Starwood 2009 Annual Report Download - page 141

Download and view the complete annual report

Please find page 141 of the 2009 Starwood annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

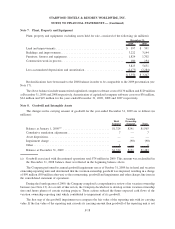

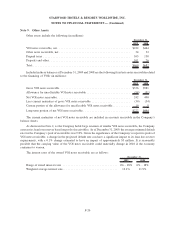

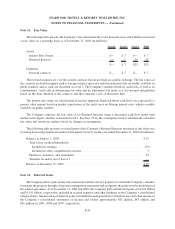

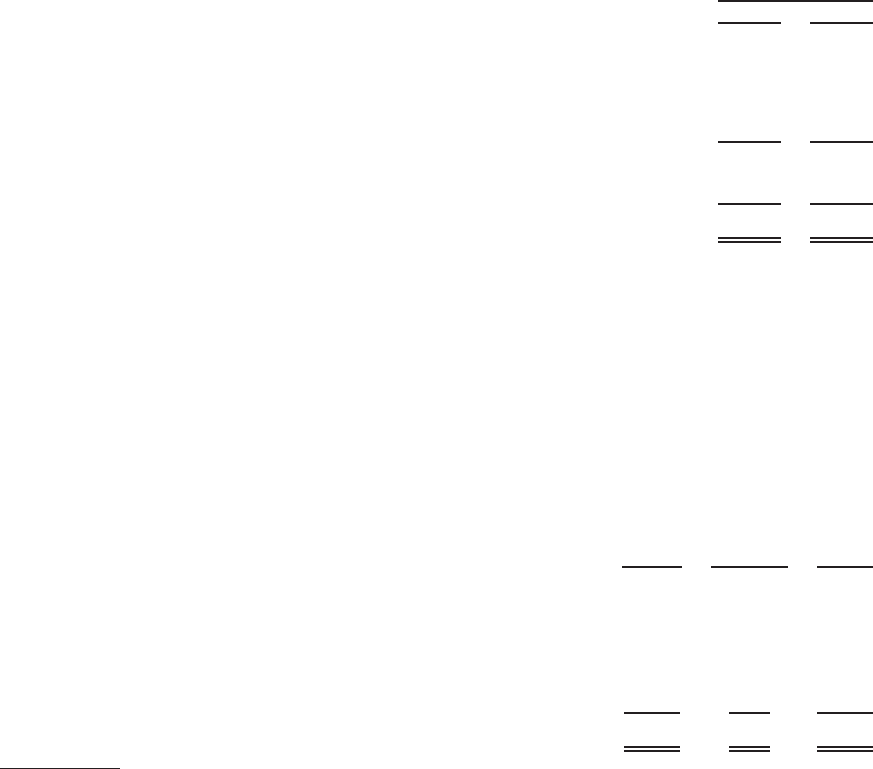

Note 7. Plant, Property and Equipment

Plant, property and equipment, excluding assets held for sale, consisted of the following (in millions):

2009 2008

December 31,

Land and improvements .......................................... $ 597 $ 591

Buildings and improvements....................................... 3,222 3,144

Furniture, fixtures and equipment ................................... 1,824 1,702

Construction work in process ...................................... 180 194

5,823 5,631

Less accumulated depreciation and amortization ........................ (2,473) (2,284)

$ 3,350 $ 3,347

Reclassifications have been made to the 2008 balance in order to be comparable to the 2009 presentation (see

Note 17).

The above balances include unamortized capitalized computer software costs of $136 million and $129 million

at December 31, 2009 and 2008 respectively. Amortization of capitalized computer software costs was $36 million,

$24 million and $23 million for the years ended December 31, 2009, 2008 and 2007 respectively.

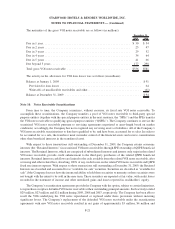

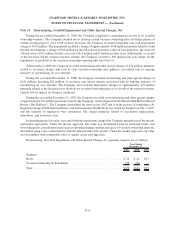

Note 8. Goodwill and Intangible Assets

The changes in the carrying amount of goodwill for the year ended December 31, 2009 are as follows (in

millions):

Hotel

Segment

Vacation

Ownership

Segment Total

Balance at January 1, 2009

(a)

............................. $1,324 $241 $1,565

Cumulative translation adjustment .......................... 7 — 7

Asset dispositions ...................................... — — —

Impairment charge ..................................... — (90) (90)

Other ............................................... 1 — 1

Balance at December 31, 2009 ............................ $1,332 $151 $1,483

(a) Goodwill associated with discontinued operations total $74 million in 2009. This amount was reclassified in

the December 31, 2008 balance sheet as reflected in the beginning balance above.

The Company performed its annual goodwill impairment test as of October 31, 2009 for its hotel and vacation

ownership reporting units and determined that the vacation ownership goodwill was impaired, resulting in a charge

of $90 million ($90 million after-tax) to the restructuring, goodwill and impairment and other charges line item in

the consolidated statement of operations.

During the fourth quarter of 2009, the Company completed a comprehensive review of its vacation ownership

business (see Note 13). As a result of this review, the Company decided not to develop certain vacation ownership

sites and future phases of certain existing projects. These actions reduced the future expected cash flows of the

vacation ownership reporting unit which contributed to impairment of its goodwill.

The first step of the goodwill impairment test compares the fair value of the reporting unit with its carrying

value. If the fair value of the reporting unit exceeds its carrying amount then goodwill of the reporting unit is not

F-18

STARWOOD HOTELS & RESORTS WORLDWIDE, INC.

NOTES TO FINANCIAL STATEMENTS — (Continued)