Time Warner Cable 2006 Annual Report Download

Download and view the complete annual report

Please find the complete 2006 Time Warner Cable annual report below. You can navigate through the pages in the report by either clicking on the pages

listed below, or by using the keyword search tool below to find specific information within the annual report.

-

1

-

2

-

3

-

4

-

5

-

6

-

7

-

8

-

9

-

10

-

11

-

12

-

13

-

14

-

15

-

16

-

17

-

18

-

19

-

20

-

21

-

22

-

23

-

24

-

25

-

26

-

27

-

28

-

29

-

30

-

31

-

32

-

33

-

34

-

35

-

36

-

37

-

38

-

39

-

40

-

41

-

42

-

43

-

44

-

45

-

46

-

47

-

48

-

49

-

50

-

51

-

52

-

53

-

54

-

55

-

56

-

57

-

58

-

59

-

60

-

61

-

62

-

63

-

64

-

65

-

66

-

67

-

68

-

69

-

70

-

71

-

72

-

73

-

74

-

75

-

76

-

77

-

78

-

79

-

80

-

81

-

82

-

83

-

84

-

85

-

86

-

87

-

88

-

89

-

90

-

91

-

92

-

93

-

94

-

95

-

96

-

97

-

98

-

99

-

100

-

101

-

102

-

103

-

104

-

105

-

106

-

107

-

108

-

109

-

110

-

111

-

112

-

113

-

114

-

115

-

116

-

117

-

118

-

119

-

120

-

121

-

122

-

123

-

124

-

125

-

126

-

127

-

128

-

129

-

130

-

131

-

132

-

133

-

134

-

135

-

136

-

137

-

138

-

139

-

140

-

141

-

142

-

143

-

144

-

145

-

146

-

147

-

148

-

149

-

150

-

151

-

152

-

153

-

154

-

155

-

156

-

157

-

158

-

159

-

160

-

161

-

162

-

163

-

164

-

165

-

166

Table of contents

-

Page 1

-

Page 2

... PRESIDENT & CEO

To our Shareholders, our Employees and the Communities We Serve: Time Warner Cable is in a thriving business. Demand for our products and services is strong and, in a competitive landscape, we have continued to win increasing numbers of subscribers with our differentiated offerings...

-

Page 3

... to operate the new systems the "Time Warner Cable way" and offer our advanced services. This work will continue throughout the year. Extending Momentum into 2007 We plan to extend our strong momentum into 2007 by concentrating on execution in both our legacy and acquired systems. We've executed the...

-

Page 4

...phone, which represents an important complement to our existing commercial high-speed data business. In 2006, our commercial video and data business generated approximately $500 million in revenues. We estimate that commercial customers spend $12 billion to $15 billion annually for telephone service...

-

Page 5

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 10-K

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES AND EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2006 Commission file number 000-52471

TIME WARNER CABLE INC.

(Exact name of registrant ...

-

Page 6

...% of these homes passed were located in one of five principal geographic areas: New York state, the Carolinas, Ohio, southern California and Texas. As of February 1, 2007, Time Warner Cable was the largest cable system operator in a number of large cities, including New York City and Los Angeles. As...

-

Page 7

... Systems." For additional information regarding the Adelphia Acquisition, the Redemptions and the Exchange, see "- The Transactions." The Adelphia Acquisition was designed to be a taxable acquisition of assets that would result in a tax basis in the acquired assets equal to the purchase price TW NY...

-

Page 8

.... TWC's annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K and any amendments to such reports filed with or furnished to the Securities and Exchange Commission ("SEC") pursuant to Section 13(a) or 15(d) of the Securities Exchange Act of 1934 are available free...

-

Page 9

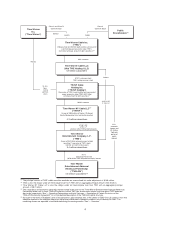

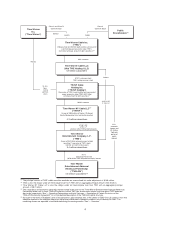

... Warner NY Cable LLC is also the obligor under an intercompany loan from TWC with an aggregate principal amount of $8.7 billion. The subscribers and economic ownership interests listed in the chart for the Time Warner Entertainment-Advance/Newhouse Partnership relate only to those TWE-A/N systems...

-

Page 10

..., regional and local cable news, entertainment and other specialty networks, such as CNN, A&E, ESPN, CNBC and MTV. TWC offers its Basic and Standard tiers for a fixed monthly fee. The rates TWC can charge for its "Basic" tier and certain video equipment are subject to regulation under federal law...

-

Page 11

... family viewing based on ratings information provided by the programmers and based on TWC's best judgment. TWC's analog and digital video subscribers pay a fixed monthly fee for the level of service they receive. Subscribers to premium channels are charged an additional monthly fee, with discounts...

-

Page 12

... to regulation. See "- Regulatory Matters" below. High definition services. TWC generally offers approximately 15 channels of high definition television, or HDTV, in each of its systems, mainly consisting of broadcast signals and standard and premium cable networks, as well as HDTV Movies-on-Demand...

-

Page 13

... with the cable company using their remote control. High-speed Data Services TWC offers residential and commercial high-speed data services to nearly 99% of its homes passed as of December 31, 2006. TWC's high-speed data services provide customers with a fast, always-on connection to the Internet...

-

Page 14

...-enabled cable modem that digitizes voice signals and routes them as data packets, using IP technology, over its own managed broadband cable systems. Calls to destinations outside of TWC's cable systems are routed to the traditional public switched telephone network. Unlike Internet phone providers...

-

Page 15

... Warner Digital Cable and Road Runner high-speed online service the ability to create and share their personal photo shows with TWC's other Time Warner Cable digital video customers using TWC's VOD technology. New Opportunities Commercial Voice TWC believes that continued innovation on its advanced...

-

Page 16

... Los Angeles, California. In addition, in many locations, contiguous cable system operators have formed advertising "interconnects" to deliver locally inserted commercials across wider geographic areas, replicating the reach of the broadcast stations as much as possible. As of December 31, 2006, TWC...

