Starwood 2009 Annual Report Download - page 53

Download and view the complete annual report

Please find page 53 of the 2009 Starwood annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

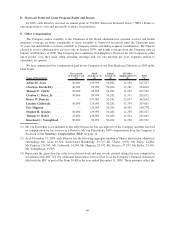

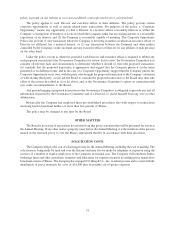

C. Estimated Payments Upon Termination

The tables below reflect the estimated amounts payable to the Named Executive Officers in the event their

employment with the Company had terminated on December 31, 2009 under various circumstances, and includes

amounts earned through that date. The actual amounts that would become payable in the event of an actual

employment termination can only be determined at the time of such termination.

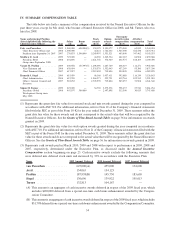

1. Involuntary Termination without Cause or Voluntary Termination for Good Reason

The following table discloses the amounts that would have become payable on account of an involuntary

termination without cause or a voluntary termination for good reason outside of the change in control context.

Name

Severance

Pay

($)

Medical

Benefits

($)

Vesting of

Restricted Stock

($)

Vesting of

Stock Options

($)

Total

($)

van Paasschen ............. 8,000,000 0 934,656 0 8,934,656

Avril(1) .................. 725,000 10,457 1,635,337 0 2,370,794

Prabhu .................. 640,658 10,023 7,001,627 0 7,652,308

Siegel(1) ................. 1,230,078 19,699 0 0 1,249,777

Turner................... 625,000 9,953 0 0 634,953

(1) Messrs. Siegel and Avril’s employment agreements provide for payments in the event of involuntary termi-

nation other than for cause but do not provide for payments in the event of voluntary termination for good

reason.

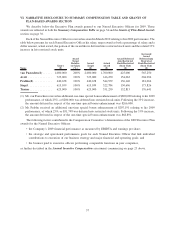

2. Termination on Account of Death or Disability

The following table discloses the amounts that would have become payable on account of a termination on

account of death or disability.

Name

Severance

Pay

($)

Medical

Benefits

($)

Vesting of

Restricted

Stock

($)

Vesting of

Stock

Options

($)

Total

($)

van Paasschen .................. 2,000,000 0 33,135,043 0 35,135,043

Avril .......................... 725,000 10,457 12,017,555 0 12,753,012

Prabhu ........................ 640,658 10,023 14,003,254 0 14,653,935

Siegel ......................... 1,230,078 19,699 13,885,817 0 15,135,594

Turner ........................ 625,000 9,953 14,300,584 0 14,935,537

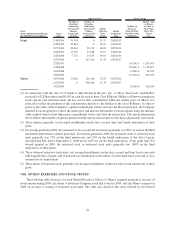

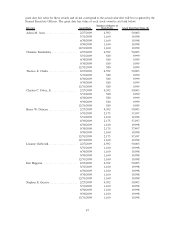

3. Change in Control

The following table discloses the amounts that would have become payable on account of an involuntary

termination without cause following a change in control or a voluntary termination with good reason following a

change in control.

Name

Severance

Pay

($)

Medical

Benefits

($)

Vesting of

Restricted

Stock

($)

Vesting of

Stock

Options

($)

Outplacement

($)

401(k)

Payment

($)

Tax

Gross-Up

($)

Total

($)

van Paasschen(1) ......... 8,000,000 21,939 33,135,043 0 0 0 7,033,949 48,190,931

Avril.................. 3,309,868 20,914 12,017,555 0 145,000 0 n/a 15,493,337

Prabhu ................ 3,304,994 20,046 14,003,254 0 128,132 0 0 17,456,426

Siegel ................. 2,964,489 39,398 13,885,817 0 123,008 0 0 17,012,712

Turner ................ 3,125,000 19,905 14,300,584 0 125,000 0 n/a 17,570,489

(1) If the amount of severance pay and other benefits payable on change in control is greater than three times certain

base period taxable compensation for Mr. van Paasschen, a 20% excise tax is imposed on the excess amount of

44