Starwood 2009 Annual Report Download - page 150

Download and view the complete annual report

Please find page 150 of the 2009 Starwood annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

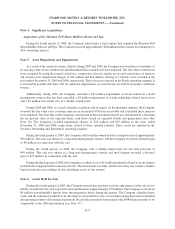

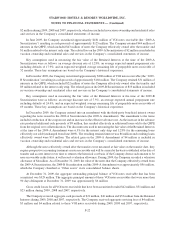

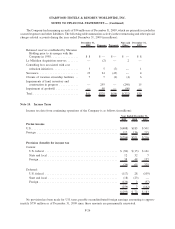

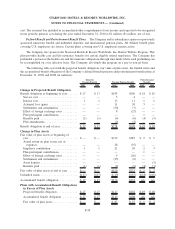

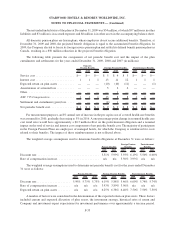

Deferred income taxes represent the tax effect of the differences between the book and tax bases of assets and

liabilities. Deferred tax assets (liabilities) include the following (in millions):

2009 2008

December 31,

Plant, property and equipment....................................... $ 502 $ 389

Intangibles ..................................................... 7 10

Allowances for doubtful accounts and other reserves ...................... 225 132

Employee benefits ............................................... 99 105

Net operating loss, capital loss and tax credit carryforwards ................. 503 605

Deferred income ................................................. (83) (238)

Other . . ....................................................... 180 98

1,433 1,101

Less valuation allowance .......................................... (482) (488)

Deferred income taxes ............................................ $ 951 $ 613

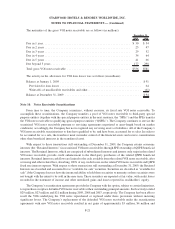

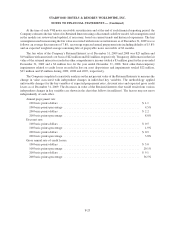

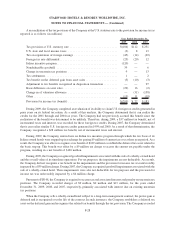

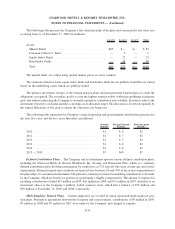

At December 31, 2009, the Company had federal and state net operating losses, which have varying expiration

dates extending through 2028, of approximately $1 million and $2.4 billion, respectively. The Company had federal

tax credit carryforwards, which are expected to be realized, of $13 million which will fully expire by 2029. The

Company also had foreign net operating loss and tax credit carryforwards of approximately $58 million and

$19 million, respectively. The majority of foreign net operating loss carryforwards are in jurisdictions with an

indefinite carryforward period and the tax credit carryforwards will fully expire by 2016. The Company has

established a valuation allowance against substantially all of the tax benefit for the federal and state loss

carryforwards and all foreign carryforwards as it is unlikely that the benefit will be realized prior to their

expiration. The Company is currently considering certain tax-planning strategies that may allow it to utilize these

tax attributes within the statutory carryforward period.

The Company generated a federal capital loss in connection with a disposition transaction in 2006 which was

originally estimated at approximately $2.6 billion at December 31, 2006. During 2007, the Company completed its

2006 tax return which included the transaction and adopted FIN 48. As a result, the Company reduced its original

estimate of this capital loss and corresponding valuation allowance by approximately $1.2 billion, resulting in a

revised amount of $1.4 billion at December 31, 2006. Through December 31, 2009, approximately $594 million of a

$1.4 billion capital loss has been utilized to offset 2009 and prior years’ capital gains. The remaining $782 million

of capital loss is available to offset federal capital gains through 2011. The Company also had state capital losses

generated by the disposition transaction in 2006 of approximately $961 million, substantially all of which expire in

2011. Due to the uncertainty of realizing the tax benefit of the federal and state capital loss carryforwards, the entire

tax benefit of the losses has been offset by a valuation allowance.

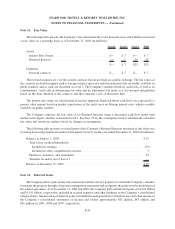

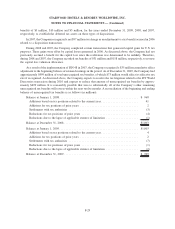

In February 1998, the Company disposed of ITT World Directories. The Company recorded $551 million of

income taxes relating to this transaction. While the Company strongly believes this transaction was completed on a

tax-deferred basis, in 2002 the IRS proposed an adjustment to fully tax the gain in 1998, which would increase

Starwood’s taxable income by approximately $1.4 billion in that year. During 2004, the Company filed a petition in

United States Tax Court to contest the IRS’s proposed adjustment. As a result of an August 2005 United States Tax

Court decision against another taxpayer, the Company decided to treat this transaction as if it were taxable in 1998

for accounting purposes. As such, the Company applied substantially all of its federal net operating loss

carryforwards against the gain and accrued interest, resulting in a $360 million net current liability. The Company

paid the entire current liability to the IRS in October 2005 in order to eliminate any future interest accruals

associated with the pending dispute. In January 2009, the Company and the IRS reached an agreement in principle

to settle the litigation pertaining to the tax treatment of this transaction. The Company expects to finalize the details

of the agreement and obtain the refund during 2010.

F-27

STARWOOD HOTELS & RESORTS WORLDWIDE, INC.

NOTES TO FINANCIAL STATEMENTS — (Continued)