Time Warner Cable 2006 Annual Report Download - page 129

Download and view the complete annual report

Please find page 129 of the 2006 Time Warner Cable annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

concerning integration planning for the Transactions and other costs incurred in connection with notifying new

customers of the change in cable providers.

As of December 31, 2006, payments of $42 million have been made against this accrual, of which $38 million

and $4 million were made during 2006 and 2005, respectively. The remaining $4 million liability is classified as a

current liability in the accompanying 2006 consolidated balance sheet.

Restructuring Costs

For the year ended December 31, 2006, the Company incurred restructuring costs of approximately $18 mil-

lion. The year ended December 31, 2005 included approximately $35 million of restructuring costs, primarily

associated with the early retirement of certain senior executives and the closing of several local news channels,

partially offset by a $1 million reduction in restructuring charges, reflecting changes to previously established

restructuring accruals. The Company’s restructuring activities are part of the Company’s broader plans to simplify

its organizational structure and enhance its customer focus.

As of December 31, 2006, approximately $15 million of the remaining $23 million liability was classified as a

current liability, with the remaining $8 million classified as a noncurrent liability in the accompanying 2006

consolidated balance sheet. Amounts are expected to be paid through 2011.

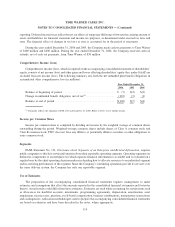

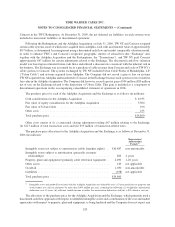

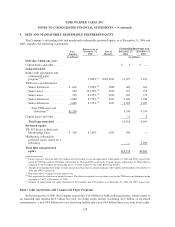

Information relating to the restructuring costs is as follows (in millions):

Employee

Terminations

Other

Exit Costs Total

2005 accruals ........................................ $28 $ 6 $34

Cash paid — 2005..................................... (5) (3) (8)

Remaining liability as of December 31, 2005 ................. 23 3 26

2006 accruals ........................................ 8 10 18

Cash paid — 2006..................................... (13) (8) (21)

Remaining liability as of December 31, 2006 ................. $18 $ 5 $23

7. GOODWILL AND OTHER INTANGIBLE ASSETS

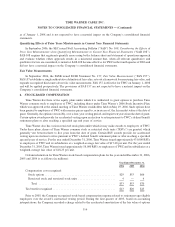

FASB Statement No. 142, Goodwill and Other Intangible Assets, requires that goodwill and other intangible

assets deemed to have an indefinite useful life be reviewed for impairment at least annually.

Goodwill impairment is determined using a two-step process. The first step of the goodwill impairment test is

to identify a potential impairment by comparing the fair value of a reporting unit with its carrying amount, including

goodwill. The Company has identified six reporting units based on the geographic locations of its systems. The

estimates of fair value of a reporting unit are determined using various valuation techniques, with the primary

technique being a discounted cash flow analysis. A discounted cash flow analysis requires one to make various

judgmental assumptions including assumptions about future cash flows, growth rates and discount rates. The

assumptions about future cash flows and growth rates are based on TWC’s budget and business plan and

assumptions are made about the perpetual growth rate for periods beyond the long-term business plan period.

Discount rate assumptions are based on an assessment of the risk inherent in the future cash flows of the respective

reporting units. In estimating the fair values of its reporting units, the Company also uses research analyst estimates,

as well as comparable market analyses. If the fair value of a reporting unit exceeds its carrying amount, goodwill of

the reporting unit is not deemed to be impaired and the second step of the impairment test is not performed. If the

carrying amount of a reporting unit exceeds its fair value, the second step of the goodwill impairment test is

performed to measure the amount of impairment loss, if any. The second step of the goodwill impairment test

compares the implied fair value of the reporting unit’s goodwill with the carrying amount of that goodwill. If the

124

TIME WARNER CABLE INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)