-

Page 17

... outbound telemarketing and door-to-door sales. In addition, TWC uses customer care channels and inbound call centers to increase awareness of its products and services offered. Creative promotional offers are also a key part of TWC's strategy, and an area where TWC works with third parties such as...

-

Page 18

...a menu and then view interactive videos that answer their questions. Customers can access Answers on Demand either online or on their television set (using TWC's VOD technology). Technology TWC's Cable Systems TWC's cable systems employ a flexible and extensible network architecture known as "hybrid...

-

Page 19

... a traditional public telephone switch. Set-top Boxes TWC's Basic and Standard tier subscribers generally do not require a set-top box to view their video services. However, because TWC's digital signals and signals for premium programming are secured, TWC's digital video customers receiving one-way...

-

Page 20

... only cable operators' one-way transmission services) and not devices capable of carrying two-way services, such as interactive program guides and VOD. As a result, those of TWC's customers who use a CableCARD equipped television set, and who do not have a set-top box, cannot access these advanced...

-

Page 21

... Related to Government Regulation - The FCC's set-top box rules could impose significant additional costs on TWC." The FCC has also ordered the cable industry to investigate and report on the possibility of implementing a downloadable security system that would be accessible to all set-top devices...

-

Page 22

... at monthly rates. TWC's video equipment fees are regulated. Under FCC rules, cable operators are allowed to set equipment rates for set-top boxes, CableCARDs and remote controls on the basis of actual capital costs, plus an annual after-tax rate of return of 11.25%, on the capital cost (net...

-

Page 23

... and home video products. "Online" competition. TWC's high-speed data services face or may face competition from a variety of companies that offer other forms of online services, including low cost dial-up services over ordinary telephone lines, and developing technologies, such as Internet service...

-

Page 24

...addition to multi-channel video providers, cable systems compete with all other sources of news, information and entertainment, including over-the-air television broadcast reception, live events, movie theaters and the Internet. In general, TWC also faces competition from other media for advertising...

-

Page 25

...video subscriber rates; carriage of broadcast television stations, as well as the way TWC sells its program packages to subscribers; the use of cable systems by franchising authorities and other third parties; cable system ownership; offering of voice and high-speed data services; and use of utility...

-

Page 26

... compete with services offered by the cable operator. The FCC regulates various aspects of such third party commercial use of channel capacity on TWC's cable systems, including the rates and some terms and conditions of the commercial use. In connection with certain changes in TWC's programming line...

-

Page 27

...-setting agreement relating to reception equipment that uses a conditional-access security card - a CableCARDTM - provided by the cable operator to receive one-way cable services. To implement the agreement, the FCC adopted regulations that (i) establish a voluntary labeling system for such one-way...

-

Page 28

... cable regulators. Franchise agreements typically require payment of franchise fees and contain regulatory provisions addressing, among other things, upgrades, service quality, cable service to schools and other public institutions, insurance and indemnity bonds. The terms and conditions of cable...

-

Page 29

... cable operators offering Non-traditional Voice Services higher rates for pole rental than for traditional cable service and cable-modem service. One state public utility commission, for example, has determined that TWC's Digital Phone service is subject to traditional, circuit-switched telephone...

-

Page 30

... the TW NY Adelphia Acquisition. The TW NY Adelphia Acquisition closed on July 31, 2006, immediately after the Redemptions. The TW NY Adelphia Acquisition included cable systems located in the following areas: West Palm Beach, Florida; Cleveland and Akron, Ohio; Los Angeles, California; and suburbs...

-

Page 31

... into a registration rights and sale agreement (the "Adelphia Registration Rights and Sale Agreement"), which governed the disposition of the shares of TWC Class A common stock received by Adelphia in the TW NY Adelphia Acquisition. Upon the effectiveness of Adelphia's plan of reorganization, the...

-

Page 32

... held by Comcast Trust I in exchange for 100% of the limited liability company interests of Cable Holdco III LLC ("Cable Holdco III"), then a subsidiary of TWE. At the time of the TWE Redemption, Cable Holdco III held both certain cable systems previously owned or operated directly or indirectly...

-

Page 33

... the systems TWC acquired in the Exchange were cable systems (i) that were owned by the Century-TCI joint venture in the Los Angeles, California area and the Parnassos joint venture in Ohio and Western New York and (ii) then owned by Comcast located in the Dallas, Texas, Los Angeles, California, and...

-

Page 34

...actually made by the party under the Exchange Agreement in relation to those Adelphia assets or liabilities. Operating Partnerships and Joint Ventures Time Warner Entertainment Company, L.P. TWE is a Delaware limited partnership that was formed in 1992. At the time of the restructuring of TWE, which...

-

Page 35

...TWC effectively acquired A/N's interest in Road Runner. TWE-A/N's financial results, other than the results of the A/N Systems, are consolidated with TWC. Road Runner continues to provide high-speed data services to the A/N Subsidiary. Management and Operations of TWE-A/N. Subject to certain limited...

-

Page 36

... notice to Time Warner that it intends to purchase such amount of TWE debt securities itself. Under the terms of the TWC Certificate of Incorporation, for three years following July 31, 2006, the date upon which shares of TWC common stock were issued in connection with the Adelphia Acquisition, at...

-

Page 37

... competitors - in particular, direct broadcast satellite operators and incumbent local telephone companies - either offer or are making significant capital investments that will allow them to offer services that provide directly comparable features and functions to those TWC offers, and they are...

-

Page 38

...areas that utilizes direct broadcast satellite video but in an integrated package with AT&T's DSL product, which enables an Internet-based return path that allows the user to order a VOD-like product and other services that TWC provides using its two-way network. TWC operates its cable systems under...

-

Page 39

... time of consumers. TWC's business competes with all other sources of entertainment and information delivery, including broadcast television, movies, live events, radio broadcasts, home video products, console games, print media and the Internet. Technological advancements, such as VOD, new video...

-

Page 40

... its customers may have a suboptimal experience when using its high-speed data service. TWC's ability to manage its network efficiently could be restricted by legislative efforts to impose so-called "net neutrality" requirements on cable operators. See "- Risks Related to Government Regulation - TWC...

