Starwood 2009 Annual Report Download - page 160

Download and view the complete annual report

Please find page 160 of the 2009 Starwood annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

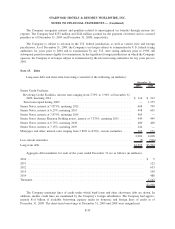

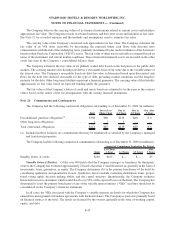

Note 19. Leases and Rentals

The Company leases certain equipment for the hotels’ operations under various lease agreements. The leases

extend for varying periods through 2015 and generally are for a fixed amount each month. In addition, several of the

Company’s hotels are subject to leases of land or building facilities from third parties, which extend for varying

periods through 2089 and generally contain fixed and variable components. The variable components of leases of

land or building facilities are primarily based on the operating profit or revenues of the related hotels.

In June 2008, the Company entered into an agreement to lease the W London Leicester Square Hotel for

40 years, commencing once the hotel reopens following a major renovation. The commencement of the lease term is

contingent upon the completion of the renovation which is under way and is expected to be completed in January

2011. The minimum future rent payments due upon completion of the hotel is £3.5 million in year one, £4.5 million

in year two, and £5.5 million in year three. After the third year the rent changes based on the United Kingdom RRI

Index. Due to the uncertain opening date, the payments are not included in the table below.

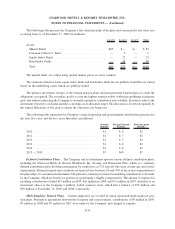

The Company’s minimum future rents at December 31, 2009 payable under non-cancelable operating leases

with third parties are as follows (in millions):

2010 .................................................................. $ 87

2011 .................................................................. $ 88

2012 .................................................................. $ 67

2013 .................................................................. $ 66

2014 .................................................................. $ 65

Thereafter............................................................... $676

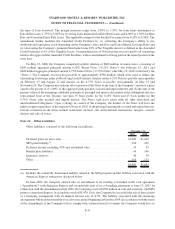

Rent expense under non-cancelable operating leases consisted of the following (in millions):

2009 2008 2007

Year Ended December 31,

Minimum rent ............................................. $89 $93 $86

Contingent rent ............................................ 2 10 10

Sublease rent .............................................. (3) (6) (6)

$88 $97 $90

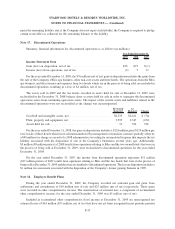

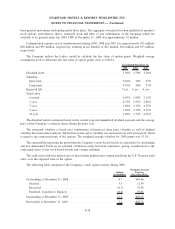

Note 20. Stockholders’ Equity

Share Repurchases. During the year ended December 31, 2009, the Company did not repurchase any

Company common shares. During the year ended December 31, 2008, the Company repurchased 13.6 million

shares at a total cost of $593 million. As of December 31, 2009, no repurchase capacity remained under the Share

Repurchase Authorization.

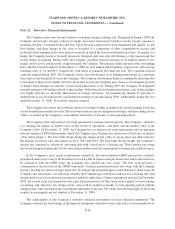

Note 21. Stock-Based Compensation

In 2004, the Company adopted the 2004 Long-Term Incentive Compensation Plan (“2004 LTIP”), which

superseded the 2002 Long-Term Incentive Compensation Plan (“2002 LTIP”) and provides the terms of equity

award grants to directors, officers, employees, consultants and advisors. Although no additional awards will be

granted under the 2002 LTIP, the Company’s 1999 Long-Term Incentive Compensation Plan or the Company’s

1995 Share Option Plan, the provisions under each of the previous plans will continue to govern awards that have

F-37

STARWOOD HOTELS & RESORTS WORLDWIDE, INC.

NOTES TO FINANCIAL STATEMENTS — (Continued)