Time Warner Cable 2006 Annual Report Download - page 7

Download and view the complete annual report

Please find page 7 of the 2006 Time Warner Cable annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.TWC by TKCCP effective on January 1, 2007. For additional information with respect to the distribution of the assets

of TKCCP to its partners on January 1, 2007, see “Management’s Discussion and Analysis of Results of Operations

and Financial Condition — Recent Developments” in the financial pages herein.

Recent Developments

Transactions with Adelphia and Comcast

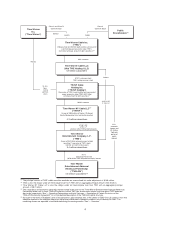

On July 31, 2006, TWC completed the following transactions with Adelphia and Comcast:

•The Adelphia Acquisition. TW NY acquired certain assets and assumed certain liabilities from Adelphia

for approximately $8.9 billion in cash and 156 million shares, or 17.3%, of TWC Class A common stock

(approximately 16% of TWC’s total common stock). The former Adelphia cable systems acquired, after

giving effect to the transactions with Adelphia and Comcast, are referred to herein as the “Adelphia Acquired

Systems.” On the same day, Comcast purchased certain assets and assumed certain liabilities from Adelphia

for approximately $3.6 billion in cash. Together, TW NY and Comcast purchased substantially all of the

cable assets of Adelphia (the “Adelphia Acquisition”).

•The Redemptions. Immediately before the Adelphia Acquisition, TWC and TWE redeemed Comcast’s

interests in TWC and TWE, respectively, in exchange for the capital stock of a subsidiary of TWC and a

subsidiary of TWE, respectively, together holding both an aggregate of approximately $2 billion in cash and

cable systems serving approximately 751,000 basic video subscribers (the “TWC Redemption” and the

“TWE Redemption,” respectively, and, together, the “Redemptions”).

•The Exchange. Immediately after the Adelphia Acquisition, TW NY and Comcast also swapped certain

cable systems, most of which were acquired from Adelphia, in order to enhance TWC’s and Comcast’s

respective geographic clusters of subscribers (the “Exchange”). The former Comcast cable systems acquired

from Comcast in the Exchange are referred to herein as the “Comcast Acquired Systems.”

For additional information regarding the Adelphia Acquisition, the Redemptions and the Exchange, see “— The

Transactions.”

The Adelphia Acquisition was designed to be a taxable acquisition of assets that would result in a tax basis in

the acquired assets equal to the purchase price TW NY paid. The resulting step-up in the tax basis of the assets

would increase future tax deductions, reduce future net cash tax payments and thereby increase TWC’s future cash

flows. See “Management’s Discussion and Analysis of Results of Operations and Financial Condition — Recent

Developments — Tax Benefits from the Transactions.”

TKCCP Dissolution

TKCCP, a 50-50 joint venture between TWC and Comcast, which, as of December 31, 2006, served

approximately 1.6 million basic video subscribers throughout Houston, Kansas City, south and west Texas and

New Mexico is in the process of being dissolved. In connection with the pending dissolution, on January 1, 2007,

TKCCP distributed its assets to its partners. TWC received TKCCP’s cable systems in Kansas City, south and west

Texas and New Mexico (the “Kansas City Pool”), which collectively served approximately 788,000 basic video

subscribers as of December 31, 2006, and Comcast received the Houston cable systems (the “Houston Pool”).

Comcast has refinanced the debt of TKCCP. TWC has not and will not assume any debt of TKCCP in connection

with the distribution of TKCCP’s assets or the dissolution. See “Management’s Discussion and Analysis of Results

of Operations and Financial Condition — Recent Developments — Dissolution of TKCCP.”

Caution Concerning Forward-Looking Statements and Risk Factors

This Annual Report on Form 10-K includes certain “forward-looking statements” within the meaning of the

Private Securities Litigation Reform Act of 1995. These statements are based on management’s current expec-

tations and are subject to uncertainty and changes in circumstances. Actual results may vary materially from the

expectations contained herein due to changes in economic, business, competitive, technological and/or regulatory

factors. For more detailed information about these factors, and risk factors with respect to the Company’s

2