Time Warner Cable 2006 Annual Report Download - page 146

Download and view the complete annual report

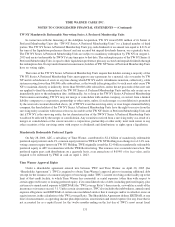

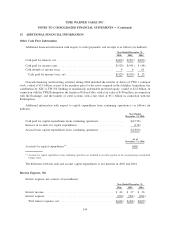

Please find page 146 of the 2006 Time Warner Cable annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.The Company’s total rent expense, which primarily includes facility rental expense and pole attachment rental

fees, amounted to $149 million, $98 million and $101 million for the years ended December 31, 2006, 2005 and

2004, respectively.

Legal Proceedings

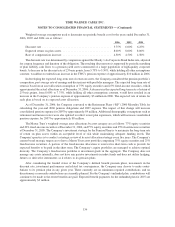

Government Investigations

As previously disclosed by the Company, the SEC and the U.S. Department of Justice (the “DOJ”) had

conducted investigations into accounting and disclosure practices of Time Warner. Those investigations focused on

advertising transactions, principally involving Time Warner’s AOL segment, the methods used by the AOL segment

to report its subscriber numbers and the accounting related to Time Warner’s interest in AOL Europe prior to

January 2002.

Time Warner and its subsidiary, AOL, entered into a settlement with the DOJ in December 2004 that provided

for a deferred prosecution arrangement for a two-year period. In December 2006, as part of the deferred prosecution

arrangement, the DOJ’s complaint against AOL was dismissed. As part of the settlement with the DOJ, in December

2004, Time Warner paid a penalty of $60 million and established a $150 million fund, which Time Warner could use

to settle related securities litigation. During October 2005, the $150 million was transferred by Time Warner into a

settlement fund for the members of the class covered by the primary consolidated securities class action that had

been pending against Time Warner. In addition, on March 21, 2005, Time Warner announced that the SEC had

approved Time Warner’s proposed settlement with the SEC. In connection with the settlement, Time Warner paid a

$300 million penalty, which will be distributed to investors in connection with the distribution of the proceeds from

the settlement in the consolidated securities class action. The payments made by Time Warner pursuant to the DOJ

and SEC settlements have no impact on the consolidated financial statements of TWC.

Pursuant to the SEC settlement, the Time Warner restated its financial statements for each of the years ended

December 31, 2000 through December 31, 2003 in its Annual Report on Form 10-K for the year ended

December 31, 2004. In addition, an independent examiner was appointed to determine whether Time Warner’s

historical accounting for transactions with 17 counterparties identified by the SEC staff, principally involving

online advertising revenues and including three cable programming affiliation agreements with related advertising

elements, was in conformity with GAAP. Of the 17 counterparties identified, only the three counterparties to the

cable programming affiliation agreements involve transactions with TWC. During the third quarter of 2006, the

independent examiner completed his review and, in accordance with the terms of the SEC settlement, provided a

report to Time Warner’s audit and finance committee of his conclusions. As a result of the conclusions, Time

Warner’s consolidated financial results were restated for each of the years ended December 31, 2000 through

December 31, 2005 and for the three months ended March 31, 2006 and the three and six months ended June 30,

2006 and are reflected in amendments filed by Time Warner with the SEC on September 13, 2006. In addition, the

Company restated its consolidated financial results for each of the years ended December 31, 2001 through

December 31, 2005 and for the three months ended March 31, 2006 and the three and six months ended June 30,

2006. The restated consolidated financial results are reflected in the Company’s Current Report on Form 8-K filed

with the SEC on February 13, 2007. See discussion of “Restatement of Prior Financial Information” in Note 1.

Other Matters

On May 20, 2006, the America Channel LLC (“America Channel”) filed a lawsuit in U.S. District Court for the

District of Minnesota against both TWC and Comcast alleging that the purchase of Adelphia by Comcast and TWC

will injure competition in the cable system and cable network markets and violate the federal antitrust laws. The

lawsuit seeks monetary damages as well as an injunction blocking the Adelphia Acquisition. The United States

Bankruptcy Court for the Southern District of New York issued an order enjoining America Channel from pursuing

injunctive relief in the District of Minnesota, ordering that America Channel’s efforts to enjoin the transaction can

only be heard in the Southern District of New York, where the Adelphia bankruptcy is pending. America Channel’s

141

TIME WARNER CABLE INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)