Time Warner Cable 2006 Annual Report Download - page 97

Download and view the complete annual report

Please find page 97 of the 2006 Time Warner Cable annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.MARKET RISK MANAGEMENT

Market risk is the potential loss arising from adverse changes in market rates and prices, such as interest rates

and changes in the market value of investments.

Interest Rate Risk

Variable-rate Debt

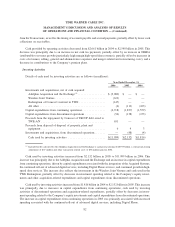

As of December 31, 2006, TWC had an outstanding balance of variable-rate debt of $11.077 billion, which

excludes an unamortized discount adjustment of $17 million. Based on the variable-rate obligations outstanding at

December 31, 2006, each 25 basis point increase or decrease in the level of interest rates would, respectively,

increase or decrease TWC’s annual interest expense and related cash payments by approximately $28 million.

These potential increases or decreases are based on simplifying assumptions, including a constant level of variable-

rate debt for all maturities and an immediate, across-the-yield curve increase or decrease in the level of interest rates

with no other subsequent changes for the remainder of the periods.

Fixed-rate Debt

As of December 31, 2006, TWC had approximately $3.640 billion of fixed-rate debt and TW NY Series A

Preferred Membership Units, including an amortized fair value adjustment of $140 million. Based on the fixed-rate

debt obligations outstanding at December 31, 2006, a 25 basis point increase or decrease in the level of interest

would, respectively, increase or decrease the fair value of the fixed-rate debt by approximately $77 million. These

potential increases or decreases are based on simplifying assumptions, including a constant level and rate of fixed-

rate debt and an immediate, across-the-board increase or decrease in the level of interest rates with no other

subsequent changes for the remainder of the periods.

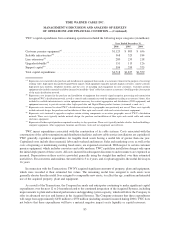

Equity Risk

TWC is also exposed to market risk as it relates to changes in the market value of its investments. TWC invests

in equity instruments of private companies for operational and strategic business purposes. These investments are

subject to significant fluctuations in fair market value due to volatility of the industries in which the companies

operate. As of December 31, 2006, TWC had approximately $2.072 billion of investments, which included

$1.363 billion related to TKCCP, whose assets were distributed to its partners on January 1, 2007. Refer to “Recent

Developments” for further details.

Some of TWC’s employees have been granted options to purchase shares of Time Warner common stock in

connection with their past employment with subsidiaries and affiliates of Time Warner. TWC has agreed that, upon

the exercise by any of its officers or employees of any options to purchase Time Warner common stock, TWC will

reimburse Time Warner in an amount equal to the excess of the closing price of a share of Time Warner common

stock on the date of the exercise of the option over the aggregate exercise price paid by the exercising officer or

employee for each share of Time Warner common stock. At December 31, 2006, TWC had accrued approximately

$137 million of stock option distributions payable to Time Warner. That amount, which is not payable until the

underlying options are exercised and then only subject to limitations on cash distributions in accordance with the

senior unsecured revolving credit facilities, will be adjusted in subsequent accounting periods based on changes in

the quoted market prices for Time Warner’s common stock. See Note 4 to the accompanying consolidated financial

statements.

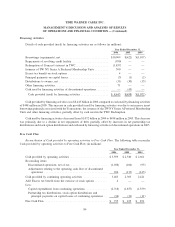

CRITICAL ACCOUNTING POLICIES

The SEC considers an accounting policy to be critical if it is important to the Company’s financial condition

and results, and if it requires significant judgment and estimates on the part of management in its application. The

92

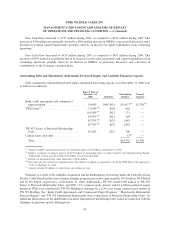

TIME WARNER CABLE INC.

MANAGEMENT’S DISCUSSION AND ANALYSIS OF RESULTS

OF OPERATIONS AND FINANCIAL CONDITION — (Continued)