Starwood 2009 Annual Report Download - page 100

Download and view the complete annual report

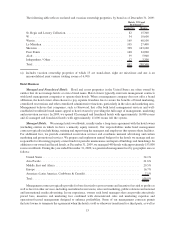

Please find page 100 of the 2009 Starwood annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Goodwill and Intangible Assets. Goodwill and intangible assets arise in connection with acquisitions,

including the acquisition of management contracts. We do not amortize goodwill and intangible assets with

indefinite lives. Intangible assets with finite lives are amortized on a straight-line basis over their respective useful

lives. We review all goodwill and intangible assets for impairment by comparing their fair values to book values

annually, or upon the occurrence of a trigger event. Impairment charges, if any, are recognized in operating results.

In 2009 we recorded a goodwill impairment charge of $90 million to our vacation ownership reporting unit. It

is reasonably possible that the remaining carrying value of vacation ownership goodwill may become further

impaired if future operating results are below our estimates.

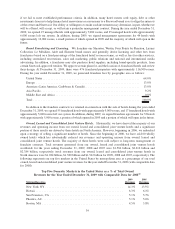

Frequent Guest Program. SPG is our frequent guest incentive marketing program. SPG members earn

points based on spending at our properties, as incentives to first time buyers of VOIs and residences and through

participation in affiliated programs. Points can be redeemed at substantially all of our owned, leased, managed and

franchised properties as well as through other redemption opportunities with third parties, such as conversion to

airline miles. Properties are charged based on hotel guests’ qualifying expenditures. Revenue is recognized by

participating hotels and resorts when points are redeemed for hotel stays.

We, through the services of third-party actuarial analysts, determine the fair value of the future redemption

obligation based on statistical formulas which project the timing of future point redemption based on historical

experience, including an estimate of the “breakage” for points that will never be redeemed, and an estimate of the

points that will eventually be redeemed as well as the cost of reimbursing hotels and other third parties in respect of

other redemption opportunities for point redemptions. Actual expenditures for SPG may differ from the actuarially

determined liability. The total actuarially determined liability as of December 31, 2009 and 2008 is $689 million

and $662 million, respectively. A 10% reduction in the “breakage” of points would result in an estimated increase of

$87 million to the liability at December 31, 2009.

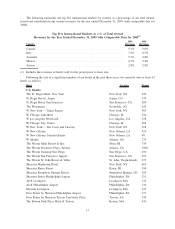

Long-Lived Assets. We evaluate the carrying value of our long-lived assets for impairment by comparing the

expected undiscounted future cash flows of the assets to the net book value of the assets if certain trigger events

occur. If the expected undiscounted future cash flows are less than the net book value of the assets, the excess of the

net book value over the estimated fair value is charged to current earnings. Fair value is based upon discounted cash

flows of the assets at a rate deemed reasonable for the type of asset and prevailing market conditions, sales of similar

assets, appraisals and, if appropriate, current estimated net sales proceeds from pending offers. We evaluate the

carrying value of our long-lived assets based on our plans, at the time, for such assets and such qualitative factors as

future development in the surrounding area, status of expected local competition and projected incremental income

from renovations. Changes to our plans, including a decision to dispose of or change the intended use of an asset,

can have a material impact on the carrying value of the asset.

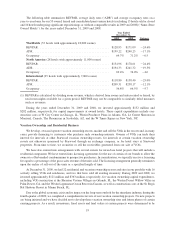

Loan Loss Reserves. For the vacation ownership and residential segment, we record an estimate of expected

uncollectibility on our VOI notes receivable as a reduction of revenue at the time we recognize profit on a sale of a

vacation ownership interest. We hold large amounts of homogeneous VOI notes receivable and therefore assess

uncollectibility based on pools of receivables. In estimating our loss reserves, we use a technique referred to as static

pool analysis, which tracks uncollectible notes for each year’s sales over the life of the respective notes and projects

an estimated default rate that is used in the determination of our loan loss reserve requirements. As of December 31,

2009, the average estimated default rate for our pools of receivables was 9.8%. Given the significance of our

respective pools of VOI notes receivable, a change in the projected default rate can have a significant impact to our

loan loss reserve requirements, with a 0.1% change estimated to have an impact of approximately $3 million.

For the hotel segment, we measure the impairment of a loan based on the present value of expected future cash

flows discounted at the loan’s original effective interest rate or the estimated fair value of the collateral. For

impaired loans, we establish a specific impairment reserve for the difference between the recorded investment in the

loan and the present value of the expected future cash flows or the estimated fair value of the collateral. We apply the

loan impairment policy individually to all loans in the portfolio and do not aggregate loans for the purpose of

applying such policy. For loans that we have determined to be impaired, we recognize interest income on a cash

basis.

25