-

Page 41

... to acquire or develop and introduce new technologies, products and services more quickly than it does. Furthermore, advances in technology, decreases in the cost of existing technologies or changes in competitors' product and service offerings also may require TWC in the future to make additional...

-

Page 42

... declines in TWC's operating areas, opportunities to gain new basic subscribers will decrease, which may have a material adverse effect on TWC's growth, business and financial results or financial condition. TWC relies on network and information systems and other technology, and a disruption...

-

Page 43

... loss of any member of TWC's senior management team or other qualified employees could impair TWC's ability to execute its business plan and growth strategy, cause TWC to lose subscribers and reduce its net sales, or lead to employee morale problems and/or the loss of key employees. In addition, key...

-

Page 44

... a corresponding operating loss, which could have a material adverse effect on the market price of its Class A common stock. The IRS and state and local tax authorities may challenge the tax characterizations of the Adelphia Acquisition, the Redemptions and the Exchange, or TWC's related valuations...

-

Page 45

... boxes. This increased demand comes at a time when TWC's set-top box suppliers need to begin making changes in their production processes to enable them to supply cable operators with set-top boxes that use separate security. See "- Risks Related to Government Regulation - The FCC's settop box rules...

-

Page 46

...of TWC's systems currently purchases set-top boxes from a limited number of vendors. This is due to the fact that each of TWC's cable systems uses one of two proprietary conditional access security schemes, which allow TWC to regulate subscriber access to some services, such as premium channels. TWC...

-

Page 47

...-top box. Accordingly, customers using these devices without set-top boxes may have limited exposure and access to TWC's advanced video services, including its interactive program guide and VOD and SVOD. If such devices attain wide consumer acceptance, TWC's revenue from equipment rental and two-way...

-

Page 48

... average bandwidth usage of TWC's high-speed data customers has been increasing significantly in recent years as the amount of high-bandwidth content and the number of applications available on the Internet continues to grow. In order to continue to provide quality service at attractive prices, TWC...

-

Page 49

... broadcast signals voluntarily, so called "must carry" rules require TWC to carry video programming that it might not otherwise carry, including some local broadcast television signals on some of its cable systems. In addition, TWC is required to carry local public, educational and government access...

-

Page 50

... fees from subscribers. The FCC's set-top box rules could impose significant additional costs on TWC. Currently, many cable subscribers rent set-top boxes from TWC that perform both signal-reception functions and conditional-access security functions, as well as enable delivery of advanced services...

-

Page 51

... related to: • the nature, quality and cost of services rendered to TWC by Time Warner; • the desirability of corporate opportunities, such as the entry into new businesses or pursuit of potential acquisitions, particularly those that might allow TWC to compete with Time Warner; and • employee...

-

Page 52

... and could have a material adverse effect on the market price of TWC Class A common stock and its liquidity and operations and restrict its growth. Time Warner's capital markets and debt activity could adversely affect capital resources available to TWC. TWC's ability to obtain financing in the...

-

Page 53

... and regional data centers used in TWC's high-speed data services business in Herndon, VA; Raleigh, NC; Tampa, FL; Syracuse, NY; Austin, TX; Kansas City, MO; Orange County, CA; New York, NY; and Columbus, OH. As of December 31, 2006, TWC also leased and owned locations for its corporate offices in...

-

Page 54

... 1, 2006, Ronald A. Katz Technology Licensing, L.P. filed a complaint in the U.S. District Court for the District of Delaware alleging that TWC and several other cable operators infringe a number of patents purportedly relating to TWC's customer call center operations, voicemail and/or VOD services...

-

Page 55

...speed data and Internet-based phone services. In addition, on September 13, 2006, Rembrandt Technologies, LP filed a complaint in the U.S. District Court for the Eastern District of Texas alleging that TWC infringes several patents purportedly related to "high-speed cable modem internet products and...

-

Page 56

TWC relating to intellectual property rights and intellectual property licenses, could have a material adverse effect on TWC's business, financial condition and operating results. Item 4. Submission of Matters to a Vote of Security Holders. Pursuant to Section 228 of the General Corporation Law of ...

-

Page 57

... employed by Turner Broadcasting System, Inc. (a subsidiary of Time Warner since 1996), including as Senior Vice President and Chief Accounting Officer from 1996 until September 2000. Mr. LaJoie ...Michael LaJoie has served as TWC's Executive Vice President and Chief Technology Officer since January...

-

Page 58

...Research group of ABN AMRO Securities LLC from 2000 to 2002, and Vice President of Investor Relations at Time Warner from 1999 to 2000. Mr. Martin first joined Time Warner in 1993 as a Manager of SEC financial reporting. Mr. Rossetti ...Carl U.J. Rossetti has served as TWC's Executive Vice President...

-

Page 59

... Financial Officer concluded that TWC's disclosure controls and procedures are effective in timely making known to them material information relating to TWC and its consolidated subsidiaries required to be disclosed in TWC's reports filed or submitted under the Exchange Act. Management's Report on...

-

Page 60

... Related Transactions; Principal Accountant Fees and Services.

Information called for by Items 10, 11, 12, 13 and 14 of Part III is incorporated by reference from the Company's definitive Proxy Statement to be filed in connection with its 2007 Annual Meeting of Stockholders pursuant to Regulation...

-

Page 61

... or 15(d) of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

TIME WARNER CABLE INC.

By: /s/ Glenn A. Britt Name: Glenn A. Britt Title: President and Chief Executive Officer Dated: February 23...

-

Page 62

Signature

Title

Date

/s/ N.J. Nicholas, Jr. N.J. Nicholas, Jr. /s/ Wayne H. Pace Wayne H. Pace

Director

February 23, 2007

Director

February 23, 2007

57

-

Page 63

TIME WARNER CABLE INC. INDEX TO CONSOLIDATED FINANCIAL STATEMENTS AND OTHER FINANCIAL INFORMATION

Page

Management's Discussion and Analysis of Results of Operations and Financial Condition ...Consolidated Financial Statements: Consolidated Balance Sheet ...Consolidated Statement of Operations ......

