Starwood 2009 Annual Report Download - page 64

Download and view the complete annual report

Please find page 64 of the 2009 Starwood annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.APPENDIX A

STARWOOD HOTELS & RESORTS WORLDWIDE, INC.

ANNUAL INCENTIVE PLAN FOR CERTAIN EXECUTIVES

AS AMENDED AND RESTATED IN DECEMBER 2008

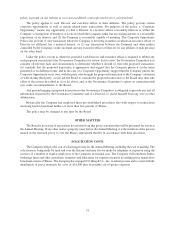

1. Definitions. When the following terms are used herein with initial capital letters, they shall have the

following meanings:

Code — shall mean the Internal Revenue Code of 1986, as it may be amended from time to time, and any final

Treasury Regulations promulgated thereunder. All citations to sections of the Code are to such sections as they may

from time to time be amended or renumbered.

Committee — shall mean a committee comprised solely of two or more members of the Board of Directors of

the Company, each of whom is an “outside director” within the meaning of Code section 162(m) and a “Non-

Employee Director” within the meaning of Rule 16b-3 under the Exchange Act.

Company — shall mean Starwood Hotels & Resorts Worldwide, Inc., a Maryland corporation.

Deferred Share Account — shall mean a book reserve maintained by the Company for the purpose of

measuring the amount payable to a Participant with respect to the deferred portion of the Participant’s bonus

payment for a Performance Period.

Designated Beneficiary — shall mean the person or persons entitled to receive the remaining Distributable

Balance in a Participant’s Deferred Share Account at the Participant’s death.

Disability — shall have the same meaning as in Code section 409A(a)(2)(C).

Distributable Balance — shall mean the vested portion of a Participant’s Deferred Share Account that is

distributable to the Participant on the Distribution Date (as defined in subsection 5.4), as adjusted for deemed

investment returns pursuant to subsection 5.2.

Exchange Act — shall mean the Securities Exchange Act of 1934, as amended.

Fair Market Value — shall mean the fair market value of a Share, as determined by the Committee, which,

unless otherwise specified, shall be the average of the high and low sales price for a Share as reported in the

New York Stock Exchange Composite Transactions on the date as of which such value is being determined, or, if

there is no such sale on the relevant date, then on the preceding business day on which a sale was reported.

Participant — shall mean the Executive Chairman and the Chief Executive Officer, and any other executive

officer of the Company who is designated by the Committee as a Participant in this Plan at any time ending on or

before the lesser of (i) the 90th day of the applicable Performance Period or (ii) the date on which 25% of the

Performance Period has elapsed.

Performance Measure — The Performance Measure shall be directly and specifically tied to one or more of the

following business criteria, determined with respect to the Company: earnings before interest, taxes, depreciation

and amortization (“EBITDA”), consolidated pre-tax earnings, net revenues, net earnings, operating income,

earnings before interest and taxes, cash flow measures, return on equity, return on net assets employed or earnings

per share for the applicable Performance Period, subject to such other special rules and conditions as the Committee

may establish at any time ending on or before the lesser of (i) the 90th day of the applicable Performance Period or

(ii) the date on which 25% of the applicable Performance Period has elapsed.

Performance Period — shall mean the twelve consecutive month period, which coincides with the Company’s

fiscal year, or, such other period as the Committee may determine in its discretion.

Plan — shall mean the Starwood Hotels & Resorts Worldwide, Inc. Annual Incentive Plan for Certain

Executives as set forth herein and as from time to time amended.

Separation from Service — shall mean a Participant’s separation from service with the Starwood Organization,

within the meaning of Code section 409A(a)(2)(A)(i). The term may also be used as a verb (i.e., “Separates from

A-1