Starwood 2009 Annual Report Download - page 166

Download and view the complete annual report

Please find page 166 of the 2009 Starwood annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

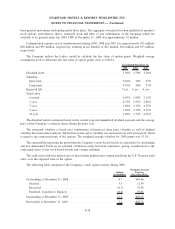

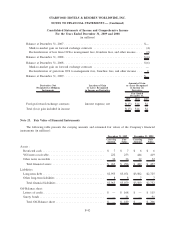

The Company believes the carrying values of its financial instruments related to current assets and liabilities

approximate fair value. The Company records its retained interests and derivative assets and liabilities at fair value.

See Note 11 for recorded amounts and the methods and assumptions used to estimate fair value.

The carrying value of the Company’s restricted cash approximates its fair value. The Company estimates the

fair value of its VOI notes receivable by discounting the expected future cash flows with discount rates

commensurate with the risk of the underlying notes, primarily determined by the credit worthiness of the borrowers

based on their Fair Isaac Corporation (“FICO”) scores. The fair value of other notes receivable is estimated based on

terms of the instrument and current market conditions. These financial instrument assets are recorded in the other

assets line item in the Company’s consolidated balance sheet.

The Company estimates the fair value of its publicly traded debt based on the bid prices in the public debt

markets. The carrying amount of its floating rate debt is a reasonable basis of fair value due to the variable nature of

the interest rates. The Company’s non-public fixed rate debt fair value is determined based upon discounted cash

flows for the debt rates deemed reasonable for the type of debt, prevailing market conditions and the length to

maturity for the debt. Other long-term liabilities represent a financial guarantee. The carrying value of this liability

approximates its fair value based on expected funding under the guarantee.

The fair values of the Company’s letters of credit and surety bonds are estimated to be the same as the contract

values based on the nature of the fee arrangements with the issuing financial institutions.

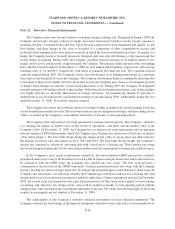

Note 24. Commitments and Contingencies

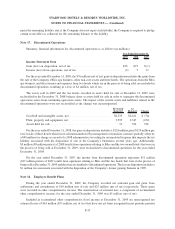

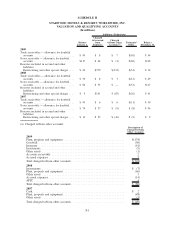

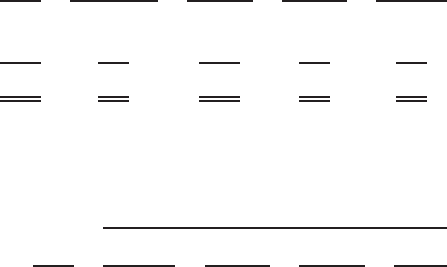

The Company had the following contractual obligations outstanding as of December 31, 2009 (in millions):

Total

Due in Less

Than 1 Year

Due in

1-3 Years

Due in

3-5 Years

Due After

5 Years

Unconditional purchase obligations

(a)

............. $308 $86 $136 $80 $ 6

Other long-term obligations .................... 4 1 3 — —

Total contractual obligations ................... $312 $87 $139 $80 $ 6

(a) Included in these balances are commitments that may be reimbursed or satisfied by the Company’s managed

and franchised properties.

The Company had the following commercial commitments outstanding as of December 31, 2009 (in millions):

Total

Less Than

1 Year 1-3 Years 3-5 Years

After

5 Years

Amount of Commitment Expiration Per Period

Standby letters of credit .......................... $168 $165 $— $— $3

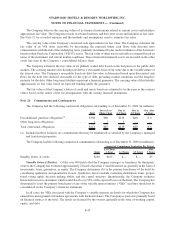

Variable Interest Entities. Of the over 900 hotels that the Company manages or franchises for third party

owners, the Company has evaluated approximately 22 hotels that it has a variable interest in, generally in the form of

investments, loans, guarantees, or equity. The Company determines if it is the primary beneficiary of the hotel by

considering qualitative and quantitative factors. Qualitative factors include evaluating distribution terms, propor-

tional voting rights, decision making ability, and the capital structure. Quantitatively, the Company evaluates

financial forecasts to determine which would absorb over 50% of the expected losses of the hotel. The Company has

determined it is not the primary beneficiary of any of the variable interest entities (“VIEs”) and they should not be

consolidated in the Company’s financial statements.

In all cases, the VIEs associated with the Company’s variable interests are hotels for which the Company has

entered into management or franchise agreements with the hotel owners. The Company is paid a fee primarily based

on financial metrics of the hotel. The hotels are financed by the owners, generally in the form of working capital,

equity, and debt.

F-43

STARWOOD HOTELS & RESORTS WORLDWIDE, INC.

NOTES TO FINANCIAL STATEMENTS — (Continued)