-

Page 64

...and is an industry leader in developing and launching innovative video, data and voice services. As part of the strategy to expand TWC's cable footprint and improve the clustering of its cable systems, on July 31, 2006, a subsidiary of TWC, Time Warner NY Cable LLC ("TW NY"), and Comcast Corporation...

-

Page 65

... offer additional plans with a variety of local and long-distance options. Digital Phone enables TWC to offer its customers a convenient package, or "bundle," of video, high-speed data and voice services, and to compete effectively against similar bundled products available from its competitors. TWC...

-

Page 66

...particular, direct broadcast satellite operators and incumbent local telephone companies, either offer or are making significant capital investments that will allow them to offer services that provide features and functions comparable to the video, data and/or voice services that TWC offers and they...

-

Page 67

...TW NY acquired from Adelphia and transferred to Comcast in the Exchange because such systems were recorded at fair value in the Adelphia Acquisition. The Company did, however, record a pretax gain of $34 million ($20 million net of tax) on the Exchange related to the disposition of Urban Cable Works...

-

Page 68

... most cable operators have a tax basis that is below the fair market value of their cable systems and, accordingly, the Company has viewed a portion of its tax basis in the acquired assets as incremental value above the amount of basis more generally associated with cable systems. The tax benefit of...

-

Page 69

TIME WARNER CABLE INC. MANAGEMENT'S DISCUSSION AND ANALYSIS OF RESULTS OF OPERATIONS AND FINANCIAL CONDITION - (Continued) The application and scope of these conditions, which will expire in July 2012, have not yet been tested. TWC retains the right to obtain FCC and judicial review of any ...

-

Page 70

...the Kansas City Pool. Accordingly, the subscribers from the Houston Pool are not included in the managed subscriber numbers for any period presented. TWE Notes Indenture On October 18, 2006, TWC, together with TWE, TW NY Holding, certain other subsidiaries of Time Warner and The Bank of New York, as...

-

Page 71

...video, high-speed data and Digital Phone services. Video revenues include monthly fees for basic, standard and digital services, together with related equipment rental charges, charges for set-top boxes and charges for premium channels and SVOD services. Video revenues also include installation, Pay...

-

Page 72

TIME WARNER CABLE INC. MANAGEMENT'S DISCUSSION AND ANALYSIS OF RESULTS OF OPERATIONS AND FINANCIAL CONDITION - (Continued) expenses. The Company's programming agreements are generally multi-year agreements that provide for the Company to make payments to the programming vendors at agreed upon rates ...

-

Page 73

... - (Continued) RESULTS OF OPERATIONS Changes in Basis of Presentation Stock-based Compensation Historically, TWC employees have participated in various Time Warner equity plans. TWC has established the Time Warner Cable Inc. 2006 Stock Incentive Plan (the "2006 Plan"). The Company expects that its...

-

Page 74

TIME WARNER CABLE INC. MANAGEMENT'S DISCUSSION AND ANALYSIS OF RESULTS OF OPERATIONS AND FINANCIAL CONDITION - (Continued) accounting for defined benefit pension plans and other postretirement benefit plans ("plans"). Specifically, FAS 158 requires companies to recognize an asset for a plan's ...

-

Page 75

TIME WARNER CABLE INC. MANAGEMENT'S DISCUSSION AND ANALYSIS OF RESULTS OF OPERATIONS AND FINANCIAL CONDITION - (Continued) Consideration Given by a Service Provider to Manufacturers or Resellers of Equipment In September 2006, the EITF reached a consensus on EITF Issue No. 06-01, Accounting for ...

-

Page 76

... other high-speed data services offered by TWC. Digital Phone subscriber numbers reflect billable subscribers who receive IP-based telephony service. Digital Phone subscribers exclude subscribers acquired from Comcast in the Exchange who receive traditional, circuit-switched telephone service (which...

-

Page 77

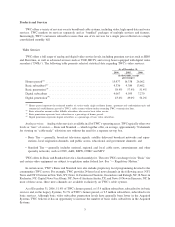

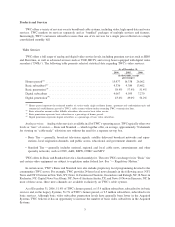

... the Acquired Systems, higher sports network programming costs, the increase in video subscribers and non-sports-related contractual rate increases. Video programming costs in the Acquired Systems were $409 million in 2006. Per subscriber programming costs increased 11%, to $20.33 per month in 2006...

-

Page 78

...the roll-out of advanced services. Other costs increased primarily due to the impact of the Acquired Systems and increases in administrative costs associated with the increase in headcount discussed above. Merger-related and restructuring costs. In 2006 and 2005, the Company expensed $38 million and...

-

Page 79

TIME WARNER CABLE INC. MANAGEMENT'S DISCUSSION AND ANALYSIS OF RESULTS OF OPERATIONS AND FINANCIAL CONDITION - (Continued) Reconciliation of Operating Income to OIBDA. The following table reconciles Operating Income to OIBDA. In addition, the table provides the components from Operating Income to ...

-

Page 80

TIME WARNER CABLE INC. MANAGEMENT'S DISCUSSION AND ANALYSIS OF RESULTS OF OPERATIONS AND FINANCIAL CONDITION - (Continued) Developments - Dissolution of TKCCP" for selected operating statement information for the Kansas City Pool for the years ended December 31, 2006 and 2005. Interest expense, net....

-

Page 81

TIME WARNER CABLE INC. MANAGEMENT'S DISCUSSION AND ANALYSIS OF RESULTS OF OPERATIONS AND FINANCIAL CONDITION - (Continued) Cumulative effect of accounting change, net of tax. In 2006, the Company recorded a benefit of $2 million, net of tax, as the cumulative effect of a change in accounting ...

-

Page 82

TIME WARNER CABLE INC. MANAGEMENT'S DISCUSSION AND ANALYSIS OF RESULTS OF OPERATIONS AND FINANCIAL CONDITION - (Continued) December 31, 2004 and December 31, 2005. Aggregate revenues associated with digital video services, including digital tiers, Pay-Per-View, VOD, SVOD and digital video recorders,...

