Time Warner Cable 2006 Annual Report Download - page 145

Download and view the complete annual report

Please find page 145 of the 2006 Time Warner Cable annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

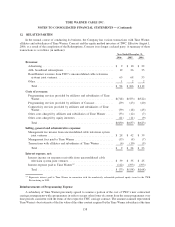

14. COMMITMENTS AND CONTINGENCIES

Prior to the TWE Restructuring, TWE had various contingent commitments, including guarantees, related to

the TWE non-cable businesses. In connection with the restructuring of TWE, some of these commitments were not

transferred with their applicable non-cable business and they remain contingent commitments of TWE. Time

Warner and its subsidiary, WCI, have agreed, on a joint and several basis, to indemnify TWE from and against any

and all of these contingent liabilities, but TWE remains a party to these commitments.

TWC has cable franchise agreements containing provisions requiring the construction of cable plant and the

provision of services to customers within the franchise areas. In connection with these obligations under existing

franchise agreements, TWC obtains surety bonds or letters of credit guaranteeing performance to municipalities and

public utilities and payment of insurance premiums. Such surety bonds and letters of credit as of December 31, 2006

and 2005 totaled $328 million and $245 million, respectively. Payments under these arrangements are required only

in the event of nonperformance. TWC does not expect that these contingent commitments will result in any amounts

being paid in the foreseeable future.

Firm Commitments

The Company has commitments under various firm contractual arrangements to make future payments for

goods and services. These firm commitments secure future rights to various assets and services to be used in the

normal course of operations. For example, the Company is contractually committed to make some minimum lease

payments for the use of property under operating lease agreements. In accordance with current accounting rules, the

future rights and obligations pertaining to these contracts are not reflected as assets or liabilities on the accom-

panying consolidated balance sheet.

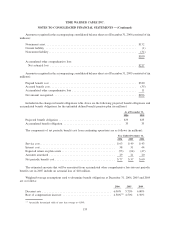

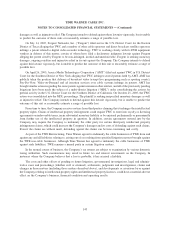

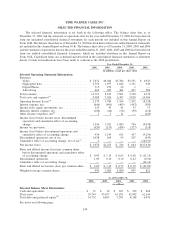

The following table summarizes the material firm commitments of the Company at December 31, 2006 and the

timing of and effect that these obligations are expected to have on the Company’s liquidity and cash flow in future

periods. This table excludes certain Adelphia and Comcast commitments, which TWC did not assume, and

excludes repayments on long-term debt (including capital leases) and commitments related to other entities,

including certain unconsolidated equity method investees. TWC expects to fund these firm commitments with cash

provided by operating activities generated in the ordinary course of business.

2007

2008-

2009

2010-

2011

2012 and

Thereafter Total

(in millions)

Programming purchases

(a)

................ $2,867 $4,203 $2,846 $1,843 $11,759

Facility leases

(b)

....................... 73 140 128 461 802

Data processing services ................. 40 79 79 36 234

High-speed data connectivity .............. 19 3 1 — 23

Digital Phone connectivity

(c)

.............. 193 401 196 — 790

Converter and modem purchases ........... 399 3 — — 402

Other ............................... 20 17 2 7 46

Total .............................. $3,611 $4,846 $3,252 $2,347 $14,056

(a)

The Company has purchase commitments with various programming vendors to provide video services to subscribers. Programming

fees represent a significant portion of its costs of revenues. Future fees under such contracts are based on numerous variables, including

number and type of customers. The amounts of the commitments reflected above are based on the number of subscribers at

December 31, 2006 applied to the per subscriber contractual rates contained in the contracts that were in effect as of December 31,

2006.

(b)

The Company has facility lease commitments under various operating leases including minimum lease obligations for real estate and

operating equipment.

(c)

Digital Phone connectivity commitments are based on the number of Digital Phone subscribers at December 31, 2006 and the per

subscriber contractual rates contained in the contracts that were in effect as of December 31, 2006.

140

TIME WARNER CABLE INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)