Starwood 2009 Annual Report Download - page 137

Download and view the complete annual report

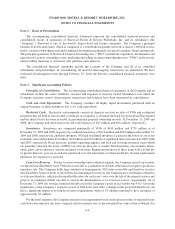

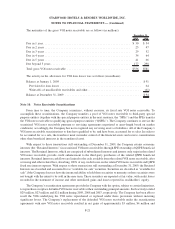

Please find page 137 of the 2009 Starwood annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.In April 2009, the FASB issued FASB Staff Position (“FSP”) Issue No. Financial Accounting Standard

(“FAS”) No. 157-4 “Determining Fair Value When the Volume and Level of Activity for the Asset or Liability Have

Significantly Decreased and Identifying Transactions that are not Orderly” (“FSP FAS No. 157-4”), included in the

Codification as ASC 820-10-65-4. This topic provides additional guidance for estimating fair value and is effective

in reporting periods ending after June 15, 2009. On June 30, 2009, the Company adopted this topic, which did not

have a material impact on its consolidated financial statements.

In April 2009, the FASB issued FSP No. FAS No. 107-1 and Accounting Principles Board (“APB”) No. 28-1

“Interim Disclosures about Fair Value of Financial Instruments” (“FSP FAS No. 107-1 and APB No 28-1”),

included in the Codification as ASC 825-10-65-1. This topic requires disclosures about the fair value of financial

instruments for annual and interim reporting periods of publicly traded companies and is effective in reporting

periods ending after June 15, 2009. On June 30, 2009, the Company adopted this topic, which did not have a

material impact on its consolidated financial statements.

In April 2009, the FASB issued FSP Issue No. FAS No. 115-2 and FAS No. 124-2 “Recognition and

Presentation of Other-Than-Temporary Impairments” (“FSP FAS No. 115-2 and 124-2”), included in the Cod-

ification as ASC 320-10-65-1. This topic amends the other-than-temporary impairment guidance for debt securities

to make the guidance more operational and to improve the disclosure of other-than-temporary impairments on debt

and equity securities in the financial statements. This topic is effective in reporting periods ending after June 15,

2009. On June 30, 2009, the Company adopted this topic, which did not have a material impact on its consolidated

financial statements.

In January 2009, the FASB issued FSP Issue No. FAS No. 132(R)-1 “Employers Disclosures about Pensions

and Other Postretirement Benefit Plan Assets” (“FSP FAS No. 132(R)-1”), included in the Codification as ASC

715-20-65-2. This topic provides guidance on an employer’s disclosures about plan assets of a defined benefit

pension or other postretirement plan. This topic is effective for fiscal years ending after December 15, 2009. The

Company adopted this topic on December 31, 2009 and incorporated it into its Employee Benefit Plan disclosure

(see Note 18).

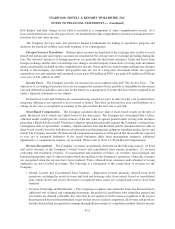

In June 2008, the FASB ratified FSP Issue No. Emerging Issues Task Force (“EITF”) 03-6-1, “Determining

Whether Instruments Granted in Share-Based Payment Transactions are Participating Securities” (FSP

No. EITF 03-6-1), included in the Codification as ASC 260-10-45-68B. This topic addresses whether instruments

granted in share-based payment awards are participating securities prior to vesting and, therefore, must be included

in the earnings allocation in calculating earnings per share under the two-class method. This topic requires that

unvested share-based payment awards that contain non-forfeitable rights to dividends or dividend-equivalents be

treated as participating securities in calculating earnings per share. This topic is effective for the Company

beginning with the first interim period ending after December 15, 2008, and will be applied retrospectively to all

prior periods. On January 1, 2009 the Company adopted this topic, which did not have an impact on its consolidated

financial statements.

In April 2008, the FASB issued FSP No. 142-3, “Determination of the Useful Life of Intangible Assets” (“FSP

No. 142-3”), included in the Codification as ASC 350-30-50-4. This topic amends the factors that should be

considered in developing renewal or extension assumptions used to determine the useful life of a recognized

intangible asset. This topic is effective for financial statements issued for fiscal years beginning after December 15,

2008 and interim periods within those fiscal years. On January 1, 2009, the Company adopted this topic, which did

not have any impact on its consolidated financial statements.

In March 2008, the FASB issued SFAS No. 161, “Disclosures about Derivative Instruments and Hedging

Activities-an amendment of FASB Statement No. 133” (“SFAS No. 161”), included in the Codification as ASC

815-10-65-1. This topic requires enhanced disclosure related to derivatives and hedging activities. This topic must

be applied prospectively to all derivative instruments and non-derivative instruments that are designated and qualify

as hedging instruments and related hedged items for all financial statements issued for fiscal years and interim

F-14

STARWOOD HOTELS & RESORTS WORLDWIDE, INC.

NOTES TO FINANCIAL STATEMENTS — (Continued)