-

Page 83

... merger-related costs associated with the Adelphia Acquisition and the Exchange. In addition, the 2005 results include approximately $35 million of restructuring costs, primarily associated with the early retirement of certain senior executives and the closing of several local news channels...

-

Page 84

... a related effective tax rate of approximately 41%. Income before discontinued operations. Income before discontinued operations was $1.149 billion in 2005 compared to $631 million in 2004. Basic and diluted income per common share before discontinued operations and cumulative effect of accounting...

-

Page 85

...-related costs of $78 million paid in 2006.

On July 31, 2006, TW NY, a subsidiary of TWC, acquired assets of Adelphia for a combination of cash and stock of TWC, Comcast's interests in TWC and TWE were redeemed and TW NY exchanged certain cable systems with Comcast. For additional details...

-

Page 86

TIME WARNER CABLE INC. MANAGEMENT'S DISCUSSION AND ANALYSIS OF RESULTS OF OPERATIONS AND FINANCIAL CONDITION - (Continued) 12.4% non-voting common stock interest in TW NY Holding. Following these transactions, TW NYalso exchanged certain cable systems with Comcast and TW NY paid Comcast ...

-

Page 87

... in 2006. This increase was principally due to the Adelphia Acquisition and the Exchange and an increase in capital expenditures from continuing operations, driven by capital expenditures associated with the integration of the Acquired Systems, the continued roll-out of advanced digital services...

-

Page 88

... to make significant capital expenditures over the next 12 to 24 months related to the continued integration of the Acquired Systems, including improvements to plant and technical performance and upgrading system capacity, which will allow the Company to offer its advanced services and features in...

-

Page 89

... of Comcast's interest in TWC ...Issuance of TW NY Series A Preferred Membership Units ...Excess tax benefit on stock options ...Principal payments on capital leases ...Distributions to owners, net ...Other financing activities ...Cash used by financing activities of discontinued operations ...Cash...

-

Page 90

TIME WARNER CABLE INC. MANAGEMENT'S DISCUSSION AND ANALYSIS OF RESULTS OF OPERATIONS AND FINANCIAL CONDITION - (Continued) Free Cash Flow increased to $735 million during 2006, as compared to $435 million during 2005. This increase of $300 million was primarily driven by a $906 million increase in ...

-

Page 91

... financial condition or results of operations of Time Warner or TWC. Borrowings under the Cable Revolving Facility may be used for general corporate purposes and unused credit is available to support borrowings under TWC's commercial paper program. Borrowings under the Cable Facilities were used to...

-

Page 92

... obligation to file reports with the SEC under the Securities Exchange Act of 1934, as amended (the "Exchange Act"). Pursuant to the Ninth Supplemental Indenture to the TWE Indenture, TW NY, a subsidiary of TWC and a successor in interest to Time Warner NY Cable Inc., agreed to waive, for so long as...

-

Page 93

TIME WARNER CABLE INC. MANAGEMENT'S DISCUSSION AND ANALYSIS OF RESULTS OF OPERATIONS AND FINANCIAL CONDITION - (Continued) Eleventh Supplemental Indenture) would be required to file with the SEC pursuant to Section 13 of the Exchange Act, if it were required to file such reports with the SEC in ...

-

Page 94

...commitments secure future rights to various assets and services to be used in the normal course of operations. For example, the Company is contractually committed to make some minimum lease payments for the use of property under operating lease agreements. In accordance with current accounting rules...

-

Page 95

...December 31, 2006, 2005 and 2004, respectively. Contingent Commitments Prior to the TWE Restructuring, TWE had various contingent commitments, including guarantees, related to TWE's non-cable businesses, including Warner Bros., Home Box Office, and TWE's interests in The WB Television Network (which...

-

Page 96

... make a payment related to any contingent liabilities of the TWE Non-cable Businesses, TWE will recognize an expense from discontinued operations and will receive a capital contribution from Time Warner and/or its subsidiary WCI for reimbursement of the incurred expenses. Additionally, costs related...

-

Page 97

TIME WARNER CABLE INC. MANAGEMENT'S DISCUSSION AND ANALYSIS OF RESULTS OF OPERATIONS AND FINANCIAL CONDITION - (Continued) MARKET RISK MANAGEMENT Market risk is the potential loss arising from adverse changes in market rates and prices, such as interest rates and changes in the market value of ...

-

Page 98

...for periods beyond the long-term business plan period. Discount rate assumptions are based on an assessment of the risk inherent in the future cash flows of the respective reporting units. In estimating the fair values of its reporting units, the Company also uses research analyst estimates, as well...

-

Page 99

... represent the weighted-average value of the applicable assumption used to value stock options at their grant date.

2006 Year Ended December 31, 2005 2004

Expected Expected Risk-free Expected

volatility ...22.3% term to exercise from grant date ...5.07 years rate ...4.6% dividend yield...1.1%

24...

-

Page 100

...dividend yield percentage by dividing the expected annual dividend by the market price of Time Warner common stock at the date of grant. The Company's stock option compensation expense for 2006, 2005 and 2004 was $29 million, $53 million and $66 million, respectively. The weighted-average fair value...

-

Page 101

... objective fair value for one or more undelivered elements of the transaction, the Company recognizes revenue on a straight-line basis over the term of the agreement. For example, the Company sells cable, Digital Phone and high-speed data services to subscribers in a bundled package at a rate lower...

-

Page 102

... make payments to the programming vendors at agreed upon rates, which represent fair market value, based on the number of subscribers to which TWC provides the service. If a programming contract expires prior to entering into a new agreement, the Company is required to estimate the programming costs...

-

Page 103

TIME WARNER CABLE INC. MANAGEMENT'S DISCUSSION AND ANALYSIS OF RESULTS OF OPERATIONS AND FINANCIAL CONDITION - (Continued) programming expense is recorded, if necessary, to reflect the terms of the new contract. The Company must also make estimates in the recognition of programming expense related ...

