Time Warner Cable 2006 Annual Report Download - page 121

Download and view the complete annual report

Please find page 121 of the 2006 Time Warner Cable annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

as of January 1, 2008 and is not expected to have a material impact on the Company’s consolidated financial

statements.

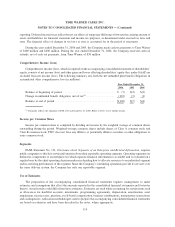

Quantifying Effects of Prior Years Misstatements in Current Year Financial Statements

In September 2006, the SEC issued Staff Accounting Bulletin (“SAB”) No. 108, Considering the Effects of

Prior Year Misstatements when Quantifying Misstatements in Current Year Financial Statements (“SAB 108”).

SAB 108 requires that registrants quantify errors using both a balance sheet and statement of operations approach

and evaluate whether either approach results in a misstated amount that, when all relevant quantitative and

qualitative factors are considered, is material. SAB 108 became effective for TWC in the fourth quarter of 2006 and

did not have a material impact on the Company’s consolidated financial statements.

Fair Value Measurements

In September 2006, the FASB issued FASB Statement No. 157, Fair Value Measurements (“FAS 157”).

FAS 157 establishes a single authoritative definition of fair value, sets out a framework for measuring fair value, and

expands on required disclosures about fair value measurement. FAS 157 is effective for TWC on January 1, 2008

and will be applied prospectively. The provisions of FAS 157 are not expected to have a material impact on the

Company’s consolidated financial statements.

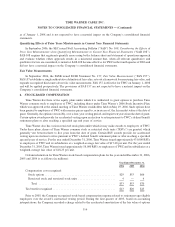

4. STOCK-BASED COMPENSATION

Time Warner has three active equity plans under which it is authorized to grant options to purchase Time

Warner common stock to employees of TWC, including shares under Time Warner’s 2006 Stock Incentive Plan,

which was approved at the annual meeting of Time Warner stockholders held on May 19, 2006. Such options have

been granted to employees of TWC with exercise prices equal to, or in excess of, the fair market value at the date of

grant. Generally, the options vest ratably, over a four-year vesting period, and expire ten years from the date of grant.

Certain option awards provide for accelerated vesting upon an election to retire pursuant to TWC’s defined benefit

retirement plans or after reaching a specified age and years of service.

Time Warner also has various restricted stock plans under which it may make awards to employees of TWC.

Under these plans, shares of Time Warner common stock or restricted stock units (“RSUs”) are granted, which

generally vest between three to five years from the date of grant. Certain RSU awards provide for accelerated

vesting upon an election to retire pursuant to TWC’s defined benefit retirement plans or after reaching a specified

age and years of service. For the year ended December 31, 2006, Time Warner issued approximately 431,000 RSUs

to employees of TWC and its subsidiaries at a weighted-average fair value of $17.40 per unit. For the year ended

December 31, 2005, Time Warner issued approximately 58,000 RSUs to employees of TWC and its subsidiaries at a

weighted-average fair value of $18.25 per unit.

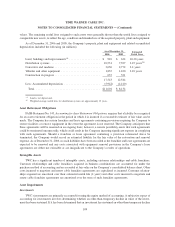

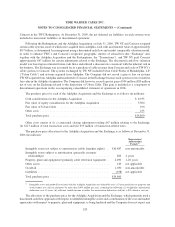

Certain information for Time Warner stock-based compensation plans for the year ended December 31, 2006,

2005 and 2004 is as follows (in millions):

2006 2005 2004

Year Ended December 31,

Compensation cost recognized:

Stock options ............................................. $29 $53 $66

Restricted stock and restricted stock units ........................ 4 — 4

Total ................................................. $33 $53 $70

Tax benefit recognized ........................................ $13 $20 $25

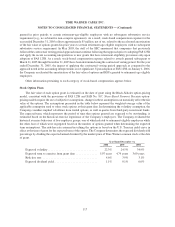

Prior to 2005, the Company recognized stock-based compensation expense related to retirement-age-eligible

employees over the award’s contractual vesting period. During the first quarter of 2005, based on accounting

interpretations, the Company recorded a charge related to the accelerated amortization of the fair value of options

116

TIME WARNER CABLE INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)