Time Warner Cable 2006 Annual Report Download - page 79

Download and view the complete annual report

Please find page 79 of the 2006 Time Warner Cable annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

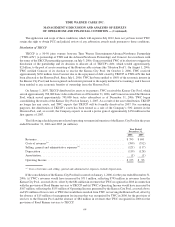

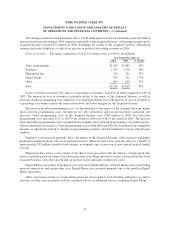

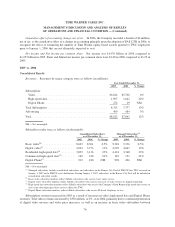

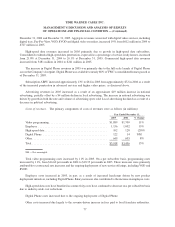

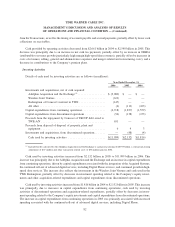

Reconciliation of Operating Income to OIBDA. The following table reconciles Operating Income to OIBDA.

In addition, the table provides the components from Operating Income to Net income for purposes of the

discussions that follow (in millions):

2006 2005 % Change

Year Ended December 31,

Net income .......................................... $1,976 $1,253 58%

Discontinued operations, net of tax ..................... (1,038) (104) NM

Cumulative effect of accounting change, net of tax .......... (2) — NM

Income before discontinued operations and cumulative effect of

accounting change .................................. 936 1,149 (19)%

Income tax provision ................................ 620 153 305%

Income before income taxes, discontinued operations and

cumulative effect of accounting change .................. 1,556 1,302 20%

Interest expense, net ................................ 646 464 39%

Income from equity investments, net .................... (129) (43) 200%

Minority interest expense, net ......................... 108 64 69%

Other income ..................................... (2) (1) 100%

Operating Income ...................................... 2,179 1,786 22%

Depreciation ...................................... 1,883 1,465 29%

Amortization ...................................... 167 72 132%

OIBDA . . . .......................................... $4,229 $3,323 27%

NM — Not meaningful.

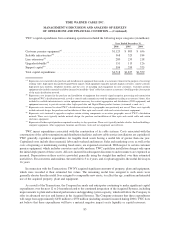

OIBDA. OIBDA increased to $4.229 billion in 2006 from $3.323 billion in 2005. This increase was

attributable to the impact of the Acquired Systems and revenue growth (particularly growth in high margin high-

speed data revenues), partially offset by higher costs of revenues and selling, general and administrative expenses,

as discussed above.

Depreciation expense. Depreciation expense increased to $1.883 billion in 2006 from $1.465 billion in 2005

primarily due to the impact of the Acquired Systems and demand-driven increases in recent years of purchases of

customer premise equipment, which generally has a significantly shorter useful life compared to the mix of assets

previously purchased.

Amortization expense. Amortization expense increased to $167 million in 2006 from $72 million in 2005 as a

result of the amortization of intangible assets associated with customer relationships acquired as part of the

Transactions.

Operating Income. Operating Income increased to $2.179 billion in 2006 from $1.786 billion in 2005

primarily due to the increase in OIBDA, partially offset by the increase in depreciation and amortization expense, as

discussed above.

As a result of the impact of the Adelphia Acquisition and the consolidation of TKCCP, beginning January 1,

2007, the Company anticipates that OIBDA and Operating Income will increase during 2007. Refer to Note 5 of the

accompanying consolidated financial statements for certain pro forma information presenting the Company’s

financial results as if the Transactions had occurred on January 1, 2005 and refer to “Overview — Recent

74

TIME WARNER CABLE INC.

MANAGEMENT’S DISCUSSION AND ANALYSIS OF RESULTS

OF OPERATIONS AND FINANCIAL CONDITION — (Continued)