-

Page 104

.... In addition, the Company operates in a highly competitive, consumer and technology-driven and rapidly changing business. The Company's business is affected by government regulation, economic, strategic, political and social conditions, consumer response to new and existing products and services...

-

Page 105

... income tax obligations, net ...12,902 Long-term payables to affiliated parties ...137 Other liabilities ...296 Noncurrent liabilities of discontinued operations ...2 Minority interests ...1,624 Commitments and contingencies (Note 14) Mandatorily redeemable Class A common stock, $0.01 par value, 43...

-

Page 106

TIME WARNER CABLE INC. CONSOLIDATED STATEMENT OF OPERATIONS

Year Ended December 31, 2006 2005 2004 (in millions, except per share data)

Revenues: Subscription: Video ...High-speed data ...Digital Phone ...Total Subscription ...Advertising ...Total revenues(a) ...Costs and expenses: Costs of ...

-

Page 107

TIME WARNER CABLE INC. CONSOLIDATED STATEMENT OF CASH FLOWS

Year Ended December 31, 2006 2005 2004 (in millions)

OPERATING ACTIVITIES Net income(a) ...Adjustments for noncash and nonoperating items: Cumulative effect of accounting change, net of tax ...Depreciation and amortization ...Income from ...

-

Page 108

...(Class A common stock and paid-in-capital) before ultimately being redeemed on July 31, 2006. Amounts represent a change in TWC's accrued liability payable to Time Warner Inc. for vested employee stock options, as well as other amounts pursuant to accounting for stock option plans.

See accompanying...

-

Page 109

..., intends to offer additional plans with a variety of local and long-distance options. Digital Phone enables TWC to offer its customers a convenient package, or "bundle," of video, high-speed data and voice services, and to compete effectively against similar bundled products available from its...

-

Page 110

... by selling advertising time to national, regional and local businesses. As of July 31, 2006, the date the transactions with Adelphia and Comcast closed, the penetration rates for basic video, digital video and high-speed data services were generally lower in the systems acquired from Adelphia...

-

Page 111

..., the Company recorded a benefit of $2 million, net of tax, as the cumulative effect of a change in accounting principle upon the adoption of FAS 123R in 2006, to recognize the effect of estimating the number of Time Warner equitybased awards granted to TWC employees prior to January 1, 2006 that...

-

Page 112

..., the Company has recorded corresponding reductions in the cable programming costs over the life of the related cable programming affiliation agreements (which range from 10 to 12 years) that were acquired contemporaneously with the execution of the advertising agreements. This has the effect of...

-

Page 113

... systems that are controlled by TWC and for which TWC holds an economic interest. The Time Warner corporate costs include specified administrative services, including selected tax, human resources, legal, information technology, treasury, financial, public policy and corporate and investor relations...

-

Page 114

... purchase method of accounting and are recorded at fair value on the Company's consolidated balance sheet. Other costs incurred to negotiate and renew cable franchise agreements are capitalized as incurred. Customer relationships acquired are amortized over their estimated useful life (4 years) and...

-

Page 115

... long-term rate of return on plan assets, the discount rate used to determine the present value of future pension benefits and the rate of compensation increases. The determination of these assumptions is discussed in more detail in Note 11. Stock-based Compensation The Company accounts for stock...

-

Page 116

TIME WARNER CABLE INC. NOTES TO CONSOLIDATED FINANCIAL STATEMENTS - (Continued) Revenues and Costs Cable revenues are principally derived from video, high-speed data and Digital Phone subscriber fees and advertising. Subscriber fees are recorded as revenue in the period the service is provided. ...

-

Page 117

...the terms of programming purchase contracts with cable networks, TWC may at the same time negotiate for the sale of advertising to the same cable network. Arrangements, although negotiated contemporaneously, may be documented in one or more contracts. In accounting for such arrangements, the Company...

-

Page 118

TIME WARNER CABLE INC. NOTES TO CONSOLIDATED FINANCIAL STATEMENTS - (Continued) transaction, the Company recognizes revenue on a straight-line basis over the term of the agreement. For example, the Company sells cable, Digital Phone and high-speed data services to subscribers in a bundled package at...

-

Page 119

... statement and income tax purposes, as determined under enacted tax laws and rates. The financial effect of changes in tax laws or rates is accounted for in the period of enactment. During the years ended December 31, 2006 and 2005, the Company made cash tax payments to Time Warner of $489 million...

-

Page 120

TIME WARNER CABLE INC. NOTES TO CONSOLIDATED FINANCIAL STATEMENTS - (Continued) 3. RECENT ACCOUNTING STANDARDS

Employers' Accounting for Defined Benefit Pension and Other Postretirement Plans On December 31, 2006, the Company adopted the provisions of FASB Statement No. 158, Employers' Accounting ...

-

Page 121

... to employees of TWC and its subsidiaries at a weighted-average fair value of $18.25 per unit. Certain information for Time Warner stock-based compensation plans for the year ended December 31, 2006, 2005 and 2004 is as follows (in millions):

Year Ended December 31, 2006 2005 2004

Compensation cost...

-

Page 122

...risk-free rate assumed in valuing the options is based on the U.S. Treasury yield curve in effect at the time of grant for the expected term of the option. The Company determines the expected dividend yield percentage by dividing the expected annual dividend by the market price of Time Warner common...

-

Page 123

...of Time Warner options. Restricted Stock and Restricted Stock Unit Plans The following table summarizes information about Time Warner restricted stock and RSUs granted to TWC employees that are unvested at December 31, 2006:

Number of Shares/Units (in thousands) WeightedAverage Grant Date Fair Value...

-

Page 124

... its business plan and utilized a discount rate consistent with the inherent risk in the business. The 16% interest reflects 155,913,430 shares of Class A common stock issued to Adelphia, which were valued at $35.28 per share for purposes of the Adelphia Acquisition. In addition, on July 28, 2006...

-

Page 125

... operations. Following the Redemptions and the Adelphia Acquisition, on July 31, 2006, TW NY and Comcast swapped certain cable systems, most of which were acquired from Adelphia, each with an estimated value of approximately $8.7 billion, as determined by management using a discounted cash...

