Starwood 2009 Annual Report Download - page 107

Download and view the complete annual report

Please find page 107 of the 2009 Starwood annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

During the year ended December 31, 2008, we recorded restructuring and other special charges of $141 mil-

lion, including $62 million of severance and related charges associated with our ongoing initiative of rationalizing

our cost structure in light of the current economic climate. We also recorded impairment charges of approximately

$79 million primarily related to the decision not to develop two vacation ownership projects as a result of the current

economic climate and its impact on business conditions in the timeshare industry (see Note 13 of the consolidated

financial statements).

During the year ended December 31, 2007, we recorded $53 million in net restructuring and other special

charges primarily related to accelerated depreciation of property, plant and equipment at the Sheraton Bal Harbour

in Florida (“Bal Harbour”) and demolition costs associated with our redevelopment of that hotel. Bal Harbour was

closed for business on July 1, 2007, and the majority of its employees were terminated. The hotel was demolished

and we are in the process of building a St. Regis hotel along with branded residences.

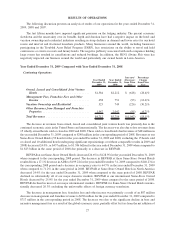

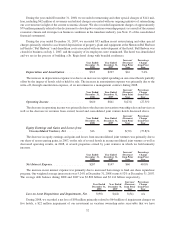

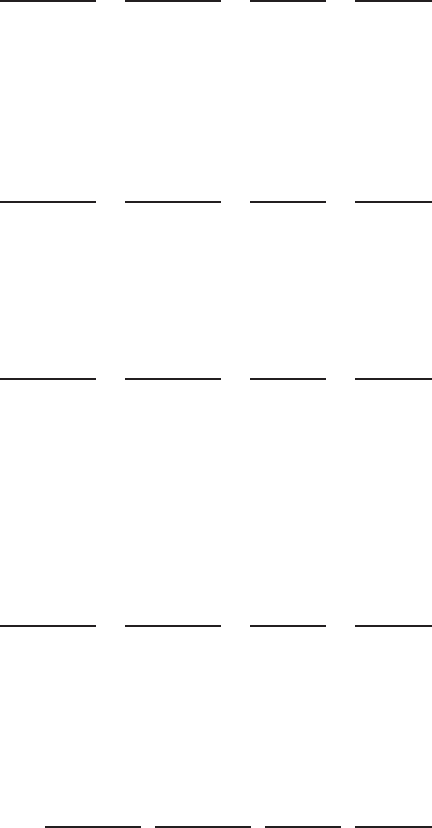

Year Ended

December 31,

2008

Year Ended

December 31,

2007

Increase/

(Decrease)

from Prior

Year

Percentage

Change

from Prior

Year

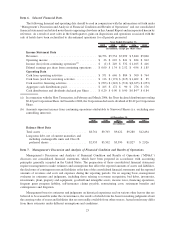

Depreciation and Amortization ........... $313 $297 $16 5.4%

The increase in depreciation expense was due to an increase in capital spending on our owned hotels partially

offset by the impact of hotels sold or held for sale. The increase in amortization expense was primarily due to the

write-off, through amortization expense, of an investment in a management contract during 2008.

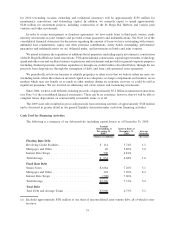

Year Ended

December 31,

2008

Year Ended

December 31,

2007

Increase/

(Decrease)

from Prior

Year

Percentage

Change

from Prior

Year

Operating Income ..................... $610 $841 $(231) (27.5)%

The decrease in operating income was primarily due to the decrease in vacation ownership sales and services as

well as the decrease in revenues from owned, leased and consolidated joint venture hotels discussed above.

Year Ended

December 31,

2008

Year Ended

December 31,

2007

Increase/

(Decrease)

from Prior

Year

Percentage

Change

from Prior

Year

Equity Earnings and Gains and Losses from

Unconsolidated Ventures, Net .......... $16 $66 $(50) (75.8)%

The decrease in equity earnings and gains and losses from unconsolidated joint ventures was primarily due to

our share of non-recurring gains, in 2007, on the sale of several hotels in an unconsolidated joint venture as well as

decreased operating results, in 2008, at several properties owned by joint ventures in which we hold minority

interests.

Year Ended

December 31,

2008

Year Ended

December 31,

2007

Increase/

(Decrease)

from Prior

Year

Percentage

Change

from Prior

Year

Net Interest Expense ................... $207 $147 $60 40.8%

The increase in net interest expense was primarily due to increased borrowings to fund our share repurchase

program. Our weighted average interest rate was 5.24% at December 31, 2008 versus 6.52% at December 31, 2007.

The average debt balance during 2008 and 2007 was $3.802 billion and $3.114 billion respectively.

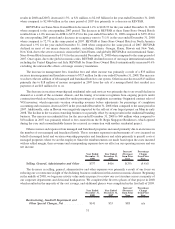

Year Ended

December 31,

2008

Year Ended

December 31,

2007

Increase/

(Decrease)

from Prior

Year

Percentage

Change

from Prior

Year

Loss on Asset Dispositions and Impairments, Net . . $(98) $(44) $(54) n/a

During 2008, we recorded a net loss of $98 million primarily related to $64 million of impairment charges on

five hotels, a $22 million impairment of our investment in vacation ownership notes receivable that we have

32