Time Warner Cable 2006 Annual Report Download - page 130

Download and view the complete annual report

Please find page 130 of the 2006 Time Warner Cable annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

carrying amount of the reporting unit’s goodwill exceeds the implied fair value of that goodwill, an impairment loss

is recognized in an amount equal to that excess. The implied fair value of goodwill is determined in the same manner

as the amount of goodwill recognized in a business combination. In other words, the fair value of the reporting unit

is allocated to all of the assets and liabilities of that unit (including any unrecognized intangible assets) as if the

reporting unit had been acquired in a business combination and the fair value of the reporting unit was the purchase

price paid to acquire the reporting unit.

The impairment test for other intangible assets not subject to amortization consists of a comparison of the fair

value of the intangible asset with its carrying value. The Company has identified six units of accounting based upon

geographic locations of its systems in performing its testing. If the carrying value of the intangible asset exceeds its

fair value, an impairment loss is recognized in an amount equal to that excess. The estimates of fair value of

intangible assets not subject to amortization are determined using various discounted cash flow valuation

methodologies. The methodology used to value the cable franchises entails identifying the projected discrete

cash flows related to such franchises and discounting them back to the valuation date. Significant assumptions

inherent in the methodologies employed include estimates of discount rates. Discount rate assumptions are based on

an assessment of the risk inherent in the respective intangible assets.

The Company’s 2006 annual impairment analysis, which was performed during the fourth quarter, did not

result in an impairment charge. Other intangible assets not subject to amortization are tested for impairment

annually, or more frequently if events or circumstances indicate that the asset might be impaired.

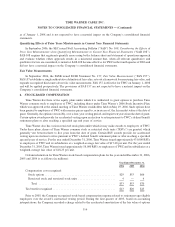

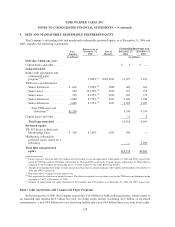

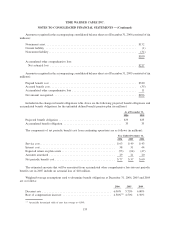

A summary of changes in the Company’s goodwill during the year ended December 31, 2006 is as follows (in

millions):

Balance at December 31, 2005 .............................................. $1,769

Acquisitions and dispositions

(a)

.............................................. 312

Other ................................................................. (22)

Balance at December 31, 2006 .............................................. $2,059

(a)

Includes goodwill recorded as a result of the preliminary purchase price allocation for the Adelphia Acquisition and the Exchange of

$1.050 billion, partially offset by a $738 million adjustment to goodwill related to the excess of the carrying value of the Comcast

minority interests in TWC and TWE acquired over the total fair value of the Redemptions. Of the $738 million adjustment to

goodwill, approximately $719 million is associated with the TWC Redemption and approximately $19 million is associated with the

TWE Redemption. Refer to Note 5 for additional information regarding the Transactions.

125

TIME WARNER CABLE INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)