-

Page 126

... acquired assets and liabilities and utilized a discount rate consistent with the inherent risk of each of the acquired assets and liabilities. In connection with the closing of the Adelphia Acquisition, the $8.9 billion cash payment was funded by borrowings under the Company's $6.0 billion senior...

-

Page 127

... securities law regulations and provisions of the U.S. bankruptcy code, TWC became a public company subject to the requirements of the Securities Exchange Act of 1934 on the same day. Under the terms of the plan, as of February 20, 2007, approximately 75% of the shares of TWC Class A common stock...

-

Page 128

TIME WARNER CABLE INC. NOTES TO CONSOLIDATED FINANCIAL STATEMENTS - (Continued) FCC Order Approving the Transactions In its order approving the Adelphia Acquisition, the Federal Communications Commission (the "FCC") imposed conditions on TWC related to regional sports networks ("RSNs"), as defined ...

-

Page 129

...for periods beyond the long-term business plan period. Discount rate assumptions are based on an assessment of the risk inherent in the future cash flows of the respective reporting units. In estimating the fair values of its reporting units, the Company also uses research analyst estimates, as well...

-

Page 130

... to acquire the reporting unit. The impairment test for other intangible assets not subject to amortization consists of a comparison of the fair value of the intangible asset with its carrying value. The Company has identified six units of accounting based upon geographic locations of its systems in...

-

Page 131

... accounted for using the equity method primarily consisted of TKCCP (50% owned, of which the Company recognized 100% of the operations of the Kansas City Pool, which TWC began consolidating beginning January 1, 2007) and SpectrumCo, LLC, a wireless joint venture in which TWC and several other cable...

-

Page 132

... results of the Kansas City Pool for the five-month period ended December 31, 2006, and all periods exclude the results of Urban Cable, which was consolidated in 2005 and transferred to Comcast in the Exchange in 2006):

Year Ended December 31, 2006 2005 2004 (in millions)

Operating Results: Total...

-

Page 133

... rate at December 31, 2006 Year of Maturity Outstanding Borrowings as of December 31, December 31, 2006 2005 (in millions)

Debt due within one year: Capital leases and other ...Long-term debt: Bank credit agreements and commercial paper program(a)(b) ...TWE notes and debentures: Senior debentures...

-

Page 134

... financial condition or results of operations of Time Warner or TWC. Borrowings under the Cable Revolving Facility may be used for general corporate purposes and unused credit is available to support borrowings under TWC's commercial paper program. Borrowings under the Cable Facilities were used to...

-

Page 135

... to file reports with the SEC under the Securities Exchange Act of 1934, as amended (the "Exchange Act"). Pursuant to the Ninth Supplemental Indenture to the indenture (the "TWE Indenture") governing the TWE Notes, TW NY, a subsidiary of TWC and a successor in interest to Time Warner NY Cable Inc...

-

Page 136

...Membership Units") to a limited number of third parties. The TW NY Series A Preferred Membership Units pay cash dividends at an annual rate equal to 8.21% of the sum of the liquidation preference thereof and any accrued but unpaid dividends thereon, on a quarterly basis. The TW NY Series A Preferred...

-

Page 137

... taxable entity for U.S. federal and various state income tax purposes and its results are included in the consolidated U.S. federal and certain state income tax returns of Time Warner. The following income tax information has been prepared assuming TWC was a stand-alone taxpayer for all periods...

-

Page 138

... of TWC's net deferred tax liabilities are as follows (in millions):

As of December 31, 2006 2005

Cable franchise costs and customer relationships ...$(10,806) Fixed assets ...(1,837) Investments ...(552) Other ...(92) Deferred tax liabilities ...Stock-based compensation ...Other ...Deferred tax...

-

Page 139

...pension plans administered by Time Warner (the "Pension Plans") and the TWC Savings Plan (the "401K Plan"), a defined pre-tax contribution plan. Benefits under the Pension Plans for all employees are determined based on formulas that reflect employees' years of service and compensation levels during...

-

Page 140

...2007 include an actuarial loss of $10 million. Weighted-average assumptions used to determine benefit obligations at December 31, 2006, 2005 and 2004 are as follows:

2006 2005 2004

Discount rate ...Rate of compensation increase ...(a)

6.00% 5.75% 4.50%(a) 4.50%

6.00% 4.50%

Actuarially determined...

-

Page 141

... of high-quality corporate bonds. A decrease in the discount rate of 25 basis points, from 5.75% to 5.50%, while holding all other assumptions constant, would have resulted in an increase in the TWC's pension expense of approximately $10 million in 2006. In developing the expected long-term rate of...

-

Page 142

TIME WARNER CABLE INC. NOTES TO CONSOLIDATED FINANCIAL STATEMENTS - (Continued) Information about the expected benefit payments for the Company's defined benefit pension plans, including unfunded plans previously noted, related to continuing operations is as follows (in millions): 2007 2008 2009 ...

-

Page 143

... cost of TWC's new contractual carriage arrangements with a programmer in order to secure other forms of content from the same programmer over time periods consistent with the terms of the respective TWC carriage contract. The amount assumed represented Time Warner's best estimate of the fair value...

-

Page 144

TIME WARNER CABLE INC. NOTES TO CONSOLIDATED FINANCIAL STATEMENTS - (Continued) the agreements were executed. Under this arrangement, the subsidiary makes periodic payments to TWC that are classified a reduction of programming costs in the accompanying consolidated statement of operations. Payments ...

-

Page 145

...commitments secure future rights to various assets and services to be used in the normal course of operations. For example, the Company is contractually committed to make some minimum lease payments for the use of property under operating lease agreements. In accordance with current accounting rules...

-

Page 146

... six months ended June 30, 2006. The restated consolidated financial results are reflected in the Company's Current Report on Form 8-K filed with the SEC on February 13, 2007. See discussion of "Restatement of Prior Financial Information" in Note 1. Other Matters On May 20, 2006, the America Channel...

