Starwood 2009 Annual Report Download - page 165

Download and view the complete annual report

Please find page 165 of the 2009 Starwood annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

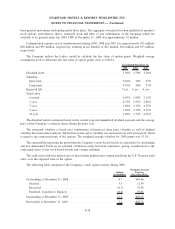

Consolidated Statements of Income and Comprehensive Income

For the Years Ended December 31, 2009 and 2008

(in millions)

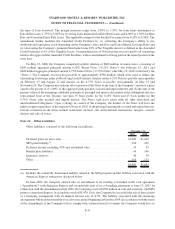

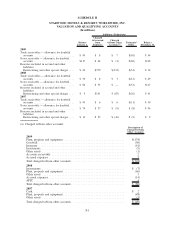

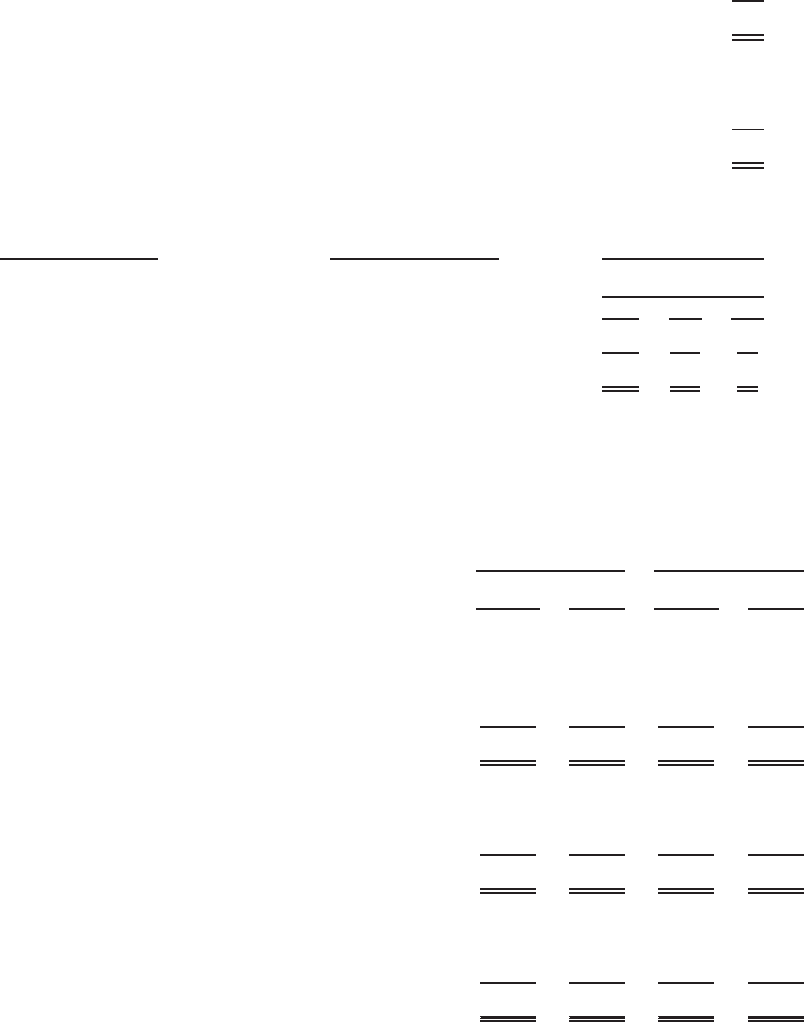

Balance at December 31, 2007 ................................................ $—

Mark-to-market gain on forward exchange contracts .............................. (4)

Reclassification of loss from OCI to management fees, franchise fees, and other income .... (2)

Balance at December 31, 2008 ................................................ $(6)

Balance at December 31, 2008 ................................................ $(6)

Mark-to-market gain on forward exchange contracts .............................. —

Reclassification of gain from OCI to management fees, franchise fees, and other income . . . 6

Balance at December 31, 2009 ................................................ $—

2009 2008 2007

Year Ended

December 31,

Derivatives Not

Designated as Hedging

Instruments

Location of Gain

or (Loss) Recognized

in Income on Derivative

Amount of Gain

or (Loss) Recognized

in Income on

Derivative

Foreign forward exchange contracts Interest expense, net $(15) $14 $4

Total (loss) gain included in income $(15) $14 $4

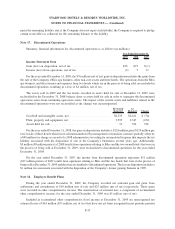

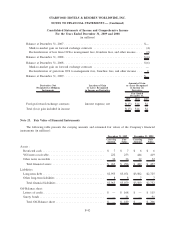

Note 23. Fair Value of Financial Instruments

The following table presents the carrying amounts and estimated fair values of the Company’s financial

instruments (in millions):

Carrying

Amount

Fair

Value

Carrying

Amount

Fair

Value

December 31, 2009 December 31, 2008

Assets :

Restricted cash ...................................... $ 7 $ 7 $ 6 $ 6

VOI notes receivable .................................. 222 253 444 419

Other notes receivable ................................. 36 36 32 32

Total financial assets ................................ $ 265 $ 296 $ 482 $ 457

Liabilities:

Long-term debt ...................................... $2,955 $3,071 $3,502 $2,725

Other long-term liabilities .............................. 8877

Total financial liabilities .............................. $2,963 $3,079 $3,509 $2,732

Off-Balance sheet:

Letters of credit ...................................... $ — $ 168 $ — $ 115

Surety bonds ........................................ — 21 — 91

Total Off-Balance sheet .............................. $ — $ 189 $ — $ 206

F-42

STARWOOD HOTELS & RESORTS WORLDWIDE, INC.

NOTES TO FINANCIAL STATEMENTS — (Continued)