Starwood 2009 Annual Report Download - page 85

Download and view the complete annual report

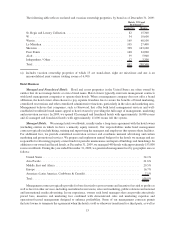

Please find page 85 of the 2009 Starwood annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.International Operations Are Subject to Unique Political and Monetary Risks. We have significant

international operations which as of December 31, 2009 included 244 owned, managed or franchised properties

in Europe, Africa and the Middle East (including 16 properties with majority ownership); 60 owned, managed or

franchised properties in Latin America (including 9 properties with majority ownership); and 155 owned, managed

or franchised properties in the Asia Pacific region (including 3 properties with majority ownership). International

operations generally are subject to various political, geopolitical, and other risks that are not present in U.S. oper-

ations. These risks include the risk of war, terrorism, civil unrest, expropriation and nationalization as well as the

impact in cases in which there are inconsistencies between U.S. law and the laws of an international jurisdiction. In

addition, some international jurisdictions restrict the repatriation of non-U.S. earnings. Various other international

jurisdictions have laws limiting the ability of non-U.S. entities to pay dividends and remit earnings to affiliated

companies unless specified conditions have been met. In addition, sales in international jurisdictions typically are

made in local currencies, which subject us to risks associated with currency fluctuations. Currency devaluations and

unfavorable changes in international monetary and tax policies could have a material adverse effect on our

profitability and financing plans, as could other changes in the international regulatory climate and international

economic conditions. Other than Italy, where our risks are heightened due to the 6 properties we owned as of

December 31, 2009, our international properties are geographically diversified and are not concentrated in any

particular region.

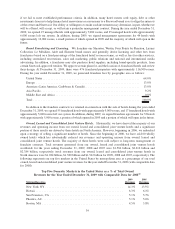

Risks Relating to Operations in Syria

During fiscal 2009, Starwood subsidiaries generated approximately $2 million of revenue from management

and other fees from hotels located in Syria, a country that the United States has identified as a state sponsor of

terrorism. This amount constitutes significantly less than 1% of our worldwide annual revenues. The United States

does not prohibit U.S. investments in, or the exportation of services to, Syria, and our activities in that country are in

full compliance with U.S. and local law. However, the United States has imposed limited sanctions as a result of

Syria’s support for terrorist groups and its interference with Lebanon’s sovereignty, including a prohibition on the

exportation of U.S.-origin goods to Syria and the operation of government-owned Syrian air carriers in the

United States except in limited circumstances. The United States may impose further sanctions against Syria at any

time for foreign policy reasons. If so, our activities in Syria may be adversely affected, depending on the nature of

any further sanctions that might be imposed. In addition, our activities in Syria may reduce demand for our stock

among certain investors.

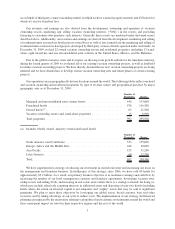

Risks Relating to Debt Financing

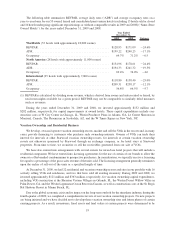

Our Debt Service Obligations May Adversely Affect Our Cash Flow. As a result of our debt obligations, we

are subject to: (i) the risk that cash flow from operations will be insufficient to meet required payments of principal

and interest, (ii) restrictive covenants, including covenants relating to certain financial ratios and ability to pay

dividends, and (iii) interest rate risk. Although we anticipate that we will be able to repay or refinance our existing

indebtedness and any other indebtedness when it matures, there can be no assurance that we will be able to do so or

that the terms of such refinancings will be favorable. Our leverage may have important consequences including the

following: (i) our ability to obtain additional financing for acquisitions, working capital, capital expenditures or

other purposes, if necessary, may be impaired or such financing may not be available on terms favorable to us and

(ii) a substantial decrease in operating cash flow, EBITDA (as defined in our credit agreements) or a substantial

increase in our expenses could make it difficult for us to meet our debt service requirements and restrictive

covenants and force us to sell assets and/or modify our operations.

We Have Little Control Over the Availability of Funds Needed to Fund New Investments and Maintain

Existing Hotels. In order to fund new hotel investments, as well as refurbish and improve existing hotels, both we

and current and potential hotel owners must have access to capital. The availability of funds for new investments and

maintenance of existing hotels depends in large measure on capital markets and liquidity factors over which we

have little control. Recent events have made the capital markets increasingly volatile. As a result, many current and

prospective hotel owners are finding hotel financing to be increasingly expensive and difficult to obtain. Delays,

increased costs and other impediments to restructuring such projects may affect our ability to realize fees, recover

loans and guarantee advances, or realize equity investments from such projects. Our ability to recover loans and

10