Starwood 2009 Annual Report Download - page 44

Download and view the complete annual report

Please find page 44 of the 2009 Starwood annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

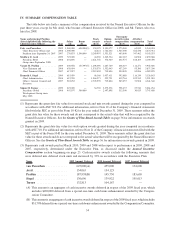

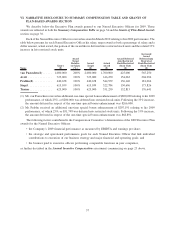

(4) Pursuant to SEC rules, perquisites and personal benefits are not reported for any Named Executive Officer for

whom such amounts were less than $10,000 in the aggregate for 2009, 2008 and 2007 but must be identified by

type for each Named Executive Officer for whom such amounts were equal to or greater than $10,000 in the

aggregate. In that regard, the All Other Compensation column of the Summary Compensation Table includes

perquisites and other personal benefits consisting of the following: annual physical examinations, COBRA

premiums paid by the Company, Company contributions to the Company’s tax-qualified 401(k) plan, dividends

on restricted stock, life insurance premiums, legal fees paid by the Company, spousal accompaniment while on

business travel, and tax and financial planning services. SEC rules require specification of the cost of any

perquisite or personal benefit when this cost exceeds $25,000. This applies to Mr. van Paasschen’s personal

travel (discussed below). These amounts are included in the All Other Compensation column.

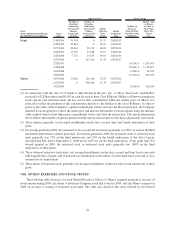

The net aggregate incremental cost to the Company of Mr. van Paasschen’s personal use of the Company-

owned plane and chartered aircraft was $3,746 in 2009, all of which he reimbursed to the Company in January

2010; $329,480 in 2008; and $165,606 in 2007. With respect to expenses incurred in 2008 and 2007, Mr. van

Paasschen’s employment agreement provides that the Company would provide Mr. van Paasschen with up to a

$500,000 credit for personal use of the Company’s aircraft during the first 12 months of his employment with

the Company. The amount for 2007 also includes relocation benefits which had an aggregate cost of $132,275

and the reimbursement of $44,556 for legal fees incurred in connection with the negotiation of his employment

agreement. These amounts (other than the reimbursed expenses for use of the Company-owned plane and

chartered aircraft in 2009) are included in the All Other Compensation column.

The cost of the Company-owned plane includes the cost of fuel, ground services and landing fees, navigation

and telecommunications, catering and aircraft supplies, crew expenses, aircraft cleaning and an allocable share

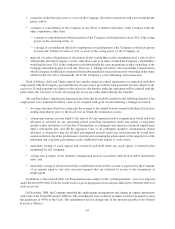

of maintenance. Pursuant to SEC rules, the following table specifies the value for each element of All Other

Compensation not specified above (other than perquisites and personal benefits) that is valued in excess of

$10,000.

Name

Dividend

Equivalents on

Restricted Stock

($) (2009)

Relocation

($) (2009)

Dividend

Equivalents on

Restricted Stock

($) (2008)

Relocation

($) (2008)

Dividend

Equivalents on

Restricted Stock

($) (2007)

van Paasschen ....... — 31,438 — 165,328 —

Avril ............... 57,254 — 150,728 — —

Prabhu ............. 85,186 — 69,917 — 63,530

Siegel .............. 89,225 — 76,538 — 24,199

Turner ............. — — — — —

(5) Represents special one-time cash bonus enhancements, less deferred amounts, awarded by the Compensation

Committee in recognition of 2009 accomplishments.

35