Starwood 2009 Annual Report Download - page 105

Download and view the complete annual report

Please find page 105 of the 2009 Starwood annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

During 2008, we recorded a net loss of $98 million primarily related to $64 million of impairment charges on

five hotels, a $22 million impairment of our investment in vacation ownership notes receivable that we have

previously securitized, and an $11 million write-off of our investment in a joint venture in which we hold minority

interest (see Note 5 of the consolidated financial statements).

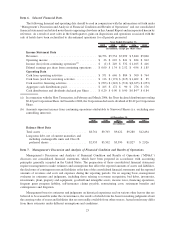

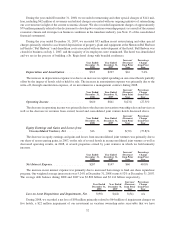

Year Ended

December 31,

2009

Year Ended

December 31,

2008

Increase/

(Decrease)

from Prior

Year

Percentage

Change

from Prior

Year

Income Tax (Benefit) Expense ........... $(293) $72 $(365) n/a

The $365 million decrease in income tax expense primarily relates to a deferred tax benefit of $120 million

(net) in 2009 for an Italian tax incentive program in which the tax basis of land and buildings for the hotels we own

in Italy was stepped-up to fair value in exchange for paying a current tax of $9 million. The remaining decrease

primarily relates to tax benefits of $67 million associated with impairments, restructuring and asset sales and

$37 million related to a foreign tax credit election change. Additionally, a benefit of $10 million was recognized to

reverse the deferred interest accrual associated with the deferral of taxable income. The remaining decrease is

primarily due to lower pretax income.

Discontinued Operations, Net of Tax

During 2009, we sold our Bliss spa business and other non-core assets for cash proceeds of $227 million.

Revenues and expenses from the Bliss spa business, together with revenues and expenses from two hotels which are

in the process of being sold, have been reclassified to discontinued operations resulting in a loss of $2 million, net of

tax. In addition, the net gain on the assets sold in 2009 has been recorded in discontinued operations resulting in

income of $76 million, net of tax.

For the year ended December 31, 2008, the gain on dispositions includes a $124 million gain ($129 million pre

tax) on the sale of three properties which were sold unencumbered by management or franchise contracts. The tax

impact on this transaction was minimized due to the utilization of capital loss carryforwards. Additionally, in 2009,

$5 million was reclassified to discontinued operations (in the 2008 results) relating to two hotels that were in the

process of being sold at the end of 2009. Discontinued operations for the year ended December 31, 2008 also

includes a $49 million tax charge as a result of a 2008 administrative tax ruling for an unrelated taxpayer, that

impacts the tax liability associated with the disposition of one of our businesses several years ago.

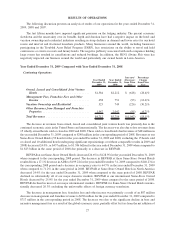

Year Ended December 31, 2008 Compared with Year Ended December 31, 2007

Continuing Operations

Year Ended

December 31,

2008

Year Ended

December 31,

2007

Increase/

(Decrease)

from Prior

Year

Percentage

Change

from Prior

Year

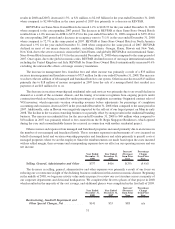

Owned, Leased and Consolidated Joint Venture

Hotels ............................... $2,212 $2,384 $(172) (7.2)%

Management Fees, Franchise Fees and Other

Income .............................. 751 730 21 2.9%

Vacation Ownership and Residential .......... 749 1,025 (276) (26.9)%

Other Revenues from Managed and Franchise

Properties ............................ 2,042 1,860 182 9.8%

Total Revenues .......................... $5,754 $5,999 $(245) (4.1)%

The decrease in revenues from owned, leased and consolidated joint venture hotels was partially due to lost

revenues from 19 wholly owned hotels sold or closed in 2008 and 2007. These sold or closed hotels had revenues of

$77 million in the year ended December 31, 2008 compared to $121 million in the corresponding period of 2007.

Revenues at our Same-Store Owned Hotels (59 hotels for the year ended December 31, 2008 and 2007, excluding

the 19 hotels sold or closed and 10 additional hotels undergoing significant repositionings or without comparable

30