-

Page 147

... of Texas alleging that the Company and a number of other cable operators infringed several patents purportedly related to a variety of technologies, including high-speed data and Internet-based telephony services. In addition, on September 13, 2006, Rembrandt Technologies, LP filed a complaint in...

-

Page 148

...District of Texas alleging that TWC and a number of other cable operators and direct broadcast satellite operators infringe a patent related to digital video recorder technology. TWC is working closely with its DVR equipment vendors in defense of this matter, certain of whom have filed a declaratory...

-

Page 149

... the Exchange; and the transfer of cable systems with a fair value of $3.1 billion in connection with the Redemptions. Additional information with respect to capital expenditures from continuing operations is as follows (in millions):

Year Ended December 31, 2006

Cash paid for capital expenditures...

-

Page 150

... high-speed data and Digital Phone products include network connectivity and certain other costs. Other Current Liabilities Other current liabilities consist of (in millions):

As of December 31, 2006 2005

Accrued compensation and benefits ...Accrued franchise fees ...Accrued sales and other taxes...

-

Page 151

TIME WARNER CABLE INC. MANAGEMENT'S REPORT ON INTERNAL CONTROL OVER FINANCIAL REPORTING Management of the Company is responsible for establishing and maintaining adequate internal control over financial reporting (as such term is defined in Rule 13a-15(f) under the Exchange Act). The Company's ...

-

Page 152

...in relation to the basic financial statements taken as a whole, presents fairly in all material respects the information set forth therein. As discussed in Notes 1 and 3, the Company adopted Financial Accounting Standards Board Statement No. 123R, Share-Based Payment, as of January 1, 2006 using the...

-

Page 153

...REGISTERED PUBLIC ACCOUNTING FIRM The Board of Directors and Shareholders of Time Warner Cable Inc. We have audited management's assessment, included in the accompanying Management's Report on Internal Control Over Financial Reporting, that Time Warner Cable Inc. (the "Company") maintained effective...

-

Page 154

... to the 2006 presentation.

2006 Year Ended December 31, 2005 2004 2003 (in millions, except per share data) 2002

Selected Operating Statement Information: Revenues: Video...High-speed data ...Digital Phone ...Advertising ...Total revenues ...Total costs and expenses(a) ...Operating Income (Loss...

-

Page 155

... to reflect the other-than-temporary declines in the value of certain unconsolidated cable television system joint ventures. Includes a noncash charge of $2 million in 2006 related to the cumulative effect of a change in accounting principle in connection with the adoption of FAS 123R (Note 1) and...

-

Page 156

...share data)

2006(a)(b) Revenues: Subscriptions ...Advertising ...Total revenues ...Operating Income ...Income before discontinued operations and cumulative effect of accounting change ...Discontinued operations, net of tax ...Cumulative effect of accounting change, net of tax ...Net income ...Basic...

-

Page 157

TIME WARNER CABLE INC. SCHEDULE II - VALUATION AND QUALIFYING ACCOUNTS

Balance at Beginning of Period Additions Charged to Costs and Expenses(a) Deductions (in millions) Balance at End of Period

Year Ended December 31, 2006: Allowance for doubtful accounts ...Year Ended December 31, 2005: Allowance...

-

Page 158

... reference to Exhibit 10.2 to Time Warner's Quarterly Report on Form 10-Q for the quarter ended June 30, 2006 (File No. 1-15062) (the "Time Warner June 30, 2006 Form 10-Q")). Amendment No. 3 to the Asset Purchase Agreement, dated June 26, 2006, between ACC and TW NY (incorporated herein by reference...

-

Page 159

..., among Comcast, Comcast Holdings, Comcast Cable Holdings LLC, Comcast of Georgia, Comcast of Texas I, LP, Comcast of Texas II, LP, Comcast of Indiana/Michigan/Texas, LP, TCI Holdings, the Company and TW NY (incorporated herein by reference to Exhibit 99.9 to the Time Warner October 13, 2006 Form...

-

Page 160

... to Exhibit 10.51 to Time Warner Inc.'s Annual Report on Form 10-K for the year ended December 31, 2005 (File number 1-15062) (the "Time Warner 2005 Form 10-K")). $4.0 Billion Five-Year Term Loan Credit Agreement, dated as of February 21, 2006, among the Company, as Borrower, the Lenders from...

-

Page 161

... ("Advance Publications"), Newhouse Broadcasting Corporation ("Newhouse"), Advance/Newhouse Partnership and Time Warner Entertainment-Advance/Newhouse Partnership ("TWE-A/N") (incorporated herein by reference to Exhibit 10(a) to TWE's Current Report on Form 8-K dated September 9, 1994 and filed with...

-

Page 162

... 28, 2003 Form 8-K). Master Transaction Agreement, dated as of August 1, 2002, by and among TWE-A/N, TWE, Paragon and Advance/Newhouse Partnership (incorporated herein by reference to Exhibit 10.1 to Time Warner's Quarterly Report on Form 10-Q for the quarter ended June 30, 2002 and filed with the...

-

Page 163

... Trust, Time Warner Cable Information Services (Kansas), LLC, Time Warner Cable Information Services (Missouri), LLC, Time Warner Information Services (Texas), L.P., Time Warner Cable/Comcast Kansas City Advertising, LLC, TCP/Comcast Las Cruces Cable Advertising, LP, TCP Security Company LLC, TCP...

-

Page 164

...Nicholas, Jr. Investor Former Co-Chief Executive Officer Time Warner Inc. Wayne H. Pace Executive Vice President & Chief Financial Officer Time Warner Inc.

TIME WARNER CABLE SENIOR CORPORATE EXECUTIVES

Glenn A. Britt President & Chief Executive Officer Landel C. Hobbs Chief Operating Officer Robert...

-

Page 165

... Center, North Tower, New York, NY 10019, Attn: Investor Relations, or by e-mail to [email protected]. The Annual Report on Form 10-K and Time Warner Cable's Quarterly Reports on Form 10-Q, as well as certain other documents filed with the Securities and Exchange Commission (SEC), are available...

-

Page 166