Time Warner Cable 2006 Annual Report Download - page 131

Download and view the complete annual report

Please find page 131 of the 2006 Time Warner Cable annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

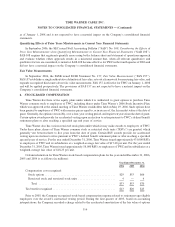

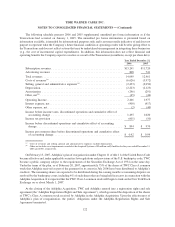

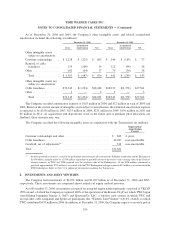

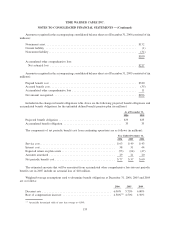

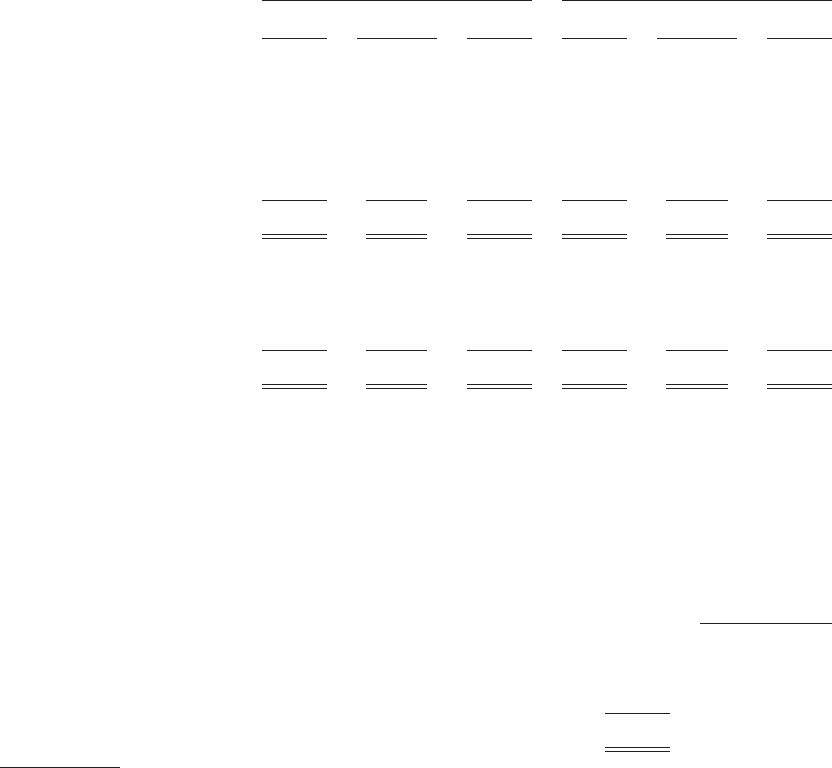

As of December 31, 2006 and 2005, the Company’s other intangible assets and related accumulated

amortization included the following (in millions):

Gross

Accumulated

Amortization Net Gross

Accumulated

Amortization Net

December 31, 2006 December 31, 2005

Other intangible assets

subject to amortization:

Customer relationships ..... $ 1,128 $ (323) $ 805 $ 246 $ (169) $ 77

Renewal of cable

franchises ............. 134 (100) 34 122 (94) 28

Other .................. 101 (64) 37 74 (36) 38

Total ................ $ 1,363 $ (487) $ 876 $ 442 $ (299) $ 143

Other intangible assets not

subject to amortization:

Cable franchises .......... $39,342 $(1,294) $38,048 $28,939 $(1,378) $27,561

Other .................. 3 — 3 3 — 3

Total ................ $39,345 $(1,294) $38,051 $28,942 $(1,378) $27,564

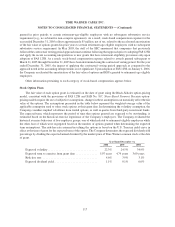

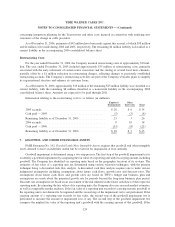

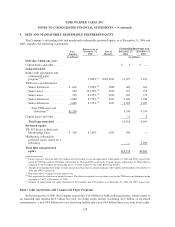

The Company recorded amortization expense of $167 million in 2006 and $72 million in each of 2005 and

2004. Based on the current amount of intangible assets subject to amortization, the estimated amortization expense

is expected to be $250 million in 2007, $233 million in 2008, $231 million in 2009, $136 million in 2010 and

$6 million in 2011. As acquisitions and dispositions occur in the future and as purchase price allocations are

finalized, these amounts may vary.

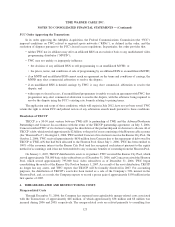

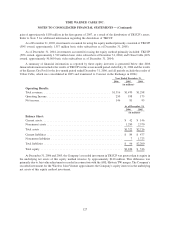

The Company recorded the following intangible assets in conjunction with the Transactions (in millions):

Depreciation/

Amortization

Periods

Customer relationships and other ............................. $ 882 4years

Cable franchises ......................................... 10,487 non-amortizable

Goodwill, net of adjustments

(a)

.............................. 312 non-amortizable

Total ................................................. $11,681

(a)

Includes goodwill recorded as a result of the preliminary purchase price allocation for the Adelphia Acquisition and the Exchange of

$1.050 billion, partially offset by a $738 million adjustment to goodwill related to the excess of the carrying value of the Comcast

minority interests in TWC and TWE acquired over the total fair value of the Redemptions. Of the $738 million adjustment to

goodwill, approximately $719 million is associated with the TWC Redemption and approximately $19 million is associated with the

TWE Redemption. Refer to Note 5 for additional information regarding the Transactions.

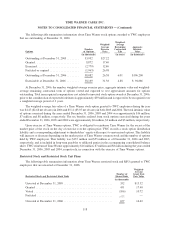

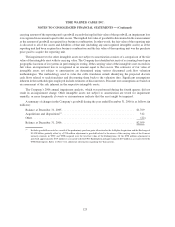

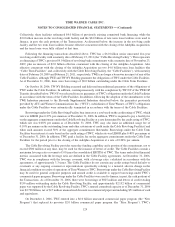

8. INVESTMENTS AND JOINT VENTURES

The Company had investments of $2.072 billion and $1.967 billion as of December 31, 2006 and 2005,

respectively. These investments are comprised almost entirely of equity method investees.

As of December 31, 2006, investments accounted for using the equity method primarily consisted of TKCCP

(50% owned, of which the Company recognized 100% of the operations of the Kansas City Pool, which TWC began

consolidating beginning January 1, 2007) and SpectrumCo, LLC, a wireless joint venture in which TWC and

several other cable companies and Sprint are participants (the “Wireless Joint Venture”) (26.6% owned), to which

TWC contributed $633 million in 2006. In addition, at December 31, 2006, the Company expects to record a pretax

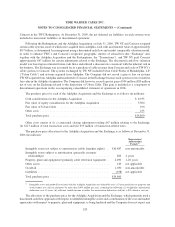

126

TIME WARNER CABLE INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)