Starwood 2009 Annual Report Download - page 57

Download and view the complete annual report

Please find page 57 of the 2009 Starwood annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

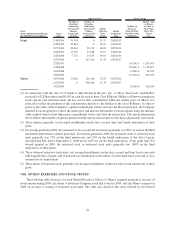

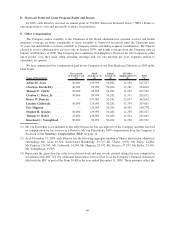

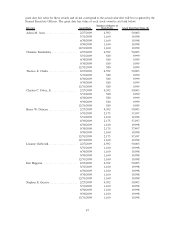

Director Grant Date

Number of Shares of

Stock/Units Grant Date Fair Value ($)

Thomas O. Ryder ................. 2/27/2009 4,392 50,003

3/31/2009 1,160 19,998

6/30/2009 1,160 19,998

9/30/2009 1,160 19,998

12/31/2009 1,160 19,998

Kneeland C. Youngblood ............ 2/27/2009 4,392 50,003

3/31/2009 580 9,999

6/30/2009 580 9,999

9/30/2009 580 9,999

12/31/2009 580 9,999

(4) Represents the grant date fair value for stock option awards granted during the year computed in accordance

with ASC 718. For additional information, refer to Note 21 of the Company’s financial statements filed with the

SEC as part of the Form 10-K for the year ended December 31, 2009. These amounts reflect the grant date fair

value for these awards and do not correspond to the actual value that will be recognized by the Directors. As of

December 31, 2009, each Director has the following aggregate number of stock options outstanding: Mr. Aron,

21,941; Ambassador Barshefsky, 46,061; Mr. Clarke, 13,831; Mr. Daley, 12,523; Mr. Duncan, 95,785;

Ms. Galbreath, 29,564; Mr. Hippeau, 57,059; Mr. Quazzo, 57,059; Mr. Ryder, 51,560; Mr. Youngblood,

51,560. All Directors received a grant of 10,979 options on February 27, 2009 with a grant date fair value of

$50,282.

(5) We reimburse Non-Employee Directors for travel expenses and other out-of-pocket costs they incur when

attending meetings and, for one meeting per year, attendance by spouses. In addition, in 2009 Non-Employee

Directors received 750,000 SPG Points valued at $11,250. The Chairman of the Board also received the cost of

an administrative assistant in January 2009. Non-Employee Directors receive interest on deferred dividends.

Pursuant to SEC rules, perquisites and personal benefits are not reported for any Director for whom such

amounts were less than $10,000 in the aggregate for 2009 but must be identified by type for each Director for

whom such amounts were equal to or greater than $10,000 in the aggregate. SEC rules do not require

specification of the value of any type of perquisite or personal benefit provided to the Non-Employee Directors

because no such value exceeded $25,000.

Pursuant to SEC rules regarding All Other Compensation that is valued in excess of $10,000 and not disclosed

above, the Company provided Mr. Duncan with administrative assistant services in January 2009. The value

associated therewith was $10,226.

48