Starwood 2009 Annual Report Download - page 54

Download and view the complete annual report

Please find page 54 of the 2009 Starwood annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.such severance pay and other benefits. Because of Mr. van Paasschen’s recent hire, his base period taxable

compensation does not reflect the total compensation paid to him, artificially increasing the excise tax that

would apply on a change in control and, correspondingly, the tax gross-up payment due under the estimate.

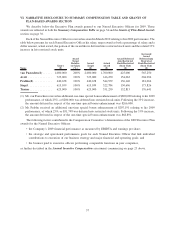

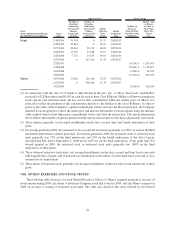

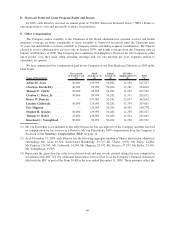

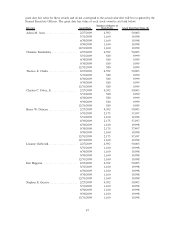

XI. DIRECTOR COMPENSATION

The Company uses a combination of cash and stock-based awards to attract and retain qualified candidates to

serve on the Board. In setting Director compensation, the Company considers the significant amount of time that

members of the Board spend in fulfilling their duties to the Company as well as the skill level required by the

Company or its Directors. The current compensation structure is described below.

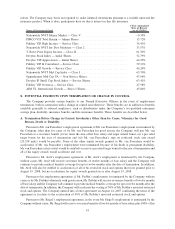

For 2009, under the Company’s Director share ownership guidelines, each Director was required to own Shares

(or deferred compensation stock equivalents) that have a market price equal to two times the annual Director’s fees

paid to such Director. In February 2010, the Board approved an increase in the share ownership guidelines in that

each Director is required to own Shares (or deferred compensation stock equivalents) that have a market price equal

to four times the annual Director’s fees paid to such Director. If any Director fails to satisfy this requirement, sales of

Shares by such Director shall be subject to a 35% retention requirement. Any new Director shall be given a period of

three years to satisfy this requirement.

Company employees who serve as members of the Board receive no fees for their services in this capacity.

Non-employee members of the Board (“Non-Employee Directors”) receive compensation for their services as

described below.

A. Annual Fees

Each Non-Employee Director receives an annual fee in the amount of $80,000, payable in four equal

installments of Shares issued under our LTIP. The number of Shares to be issued is based on the fair market value of

a Share using the average of the high and low price of the Company’s stock on the previous December 31.

A Non-Employee Director may elect to receive up to one-half of the annual fee in cash and to defer (at an

annual interest rate of LIBOR plus 11⁄2% for deferred cash amounts) any or all of the annual fee payable in cash.

Deferred cash amounts are payable in accordance with the Director’s advance election. A Non-Employee Director

is also permitted to elect to defer to a deferred unit account any or all of the annual fee payable in Shares. Deferred

stock amounts are payable in accordance with the Non-Employee Director’s advance election.

Non-Employee Directors serving as members of the Audit Committee received an additional annual fee in

cash of $10,000 ($25,000 for the chairman of the Audit Committee). The chairperson of each other committee of the

Board received an additional annual fee in cash of $10,000; commencing in 2010, this chairperson additional annual

fee has been increased to $12,500 in cash. The Chairman of the Board received an additional retainer of $150,000,

payable quarterly in restricted stock units which vest in three years.

B. Attendance Fees

Non-Employee Directors do not receive fees for attendance at meetings.

C. Equity grant

In 2009, each Non-Employee Director received an annual equity grant (made at the same time as the annual

grant is made to Company employees) under our LTIP with a value of $100,000. In February 2010, this annual

equity grant value was increased to $125,000. The equity grant was delivered 50% in stock units and 50% in stock

options. The number of stock units is determined by dividing the value by the average of the high and low Share

price on the date of grant. The number of options is determined by dividing the value by the average of the high and

low Share price on the date of grant (also the exercise price) and multiplying by two and one half. The options are

fully vested and exercisable upon grant and are scheduled to expire eight years after the grant date. The restricted

stock awarded pursuant to the annual grant generally vests upon the earlier of (i) the third anniversary of the grant

date and (ii) the date such person ceases to be a Director of the Company.

45