Starwood 2009 Annual Report Download - page 98

Download and view the complete annual report

Please find page 98 of the 2009 Starwood annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

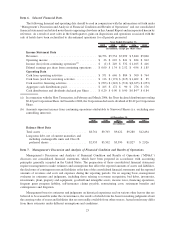

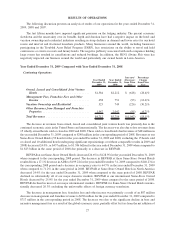

Item 6. Selected Financial Data.

The following financial and operating data should be read in conjunction with the information set forth under

“Management’s Discussion and Analysis of Financial Condition and Results of Operations” and our consolidated

financial statements and related notes thereto appearing elsewhere in this Annual Report and incorporated herein by

reference. As a result of asset sales in the fourth quarter, gains on dispositions and operations associated with the

sale of hotels have been reclassified to discontinued operations for all periods presented.

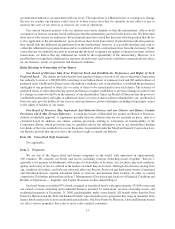

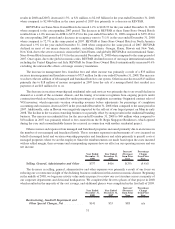

2009 2008 2007 2006 2005

Year Ended December 31,

(In millions, except per share data)

Income Statement Data

Revenues .................................... $4,756 $5,754 $5,999 $ 5,840 $5,860

Operating income ............................. $ 26 $ 610 $ 841 $ 824 $ 812

Income (loss) from continuing operations

(b)

.......... $ (1) $ 249 $ 532 $1,105 $ 416

Diluted earnings per share from continuing operations . . $ 0.00 $ 1.34 $ 2.52 $ 4.96 $ 1.85

Operating Data

Cash from operating activities . . .................. $ 571 $ 646 $ 884 $ 500 $ 764

Cash from (used for) investing activities ............. $ 116 $ (172) $ (215) $ 1,402 $ 85

Cash used for financing activities .................. $ (993) $ (243) $ (712) $(2,635) $ (253)

Aggregate cash distributions paid .................. $ 165 $ 172 $ 90 $ 276 $ 176

Cash distributions and dividends declared per Share .... $ 0.20 $ 0.90 $ 0.90 $ 0.84

(a)

$ 0.84

(a) In connection with the Host Transaction, in February and March 2006, the Trust declared distributions totaling

$0.42 per Corporation Share. In December 2006, the Corporation declared a dividend of $0.42 per Corporation

Share.

(b) Amounts represent income from continuing operations attributable to Starwood Shares (i.e. excluding non-

controlling interests).

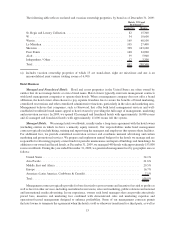

2009 2008 2007 2006 2005

At December 31,

(In millions)

Balance Sheet Data

Total assets ............................ $8,761 $9,703 $9,622 $9,280 $12,494

Long-term debt, net of current maturities and

including exchangeable units and Class B

preferred shares ....................... $2,955 $3,502 $3,590 $1,827 $ 2,926

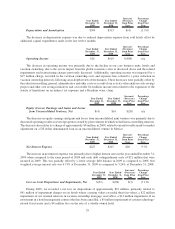

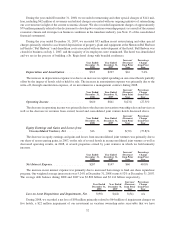

Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations.

Management’s Discussion and Analysis of Financial Condition and Results of Operations (“MD&A”)

discusses our consolidated financial statements, which have been prepared in accordance with accounting

principles generally accepted in the United States. The preparation of these consolidated financial statements

requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities,

the disclosure of contingent assets and liabilities at the date of the consolidated financial statements and the reported

amounts of revenues and costs and expenses during the reporting periods. On an ongoing basis, management

evaluates its estimates and judgments, including those relating to revenue recognition, bad debts, inventories,

investments, plant, property and equipment, goodwill and intangible assets, income taxes, financing operations,

frequent guest program liability, self-insurance claims payable, restructuring costs, retirement benefits and

contingencies and litigation.

Management bases its estimates and judgments on historical experience and on various other factors that are

believed to be reasonable under the circumstances, the results of which form the basis for making judgments about

the carrying value of assets and liabilities that are not readily available from other sources. Actual results may differ

from these estimates under different assumptions and conditions.

23