 million and other transaction-related costs of $78 million paid in 2006.

On July 31, 2006, TW NY, a subsidiary of TWC, acquired assets of Adelphia for a combination of cash and

stock of TWC, Comcast’s interests in TWC and TWE were redeemed and TW NY exchanged certain cable systems

with Comcast. For additional details, see “Recent Developments.”

In connection with the closing of the Adelphia Acquisition, TW NY paid $8.935 billion in cash, after giving

effect to certain purchase price adjustments, that was funded by an intercompany loan from TWC and the proceeds

of the private placement issuance of $300 million of TW NY Series A Preferred Membership Units with a

mandatory redemption date of August 1, 2013 and a cash dividend rate of 8.21% per annum. The intercompany loan

was financed by borrowings under the Cable Revolving Facility and the Cable Term Facilities described below and

the issuance of commercial paper. In connection with the TWC Redemption, Comcast received 100% of the capital

stock of a subsidiary of TWC holding both cable systems and approximately $1.857 billion in cash that was funded

through the issuance of TWC commercial paper and borrowings under the Cable Revolving Facility. In addition, in

connection with the TWE Redemption, Comcast received 100% of the equity interests in a subsidiary of TWE

holding both cable systems and approximately $147 million in cash that was funded by the repayment of a pre-

existing loan TWE had made to TWC (which repayment TWC funded through the issuance of commercial paper

and borrowings under the Cable Revolving Facility). Additionally, ATC’s 1% common equity interest and

$2.4 billion preferred equity interest in TWE were contributed to TW NY Holding in exchange for an approximately

80

TIME WARNER CABLE INC.

MANAGEMENT’S DISCUSSION AND ANALYSIS OF RESULTS

OF OPERATIONS AND FINANCIAL CONDITION — (Continued)